An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

You can spend multiple hours online attempting to locate the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that can be assessed by experts.

You can obtain or create the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer through our services.

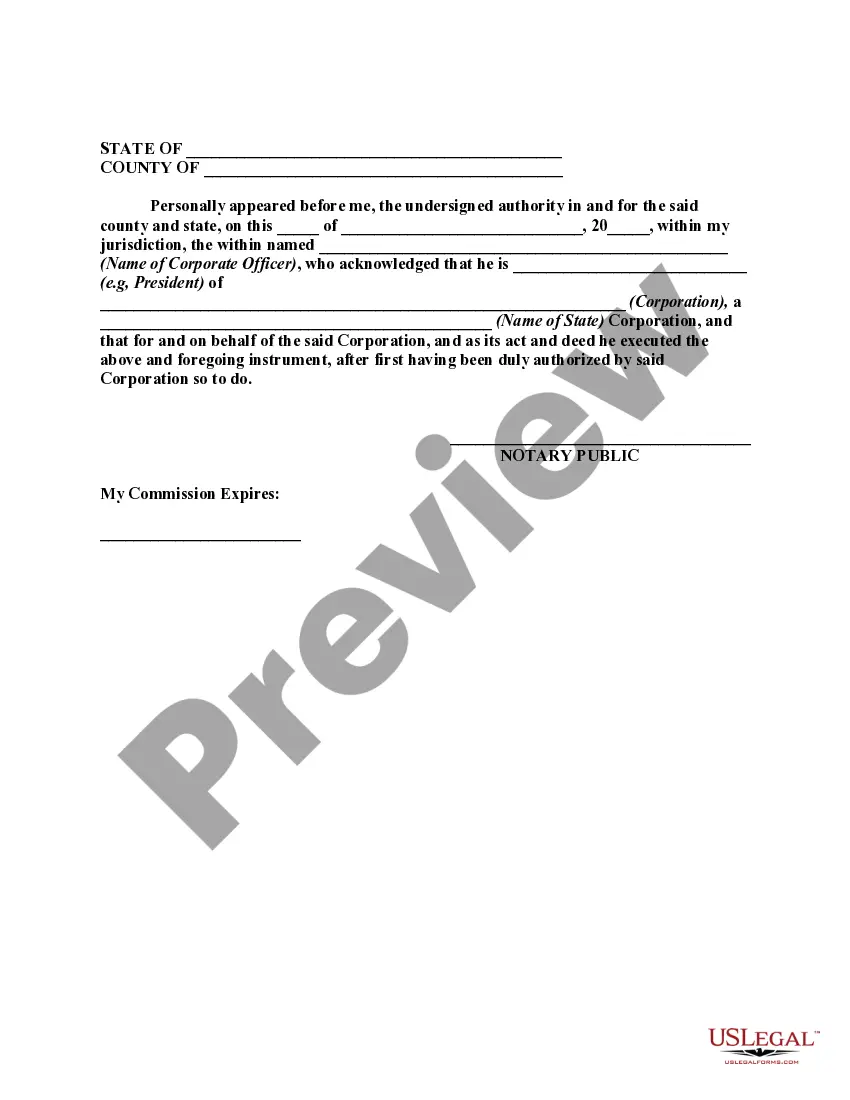

If available, utilize the Preview button to view the document template as well. If you wish to find another version of the form, use the Search area to locate the template that suits your needs.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, create, or sign the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

- Each valid document template you purchase belongs to you indefinitely.

- To retrieve another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form information to confirm you have chosen the appropriate one.

Form popularity

FAQ

California franchise tax applies to businesses operating in the state, including LLCs and corporations, regardless of their structure. Entities subject to this tax must be aware of their obligations when engaging in activities like selling property under the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer. Understanding these tax implications is vital for compliance and to avoid penalties.

California Form 590 is completed by withholding agents, typically buyers or property managers, to report amounts withheld from payments to non-residents. If a non-resident seller is executing the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, the buyer must ensure this form is filled out correctly to meet state tax requirements.

A California fiduciary tax return must be filed by estates and trusts that generate taxable income. This requirement extends to fiduciaries managing the sale of properties under the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer. It is essential for these entities to report their financial activities accurately to comply with state regulations.

California Form 593 is typically filled out by the buyer of the real estate when the seller is a non-resident. This form helps in reporting the amount of tax withheld from the seller to the California tax authorities. If you are engaging in a California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, you should ensure this form is completed accurately.

In California, withholding applies to non-residents selling real estate within the state. If a property is sold under the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, sellers should be aware of their tax obligations. This typically includes individuals, partnerships, and corporations who do not reside in California when they sell their property.

Yes, a buyer can back out of a real estate contract in California under certain conditions. If the contract includes contingencies such as financing or inspection, the buyer may terminate without penalty. However, understanding the terms of the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer is essential to know the implications of withdrawal.

Yes, California law outlines specific requirements for land sale contracts. Such contracts must be in writing, include a description of the property, and specify the terms of payment. These elements are vital in establishing a clear agreement that aligns with the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

For a contract to be legally binding in California, it must include an offer and acceptance, a mutual agreement, and lawful consideration. Parties involved must also have the legal ability to enter a contract, meaning they are of sound mind and of legal age. Clarity in these aspects helps ensure the effectiveness of the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

A valid contract in California requires several key elements to be enforceable. These include an offer, acceptance, consideration, and the capacity of both parties to contract. Furthermore, the purpose of the agreement must be lawful. Understanding these elements is crucial when navigating the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

When selling vacant land in California, certain disclosures are essential to comply with legal requirements. Sellers must provide a Real Estate Transfer Disclosure Statement, detailing any known issues with the property. Additionally, disclosures about environmental hazards must be communicated to the buyer, ensuring that the California Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer is respected in all transactions.