California Escrow Agreement - Long Form

Description

How to fill out Escrow Agreement - Long Form?

If you are looking to finalize, download, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to access the documents you require.

Numerous templates for business and personal purposes are organized by categories and titles, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to every form you have downloaded in your account.

Visit the My documents section to select a form to print or download again. Compete and retrieve, and print the California Escrow Agreement - Long Form with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to easily retrieve the California Escrow Agreement - Long Form in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the California Escrow Agreement - Long Form.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

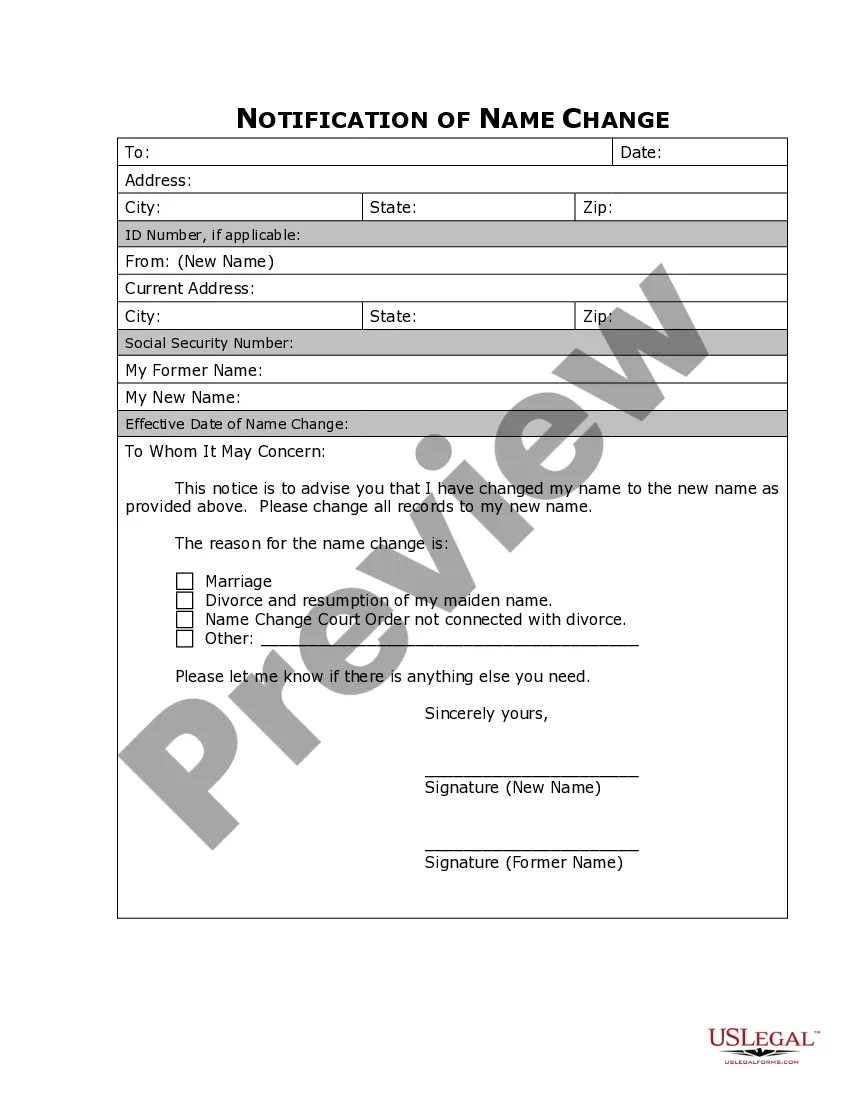

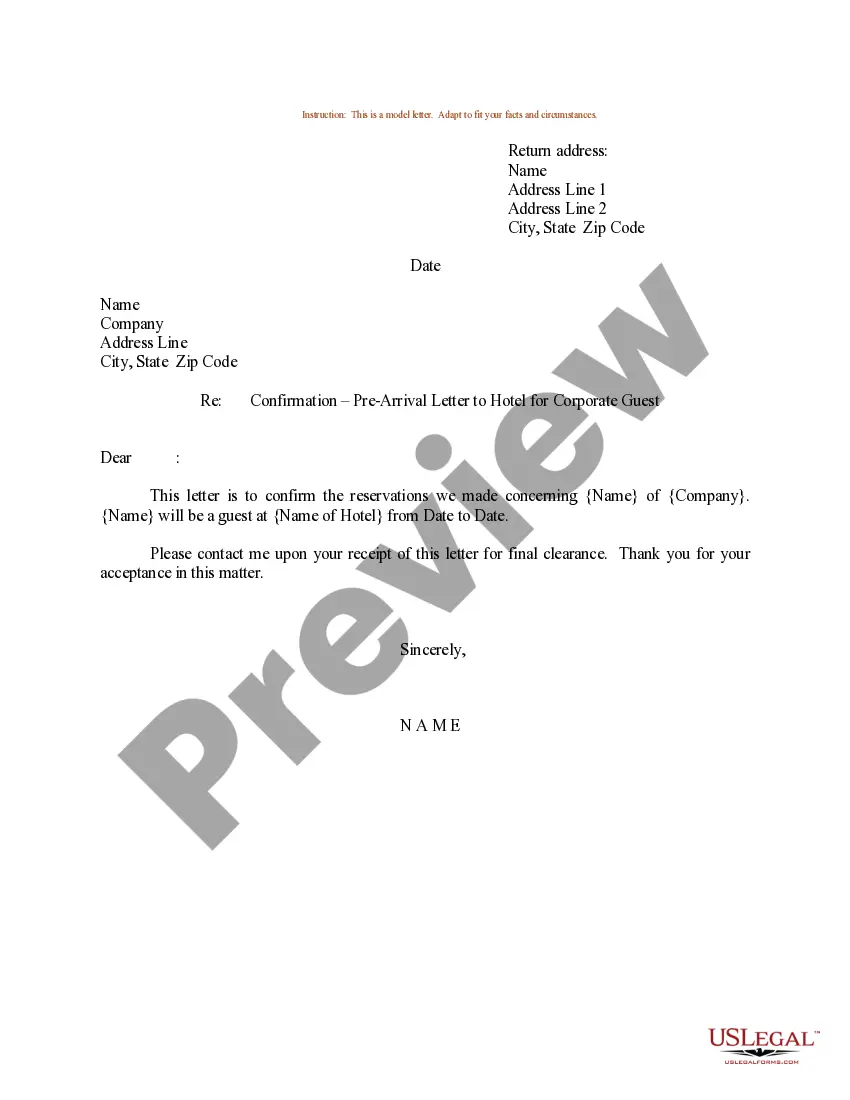

- Step 2. Utilize the Review function to verify the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other formats of the legal document.

- Step 4. Once you have located the form you need, click the Buy Now button. Choose your preferred pricing plan and submit your credentials to register for the account.

- Step 5. Complete the transaction. You may use your VISA or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the California Escrow Agreement - Long Form.

Form popularity

FAQ

Property managers in California are required to keep records for at least three years. This includes lease agreements, tenant communications, and financial statements. Proper documentation is vital for resolving disputes and ensuring compliance with state laws. Utilizing a California Escrow Agreement - Long Form can provide guidance on necessary documentation related to property management.

In California, title companies must retain records for a minimum of five years from the date of a transaction. This retention period ensures that all parties have access to important documentation should any disputes arise. If you seek clarity on your title company's practices, review their policies concerning record retention. Utilizing a California Escrow Agreement - Long Form can also help in setting clear expectations regarding documentation.

The escrow law in California defines how escrow agreements are managed and executed. This law requires a neutral third-party to handle funds and documents for both buyers and sellers in a real estate transaction. It ensures compliance with state regulations and protects the interests of all parties involved. For a comprehensive understanding, consider reviewing the California Escrow Agreement - Long Form, which outlines the necessary legal components.

