California Certificate of Trust for Successor Trustee

Description

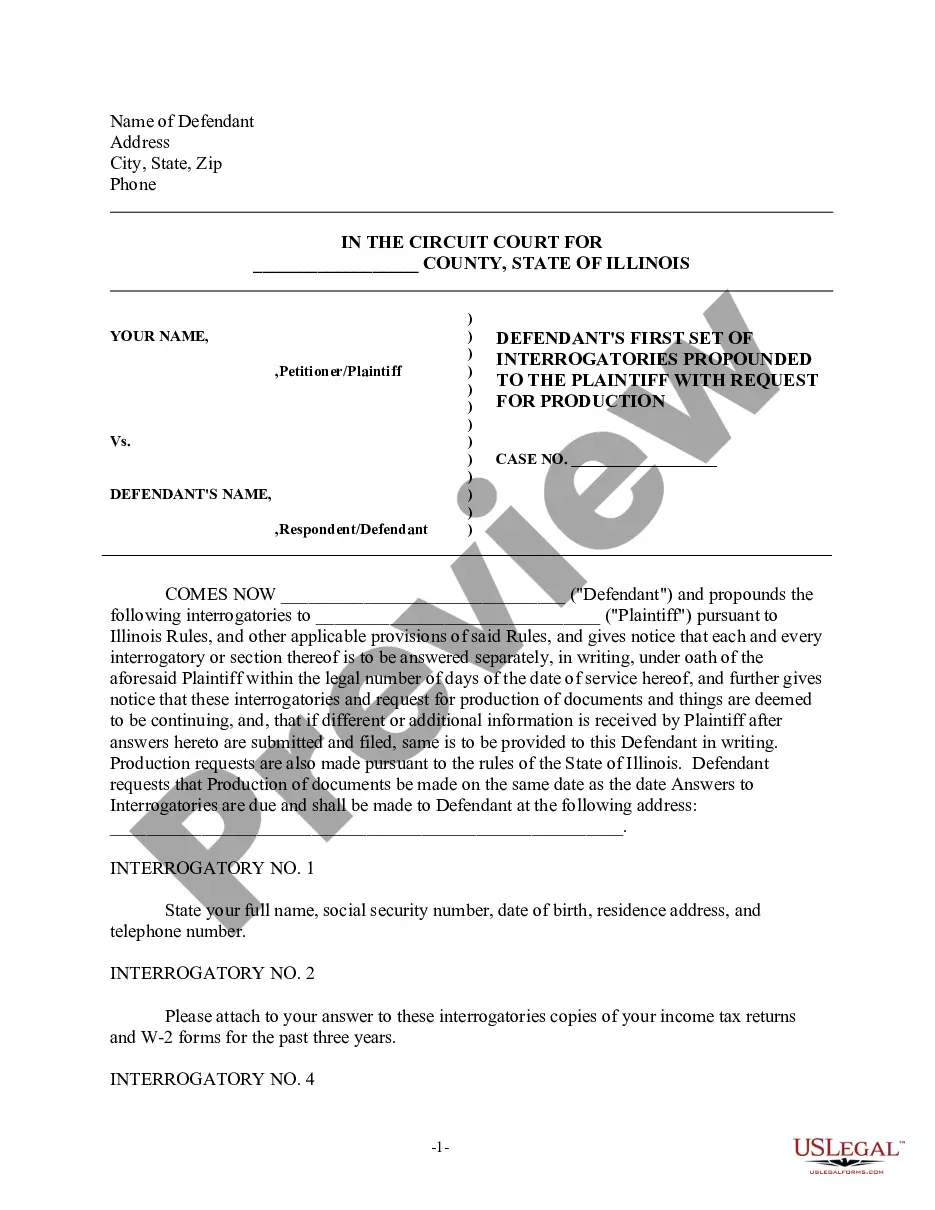

How to fill out Certificate Of Trust For Successor Trustee?

If you wish to full, download, or produce legitimate document web templates, use US Legal Forms, the greatest collection of legitimate types, which can be found on the Internet. Utilize the site`s simple and easy practical lookup to obtain the files you need. Different web templates for organization and person purposes are sorted by groups and suggests, or search phrases. Use US Legal Forms to obtain the California Certificate of Trust for Successor Trustee with a number of clicks.

If you are currently a US Legal Forms consumer, log in to the profile and then click the Acquire key to find the California Certificate of Trust for Successor Trustee. Also you can gain access to types you earlier acquired in the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your right metropolis/country.

- Step 2. Use the Preview method to look over the form`s content material. Do not forget about to read through the information.

- Step 3. If you are not satisfied with the develop, take advantage of the Research field towards the top of the screen to find other types in the legitimate develop format.

- Step 4. When you have identified the shape you need, go through the Get now key. Select the rates prepare you favor and include your qualifications to register for the profile.

- Step 5. Method the deal. You should use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Find the formatting in the legitimate develop and download it in your device.

- Step 7. Complete, modify and produce or indication the California Certificate of Trust for Successor Trustee.

Each and every legitimate document format you buy is your own property forever. You may have acces to every develop you acquired within your acccount. Select the My Forms area and choose a develop to produce or download once again.

Remain competitive and download, and produce the California Certificate of Trust for Successor Trustee with US Legal Forms. There are many skilled and state-distinct types you can use for your organization or person requires.

Form popularity

FAQ

The affidavit of successor trustee for California specifically requires that you provide proof of incapacity (most commonly a death certificate) and evidence that you have the authority to act as successor trustee (the Trust with any amendments).

Hear this out loud PauseFor example, the successor trustee can be a close friend, an adult child, your spouse, your lawyer, an accountant, or a corporate trustee.

Does a Certificate of Trust need to be recorded? A Certificate of Trust may need to be recorded in the county that any real property is in. That said, if there's no real property owned by the Trust, there may not be any need to record it.

Hear this out loud PauseWhile both roles sound familiar, there are differences between them ? most notably, that if an asset is held outside of the trust (so, in the name of the deceased), it is the responsibility of the executor, and if it is held in the name of the trust, it is the responsibility of the successor trustee.

The trust grantor and the trustee will have to sign and date the document and it will have to be notarized and signed by a notary public. At that point, it will go into effect.

An affidavit of successor trustee is filed when a trustee is removed or has died and is being replaced with the successor trustee. This is common in trusts (or joint tenancy) when it's written that if anything should happen to the trustee, the successor trustee will take over ownership.

Hear this out loud PauseA Petition is filed under PC 17200 to appoint a successor trustee. All trustees and beneficiaries sign a consent. At least one beneficiary or trustee signs a nomination of a new trustee. Always look to the trust to see if a successor is named.

Hear this out loud PauseA trustee, who can either be the trustor or another responsible party, may be appointed while the trustor is still alive; a successor trustee is charged with administering a trust after the trustor or the appointed trustee (if they are different from the trustor) becomes incapacitated or dies.