California Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

If you wish to finalize, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and indicates, or keywords.

Step 4. Once you’ve located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Process the payment. You can use your Visa, Mastercard, or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the California Blind Trust Agreement in a matter of clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Acquire button to obtain the California Blind Trust Agreement.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

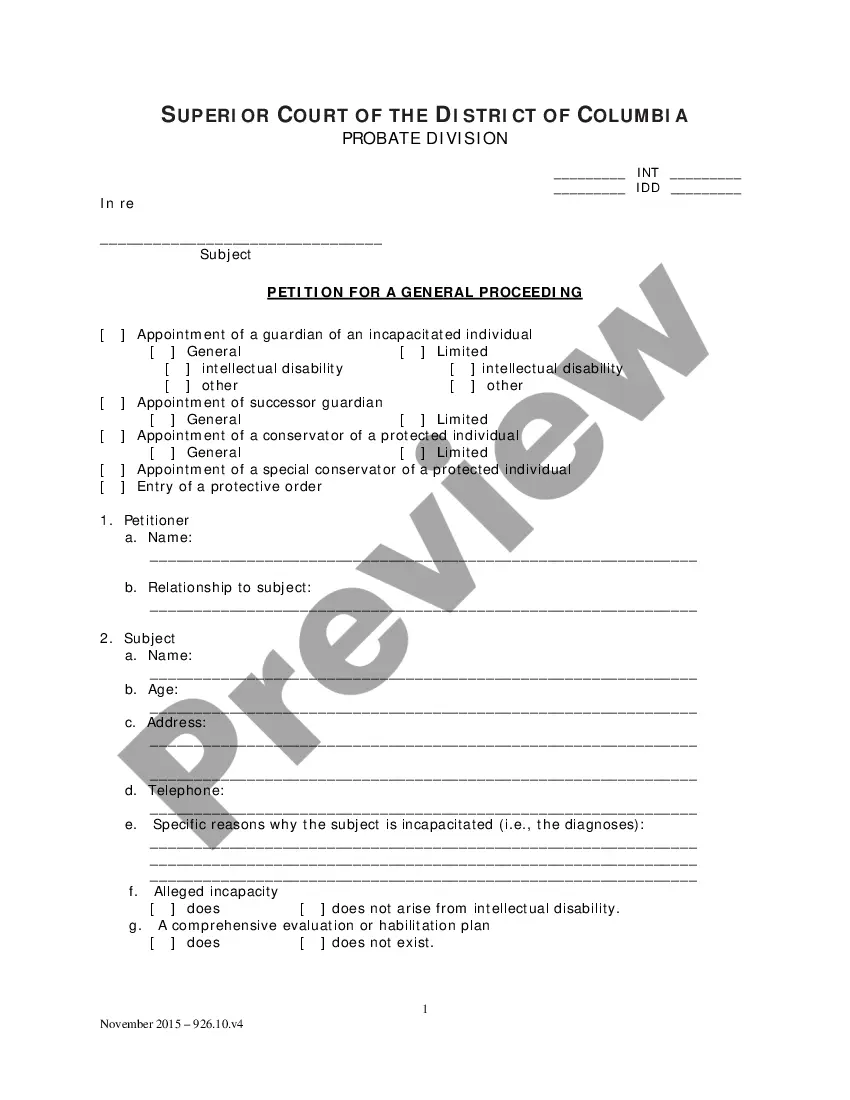

- Step 2. Use the Preview option to review the contents of the form. Remember to read through the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

In California, not all trusts need to be filed with the court; however, a California Blind Trust Agreement doesn't typically require court approval. When it comes to revocable trusts, they remain private and do not go through probate, avoiding public scrutiny. It's advisable to keep necessary records and legal documents organized for your beneficiaries. UsLegalForms helps you keep your trust documentation in order, ensuring a smooth process.

To set up a blind trust, begin by selecting a reliable trustee who will manage the assets without your input. Next, create a California Blind Trust Agreement that outlines the terms, conditions, and beneficiaries of the trust. This agreement ensures your assets remain protected while you relinquish control. For assistance in drafting the needed documents, UsLegalForms can provide templates tailored to your requirements.

One of the most significant mistakes parents make when establishing a trust fund is failing to clearly define its purpose and beneficiaries. When you draft a California Blind Trust Agreement, it's crucial to outline who will benefit and under what terms. This clarity prevents confusion and potential disputes in the future. UsLegalForms offers templates that guide you in creating a precise and effective trust fund.

In California, Form 541 must be filed by entities such as partnerships, limited liability companies, and certain trusts. If you create a California Blind Trust Agreement, your trust may need to file this form if it has income that exceeds the state’s threshold. It's essential to consult a tax professional or an attorney to ensure compliance. You can also use the resources provided by UsLegalForms to aid in this process.

To obtain a copy of a trust document in California, you typically need to contact the trustee of the trust. If the trust is a revocable type, the original creator usually has access to it. In cases where the trust has become irrevocable upon the grantor's death, you may need to request the document through the probate court. Platforms like US Legal Forms can assist you in understanding your rights regarding trust access and guide you through the necessary procedures.

To establish a California Blind Trust Agreement, start by defining your goals and understanding your assets. Next, consult with a qualified attorney who specializes in trust law. They can help you draft the agreement, ensuring it meets all legal requirements in California. Finally, execute the trust by transferring your assets into the blind trust, thus maintaining your privacy and avoiding potential conflicts of interest.

Forming a blind trust starts with selecting a trustworthy and competent individual or organization as your trustee. You will then create a California Blind Trust Agreement to legally establish the trust and set the framework for management and distribution of assets. It’s wise to consult legal resources or platforms like uslegalforms, which can guide you through the process and ensure compliance with California trust laws. This can save you time and reduce confusion during setup.

Writing a trust agreement requires clarity and attention to detail. You should start by defining the trust's purpose, include the names of the trustee and beneficiaries, and detail how you want the assets to be managed and distributed. To ensure that your California Blind Trust Agreement meets all legal requirements, consider using templates from uslegalforms, which can provide the structure you need while being user-friendly.

An example of a blind trust could be a trust established by a public official who wants to eliminate any appearance of favoritism or corruption. In this case, the California Blind Trust Agreement would designate a trustee to handle investments and distributions, with the official having no knowledge of specific assets held within the trust. This not only protects the official's reputation but also upholds accountability in public service.

Individuals often choose a blind trust to maintain privacy and avoid conflicts of interest. By using a California Blind Trust Agreement, you can effectively separate your personal interests from your financial dealings. This arrangement can also provide peace of mind, knowing that an independent trustee manages the trust without your daily input. It’s a smart strategy for anyone looking to safeguard their assets while ensuring compliance with legal standards.