Under the Equal Credit Opportunity Act, a creditor may design its own application forms, use forms prepared by another person, or use the appropriate model application forms contained in 12 C.F.R. Part 202, Appendix B. If a creditor chooses to use an Appendix B form, it may change the form by: (1) asking for additional information not prohibited by 12 C.F.R. § 202.5; (2) by deleting any information request; or (3) by rearranging the format without modifying the substance of the inquiries; provided that in each of these three instances the appropriate notices regarding the optional nature of courtesy titles, the option to disclose alimony, child support, or separate maintenance, and the limitation concerning marital status inquiries are included in the appropriate places if the items to which they relate appear on the creditor's form.

California Application for Open End Unsecured Credit - Signature Loan

Description

How to fill out Application For Open End Unsecured Credit - Signature Loan?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the most significant collection of legal documents, accessible online.

Employ the site's straightforward and efficient search feature to locate the documents you require.

Numerous templates for business and specific needs are organized by categories and states, or keywords and phrases.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the California Application for Open End Unsecured Credit - Signature Loan in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and select the Acquire option to secure the California Application for Open End Unsecured Credit - Signature Loan.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific area/region.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Lookup field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

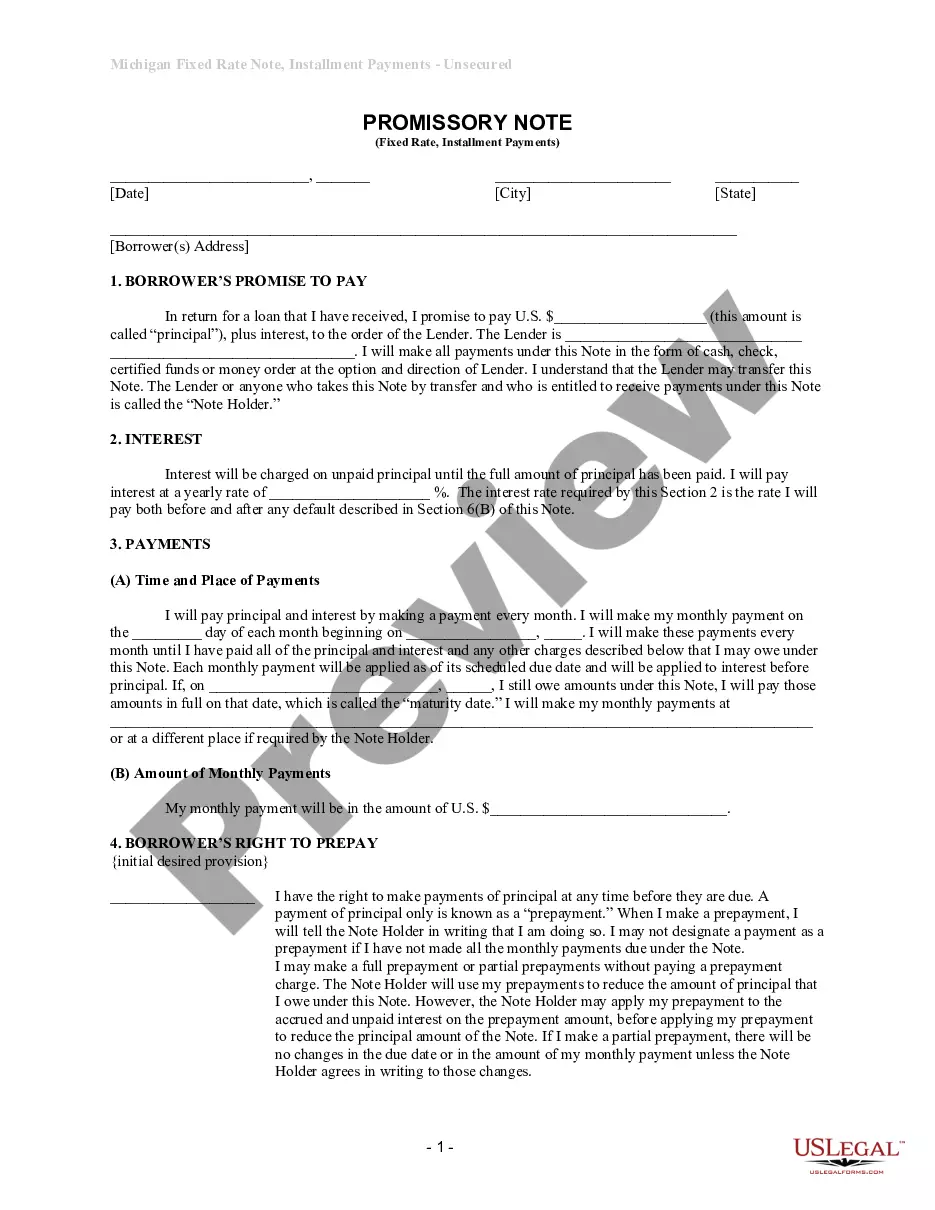

To determine whether to grant a signature loan, a lender typically looks for a solid credit history and sufficient income to repay the loan. In some cases, the lender may require a co-signer on the loan, but the co-signer is only called upon in the event the original lender defaults on payments.

Closed-end credit allows you to borrow a specific amount of money for a finite term. By contrast, open-end credit is revolving credit like a credit card that enables you to borrow repeatedly with no specified repayment date.

Personal loan is a broad term that applies to various types of loans including secured loans, unsecured loans, debt consolidation loans, variable rate loans and more. A signature loan, which does not require collateral, is simply an unsecured personal loan.

Open-end credit is a loan from a bank or other financial institution that the borrower can draw on repeatedly, up to a certain pre-approved amount, and that has no fixed end date for full repayment. Open-end credit is also referred to as revolving credit.

An open-ended loan is a loan that does not have a definite end date. Examples of open-ended loans include lines of credit and credit cards. The terms of open-ended loans may be based on an individual's credit score.

Higher credit scores are often required to qualify, since there is no collateral to offset risk for lenders. Unsecured loans may come with higher interest rates than secured loans. Approval process largely leans on borrowers' credit profiles, such as score and history.

Open loan. Fundamental difference: Open loans don't have any prepayment penalties while closed-end loans do. In other words, if you try to make a payment other than the exact monthly payment, you'll be charged a fee if you have a closed-end loan but not if you have an open loan.

A signature loan, which does not require collateral, is simply an unsecured personal loan.