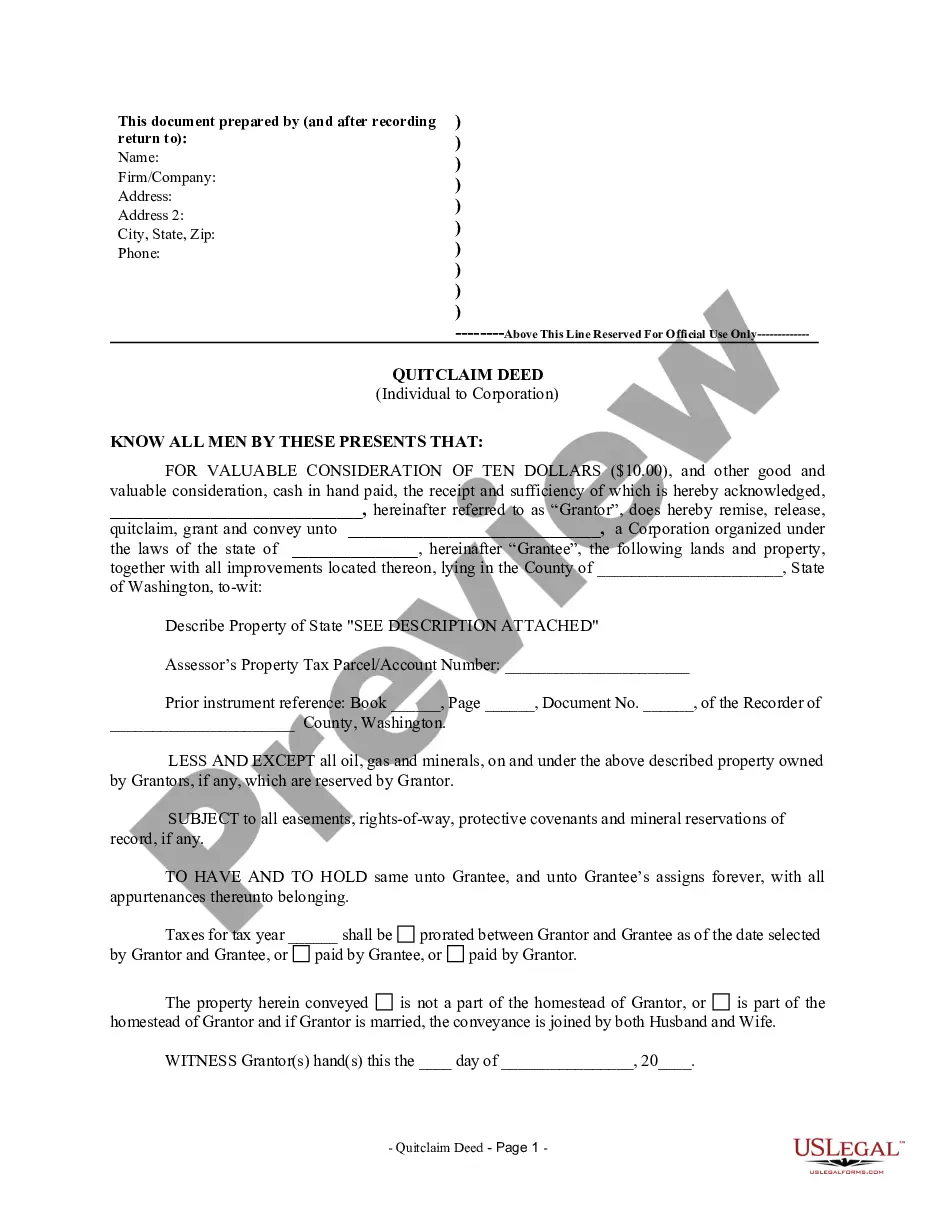

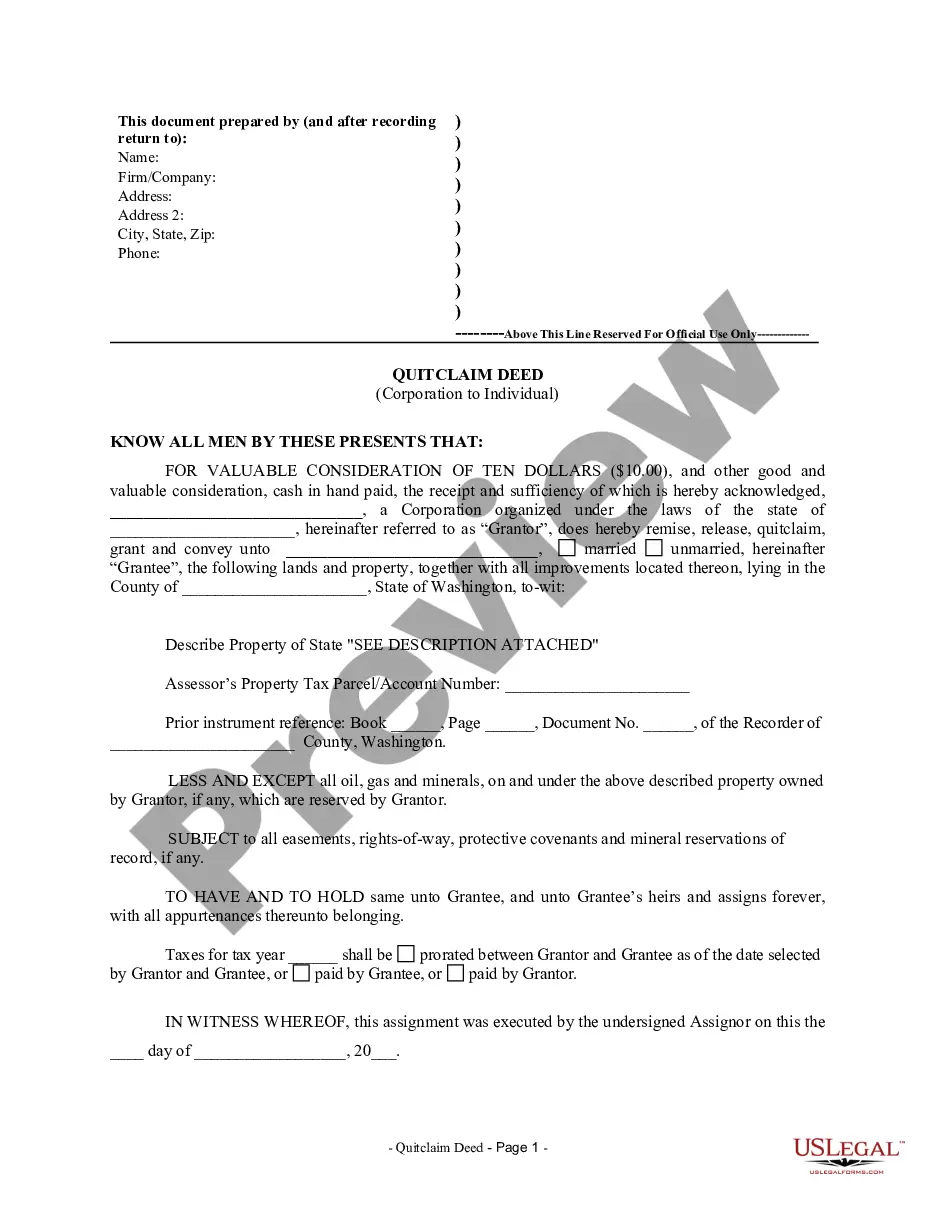

Washington Quitclaim Deed from Individual to Corporation

Definition and meaning

A Washington Quitclaim Deed from Individual to Corporation is a legal document that allows an individual to transfer ownership of a property to a corporation. This type of deed provides a straightforward method for conveying property rights and indicates that the grantor (the individual) relinquishes any claim to the property without guaranteeing that the title is clear. The corporation receiving the property (the grantee) accepts the property 'as is,' which means they take it along with any existing liens or encumbrances.

How to complete the form

Completing the Washington Quitclaim Deed requires careful attention to detail. Follow these steps:

- Begin by entering the names of the grantor and grantee in the appropriate places.

- Clearly describe the property being transferred, including the parcel number and any relevant legal descriptions.

- State the consideration being exchanged — often a nominal fee, such as ten dollars.

- Indicate whether the property is part of the grantor's homestead.

- Sign the deed in front of a notary public, ensuring the notary completes the acknowledgment section.

Once completed, the deed must be recorded in the county where the property is located to be effective.

Who should use this form

This form is typically used by individuals who own real estate and wish to transfer ownership to a corporation. It is particularly appropriate for business owners looking to consolidate assets or streamline property ownership under their corporate entity. Anyone considering this transfer should consult with a legal professional to ensure that this type of deed is suitable for their specific situation.

Legal use and context

The Washington Quitclaim Deed is legally recognized in the state of Washington and serves to convey property rights from individuals to corporations. This document is essential in real estate transactions where the transfer of ownership is involved, particularly in cases of business formation, asset transfer for tax purposes, or when investing in properties. It is important to understand that a quitclaim deed does not guarantee the title's validity, making it crucial for the grantee to perform due diligence prior to accepting the property.

Common mistakes to avoid when using this form

When filling out a quitclaim deed, users should be mindful of the following common mistakes:

- Failing to provide a complete and accurate property description can lead to disputes about the ownership.

- Not having the document notarized properly may render it ineffective.

- Omitting the essential details such as consideration or the tax parcel number can lead to complications.

- Neglecting to record the deed after completion, which is crucial for legal standing.

Attention to these details will help ensure a smooth transfer process.

What to expect during notarization or witnessing

Notarization is a critical step in validating the quitclaim deed. When you bring the signed document to a notary, be prepared to provide:

- Identification to verify your identity.

- Information regarding the transaction if requested by the notary.

The notary will then witness your signature and provide an official seal, which is necessary for the deed to be legally recognized. This step protects all parties involved by formally recording the execution of the document.

Form popularity

FAQ

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

The Washington quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.