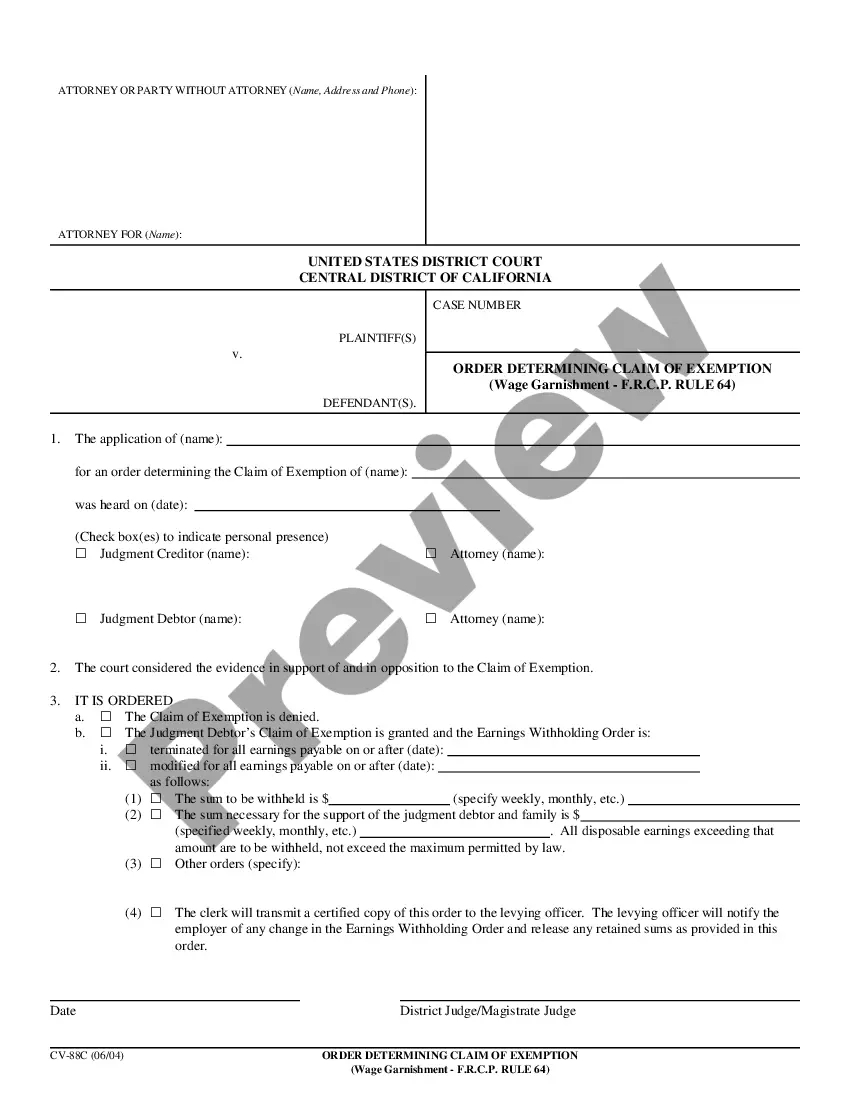

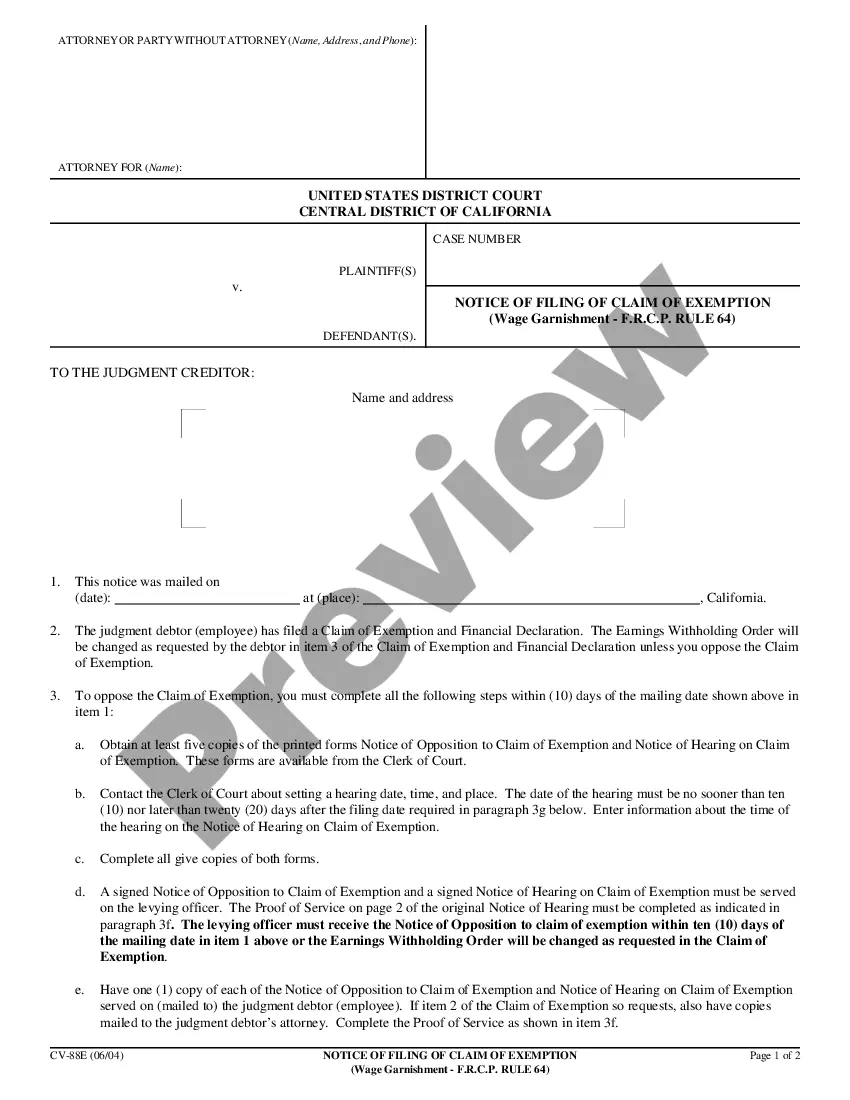

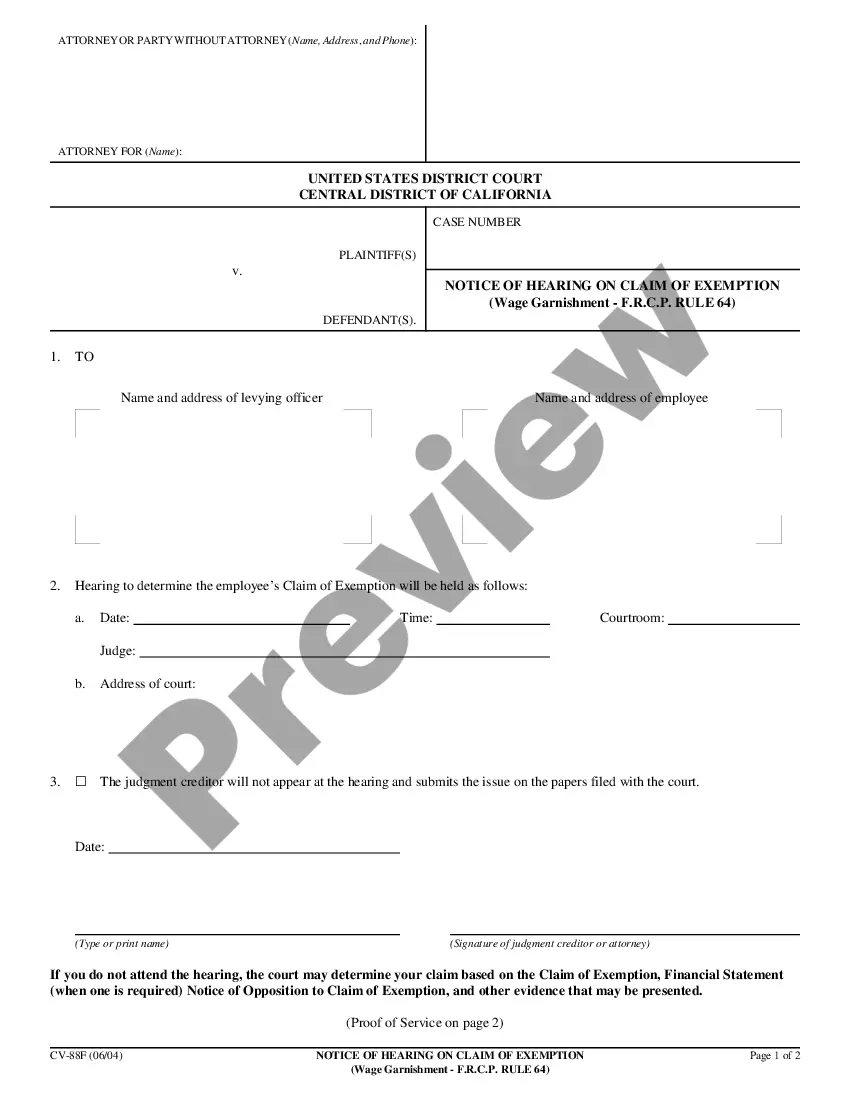

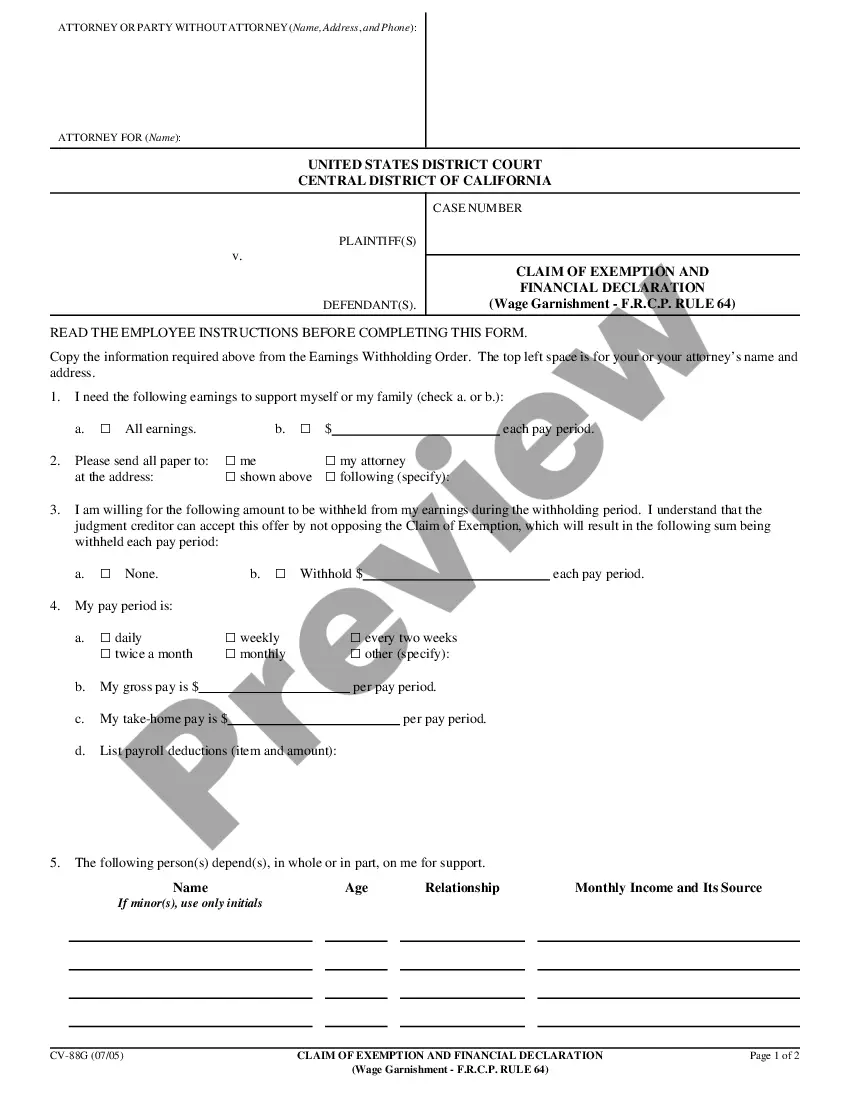

California Order Determining Claim of Exemption (Wage Garnishment-FRCP Rule 64) is a legal order issued by the court which determines the claim of exemption from wage garnishment. It is based on the Federal Rules of Civil Procedure (FRC) Rule 64, which allows a debtor to use certain exemptions to protect their wages from creditors. This order is typically issued when a creditor attempts to garnish a debtor’s wages and the debtor has filed a claim of exemption. The court will then review the evidence and decide if the claim is valid. This order can protect a debtor from having their wages garnished by a creditor. The types of exemptions available to a debtor vary by state, and include exemptions such as Social Security, pensions, disability benefits, public assistance, and more.

