California Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship

Description

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

Have you ever been in a situation where you need to keep files for business or particular reasons almost all the time.

There are numerous authorized document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of document templates, including the California Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship, which can be printed to meet federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

This service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the California Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/state.

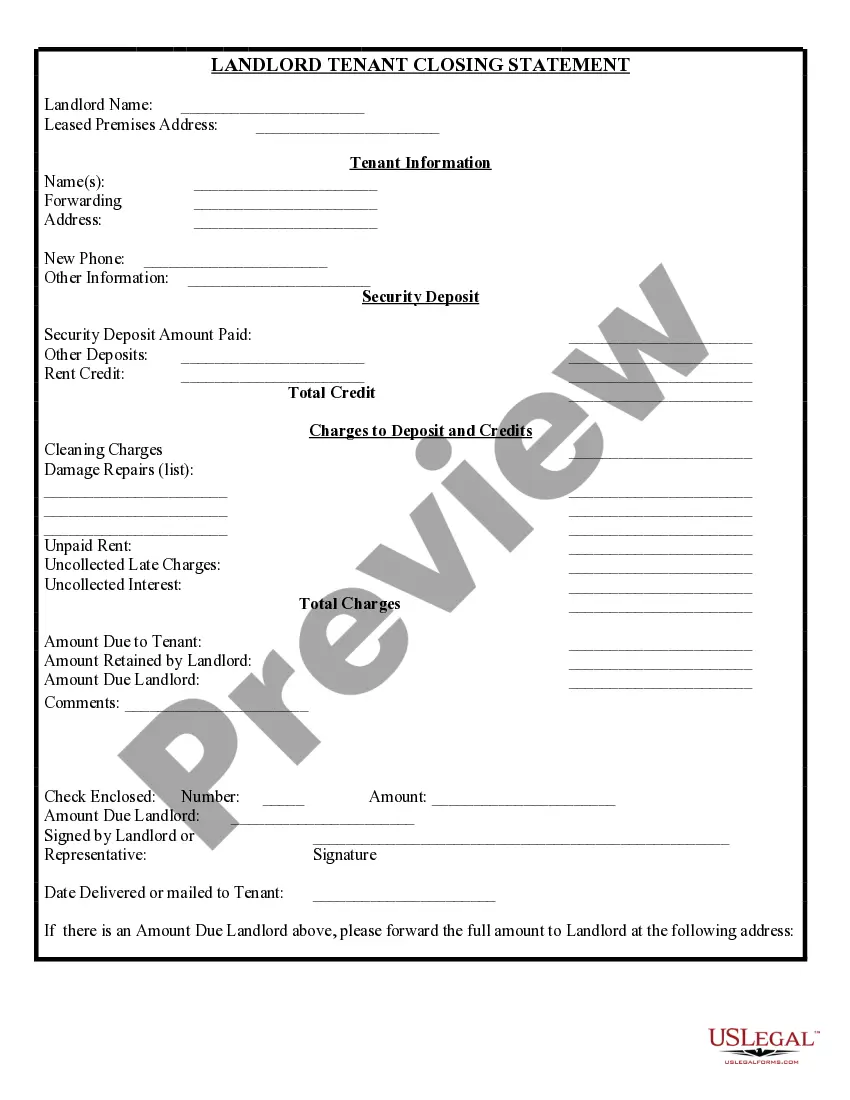

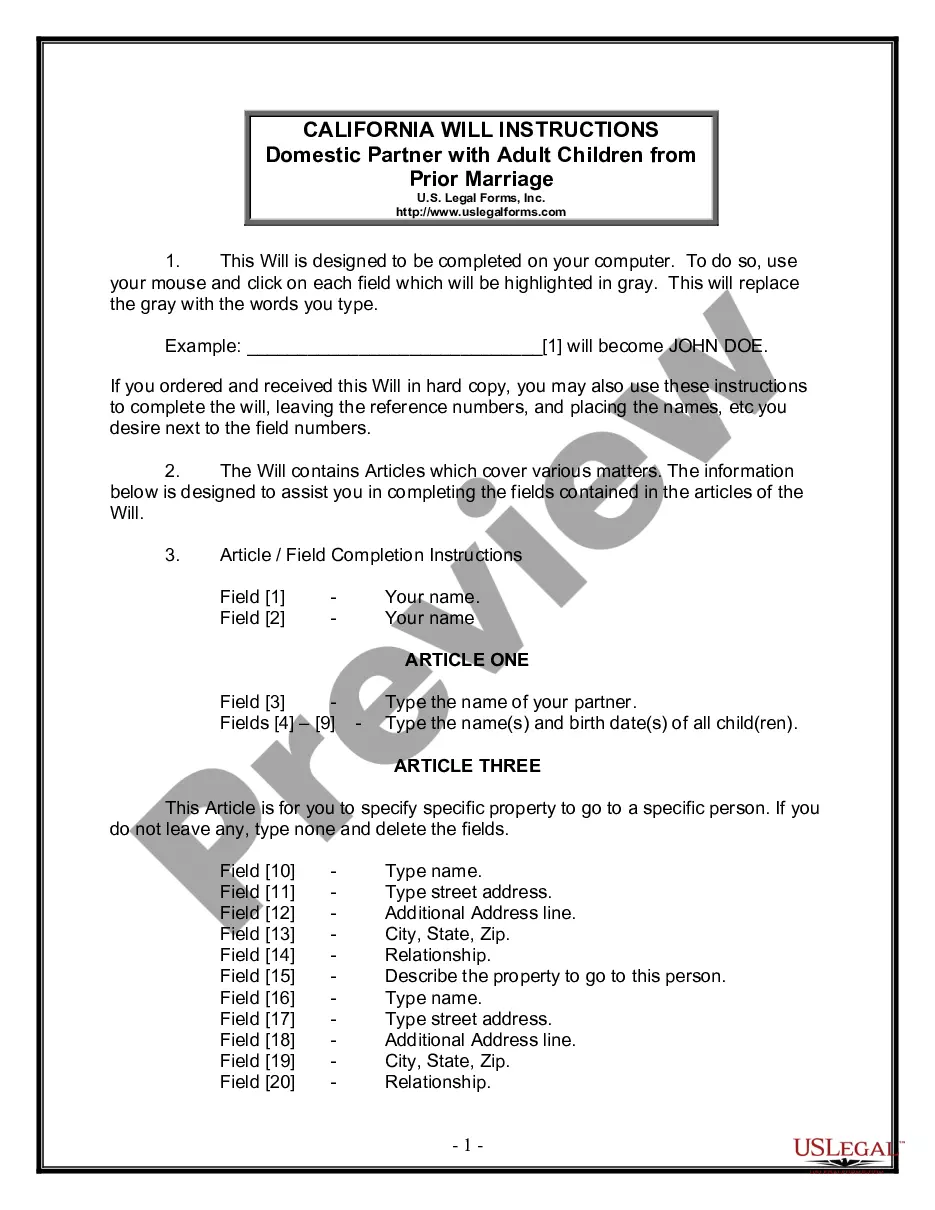

- Use the Review option to examine the template.

- Read the description to confirm you have selected the right template.

- If the template is not what you are looking for, use the Search field to find the template that fits your needs and requirements.

- Once you locate the right template, click Buy now.

- Choose the pricing plan you wish, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of the California Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship whenever needed; just go through the necessary template to download or print the document template.

Form popularity

FAQ

Yes, California does recognize joint tenancy with right of survivorship, which allows two or more parties to own property together. Under this arrangement, if one owner passes away, their share automatically transfers to the surviving owner. This feature is especially useful for unmarried individuals who want to ensure their partner inherits their portion of the property directly. Utilizing resources like uslegalforms can provide clarity and formal documentation of this agreement.

