California Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

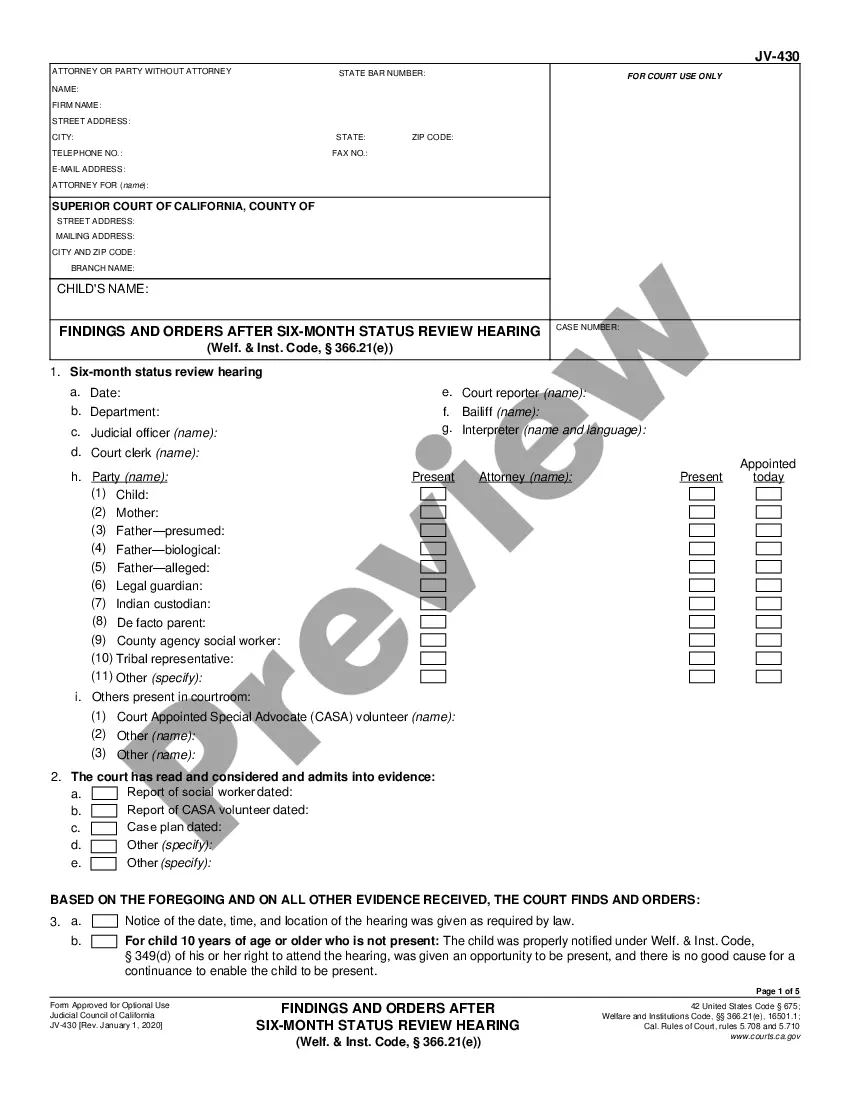

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

While using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest forms such as the California Notice of Default under Security Agreement in Purchase of Mobile Home within seconds.

If you already hold a subscription, Log In and retrieve the California Notice of Default under Security Agreement in Purchase of Mobile Home from the US Legal Forms library. The Download option will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill in, modify, print, and sign the downloaded California Notice of Default under Security Agreement in Purchase of Mobile Home. Each template saved in your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the California Notice of Default under Security Agreement in Purchase of Mobile Home with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have chosen the right form for your region/area.

- Click the Preview option to review the form’s details.

- Check the form description to ensure you have selected the correct form.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now option.

- Next, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, you can negotiate after a default judgment, although it may be more challenging. Engaging with the lender to discuss alternatives, such as settlement or repayment plans, can be beneficial. You should also review your legal options, as a knowledgeable legal resource, like uslegalforms, can assist you in understanding your rights and potential paths forward.

After a notice of default is issued, you may enter a reinstatement period, allowing you to catch up on missed payments. However, if the debt remains unpaid, the lender may schedule a foreclosure sale of the mobile home. Staying informed and proactive can significantly impact your chances of prevention or negotiation. Platforms like uslegalforms offer valuable information to help you take the right steps.

After the entry of default in California, the lender typically initiates foreclosure proceedings. This process can impact your ability to keep your mobile home, as it may lead to a sale to recover the owed debt. It is crucial to understand your rights and options at this stage. Consulting a legal expert or a platform like uslegalforms can provide you with the necessary guidance to navigate this situation.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

A notice of default is typically the final action lenders take before activating the lien and seizing the collateral for foreclosure. A notice of default is usually filed with the state court in which the lien is recorded followed by a hearing to activate the perfected lien recorded with the mortgage closing.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.

When your home loan is officially in default, the bank must file a Notice of Default with the court. They have to let you know they've filed it within 10 days. It's an official legal document informing you that you are in a state of default on your loan.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

A notice of default is a statement sent by one contract party to notify another that the latter was in default by failing to fulfil the terms of an agreement and a legal action would follow if the latter continue to default.