California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

Are you presently in a circumstance where you require documentation for both business or personal purposes almost every day? There are numerous legitimate document templates accessible online, but finding reliable versions is not easy. US Legal Forms offers thousands of form templates, including the California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, which are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale template.

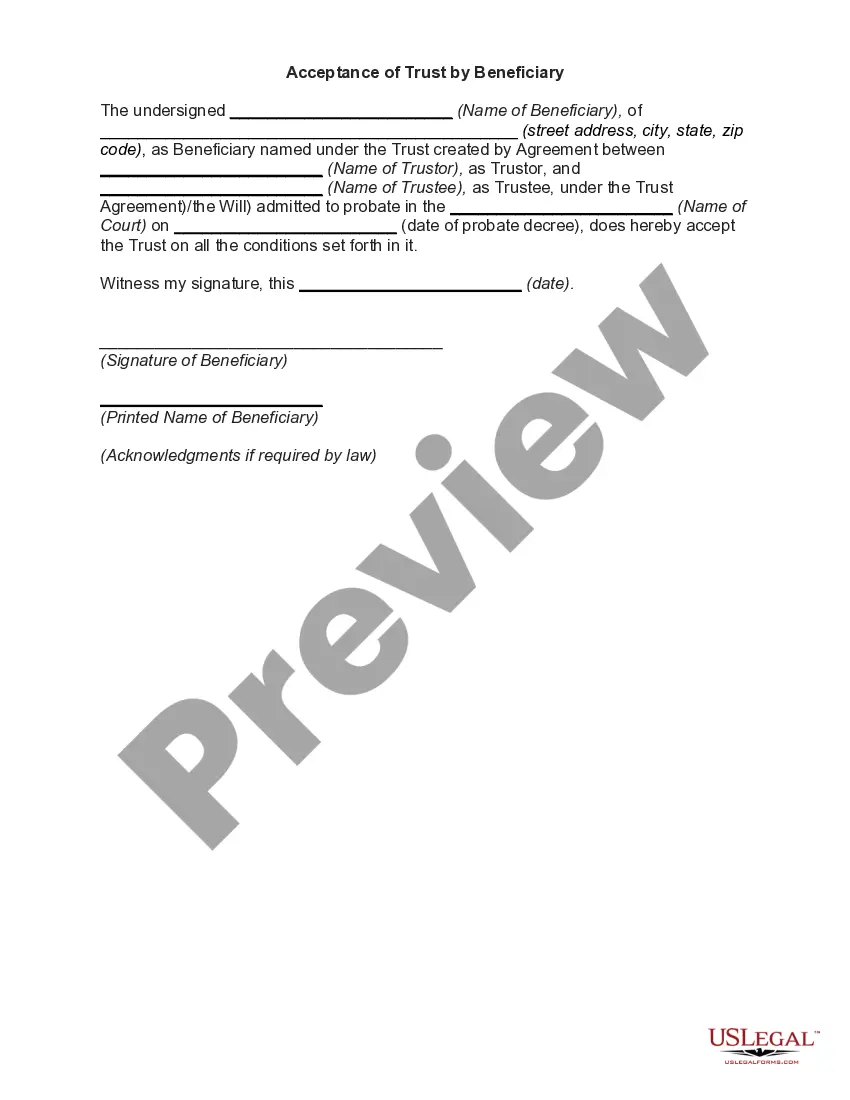

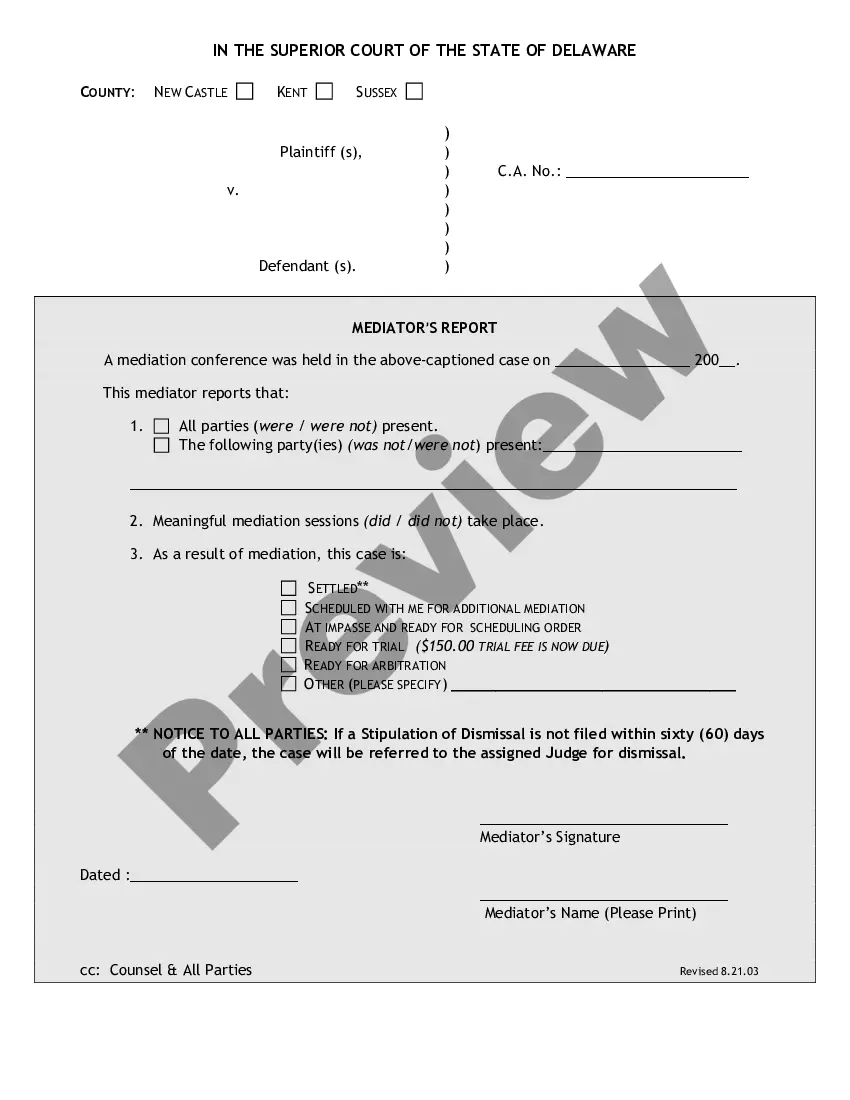

If you do not have an account and would like to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct city/state. Use the Preview button to review the form. Check the summary to confirm that you have selected the correct form. If the form isn't what you’re looking for, use the Search field to locate the form that meets your needs and specifications. Once you find the correct form, simply click Buy now. Choose the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card. Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents section. You can download another copy of California Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale at any time, if needed. Just access the necessary form to obtain or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service provides properly crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.

up in basis resets the cost basis of an inherited asset to its market value on the decedent's date of death. If the asset is later sold, the higher new cost basis would be subtracted from the sale price to calculate the capital gains tax liability, if any.

If the partner dies, the partner's estate will typically succeed to that decedent's interest in the partnership.

If the property is held in a partnership the assets in the partnership do not automatically receive a step-up in basis like those held in a disregarded LLC. It is possible to get a step-up in basis for the assets, but there must be an election under Section 754 of the Internal Revenue Code.

However, while the assets within an S or C corporation do not receive a step-up in basis, the stock does receive a step-up. In conclusion, a step-up in basis at the death of an individual can have a significant impact on the capital gains taxes paid by the heirs of a deceased person.

If the heir will be the new owner, submit the following to a DMV office: The California Certificate of Title. ... Affidavit for Transfer without Probate (REG 5), completed and signed by the heir. An original or certified copy of the death certificate of all deceased owners.

754 provides an election to adjust the inside bases of partnership assets pursuant to Sec. 743(b) upon the transfer of a partnership interest caused by a partner's death. A Sec. 754 election can also be made when a member's interest is sold or upon certain distributions of partnership assets.

If the value of the property owned by the person who died had decreased since that person acquired it, the basis will be decreased. For example, if Alex owned stock that he purchased for $100,000, but the stock was only worth $50,000 on the date of his death, the new stepped down basis is $50,000.