Yes, in California, joint tenancy automatically includes the right of survivorship. This means that if one tenant dies, the ownership of the property passes directly to the surviving tenant, without going through probate. This feature makes joint tenancy a popular choice among unmarried couples because it simplifies the transfer of property ownership.

Utilizing a revocable trust is the best way for a married couple to take title. Titling property in your trust avoids probate upon the death of both the initial and surviving spouses and preserves the capital gains step up for the entire property on the first death.

Yes. You can find a lender that will allow you to apply for a home loan with your partner. However, you'll run into different challenges than married couples based on the current legal framework. Take the time to determine whether you and your partner should apply for a loan together.

There are two ways to hold title in this scenario: tenancy in common and joint tenancy with rights of survivorship. Tenancy in common, or TIC, means each person owns a percentage of the house, and if they die, their interest in the property goes to their estate.

If you're part of a couplemarried or notit's often smart to hold title to your cars together, as "joint tenants with the right of survivorship." That way, when one owner dies, the other will own the vehicle, without probate court proceedings. The transfer is quick and easy.

To truly protect yourself legally, you can put together a cohabitation agreement, which is sort of like a prenup. "Cohabitation agreements usually include how property will be divided in the event of a separation," said attorney David Reischer, CEO of LegalAdvice.com.

There are laws in place in California that protect married couples from significant financial loss when they divorce and have to divide up their property, but there are no such laws to protect the financial well-being of unmarried couples who buy a home together.