Escrow instructions are detailed agreements outlining the conditions under which funds and property will be transferred. These instructions are part of the California Escrow Agreement - Long Form and ensure that all parties understand their obligations. They specify actions, timelines, and requirements, which are crucial for a successful closing process. Clear escrow instructions reduce the risk of misunderstandings and delays.

In California, it is primarily the responsibility of the parties involved in the transaction to determine the escrow instructions. Both the buyer and seller should collaborate to clarify their preferences within the California Escrow Agreement - Long Form. This collaborative approach ensures that all necessary details are included and all parties feel secure in the agreement. A knowledgeable escrow agent can provide guidance throughout this process.

Typically, the escrow agent is responsible for sending escrow instructions. These instructions detail the terms agreed upon by both parties in the California Escrow Agreement - Long Form. However, both the buyer and seller may provide input on the contents of these instructions to ensure clarity and understanding. Open communication helps facilitate this process.

Yes, you can request a longer escrow period. It is essential to discuss your needs with all parties involved in the California Escrow Agreement - Long Form. Make sure to communicate any specific time requirements to ensure everyone is on the same page. This flexibility can help accommodate various situations and ensure a smooth transaction.

The standard escrow contract is a comprehensive document that outlines the terms and conditions of an escrow arrangement, ensuring clarity and legal compliance. This contract usually includes details about the parties involved, the assets held in escrow, and the specific obligations each party must fulfill. Familiarizing yourself with the California Escrow Agreement - Long Form can provide a solid foundation for understanding the prerequisites of your transaction.

To draft an escrow agreement, clearly define the roles of each party, outline the obligations, and specify the conditions for release of funds or documents. Utilizing a template, like the California Escrow Agreement - Long Form available on our platform, can simplify the process immensely. By inserting your specific terms into a well-structured template, you can create a robust agreement that meets all legal standards.

The standard close of escrow refers to the point at which all conditions of the California Escrow Agreement - Long Form have been met, and the funds and documents are officially transferred to complete the transaction. This process typically occurs within 30 to 60 days, depending on various factors, including local regulations and the complexity of the deal. Timely closure is critical for maintaining trust among all parties.