California Order Determing Claim Of Exemption (Wage Garnishment-FRCP Rule 64)

Description

How to fill out California Order Determing Claim Of Exemption (Wage Garnishment-FRCP Rule 64)?

If you are searching for a method to effectively finalize the California Order Determining Claim of Exemption (Wage Garnishment-FRCP Rule 64) without engaging a legal advisor, then you are in the perfect place.

US Legal Forms has established itself as the largest and most esteemed repository of official templates for every individual and business scenario. Each document you encounter on our online platform is drafted in compliance with federal and state regulations, ensuring that your paperwork is correct.

Another fantastic aspect of US Legal Forms is that you will never lose the documents you purchased - you can access any of your downloaded forms in the My documents tab of your account whenever needed.

- Ensure the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its textual description or navigating through the Preview mode.

- Input the form name in the Search tab at the top of the page and select your state from the list to find another template if there are any discrepancies.

- Proceed with the content verification and click Buy now when you are confident that the paperwork meets all the requirements.

- Log In to your account and click Download. If you do not yet have one, sign up for the service and select a subscription plan.

- Use your credit card or the PayPal option to obtain your US Legal Forms subscription. The blank will be available for download immediately afterward.

- Select the format in which you want to receive your California Order Determining Claim of Exemption (Wage Garnishment-FRCP Rule 64) and download it by clicking the designated button.

- Upload your template to an online editor to complete and sign it quickly or print it to prepare a physical copy manually.

Form popularity

FAQ

The right to claim exemptions allows individuals to protect essential income and assets from wage garnishment under the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64). This means that if your income falls below a certain threshold or if you have specific financial obligations, you may not be subjected to full garnishment. Understanding this right is crucial for financial stability. Platforms like uslegalforms can help you explore your eligibility and guide you through claiming your exemptions.

Writing a letter to stop wage garnishment involves clearly stating your case and requesting an exemption under the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64). In your letter, include details such as your income, expenses, and any relevant circumstances that justify your request. It’s important to follow the proper format and submit the letter to the appropriate court. uslegalforms provides templates that can help you draft this letter effectively.

To navigate around wage garnishment, you may consider filing a California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64). This legal document allows you to assert your rights and potentially stop or reduce the garnishment. You need to provide proof of any applicable exemptions, such as financial hardship or necessary expenses. Utilizing platforms like uslegalforms can simplify this process by offering the necessary forms and guidance.

To write a letter to stop a garnishment, begin by addressing the creditor or the court involved. Clearly state your reasons for stopping the garnishment, such as a change in financial circumstances or eligibility for an exemption. Reference the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64) to support your request. Finally, ensure you send the letter via certified mail and retain a copy for future reference.

A WG 006 claim of exemption is a specific form used in California to assert that certain income should not be subject to wage garnishment. By filing this claim, individuals can protect a portion of their wages from being garnished, especially during financial hardship. Understanding the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64) can help you determine whether you qualify for this exemption. Consider consulting legal resources for assistance with the process.

Stopping a California state tax wage garnishment involves a few steps. First, reach out to the California Franchise Tax Board to discuss your situation and seek a resolution. You may file a claim of exemption under the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64) if you qualify. If you need additional support, US Legal Forms provides templates and guidance to help you navigate this process effectively.

When writing a revoke wage assignment letter, clearly state your intention to revoke any previous wage assignment agreements. Include your personal information, such as your name and address, and detail the specific wage assignment you wish to revoke. Don't forget to mention the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64) as part of your protection against excessive garnishment. Ensure you keep a copy of the letter for your records.

To negotiate a wage garnishment, start by contacting your creditor to discuss your financial situation. Explain why you cannot afford the current garnishment amount and propose a lower payment plan. You can also refer to the California Order Determining Claim Of Exemption (Wage Garnishment-FRCP Rule 64) for guidance on your rights and potential exemptions. Additionally, consider seeking assistance from a legal service to strengthen your negotiation.

Filing an exemption for wage garnishment in California requires you to complete the claim of exemption forms provided by the court. Carefully fill these out, detailing your earnings and essential expenses. File the forms with the court handling your case, and ensure to notify the relevant parties to maximize your chances for a successful exemption.

When composing a letter to stop wage garnishment, begin with a polite introduction stating your purpose. Include information about the wage garnishment, your identity, and highlight your financial circumstances that support your request for exemption. It’s crucial to send this letter to the appropriate court or creditor to initiate the process of halting the garnishment.