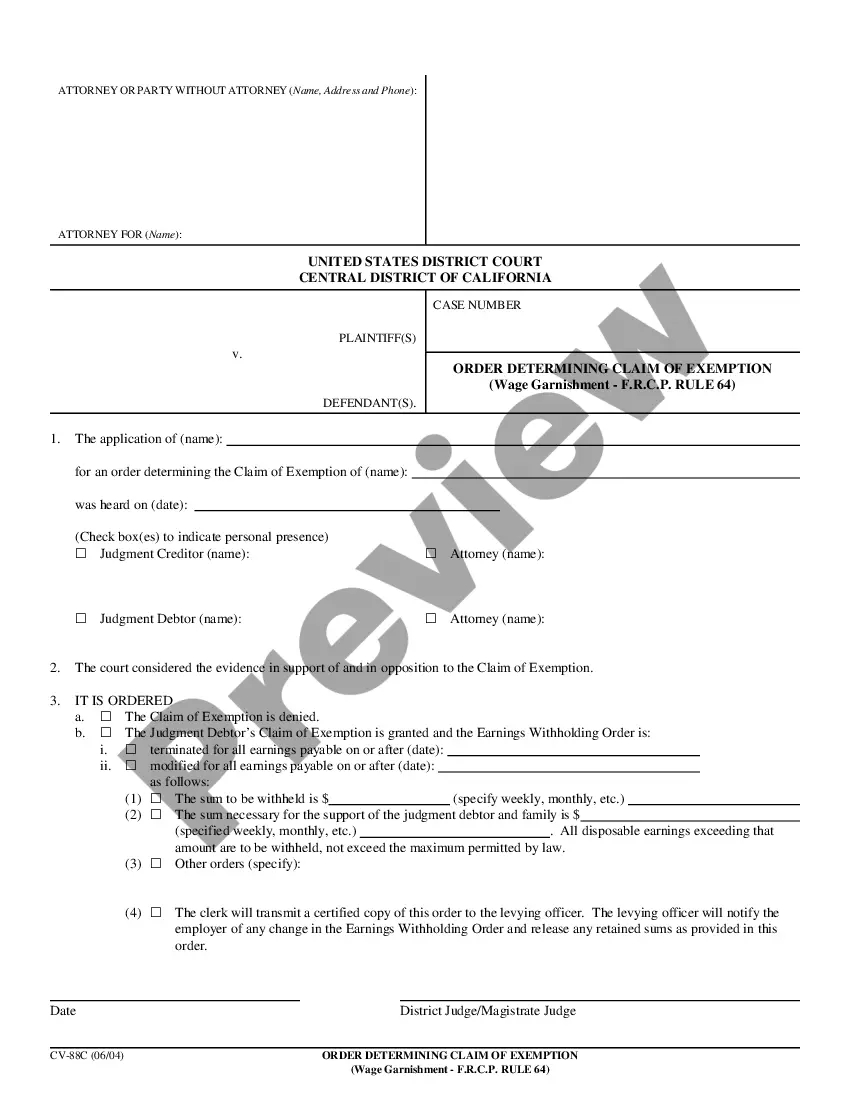

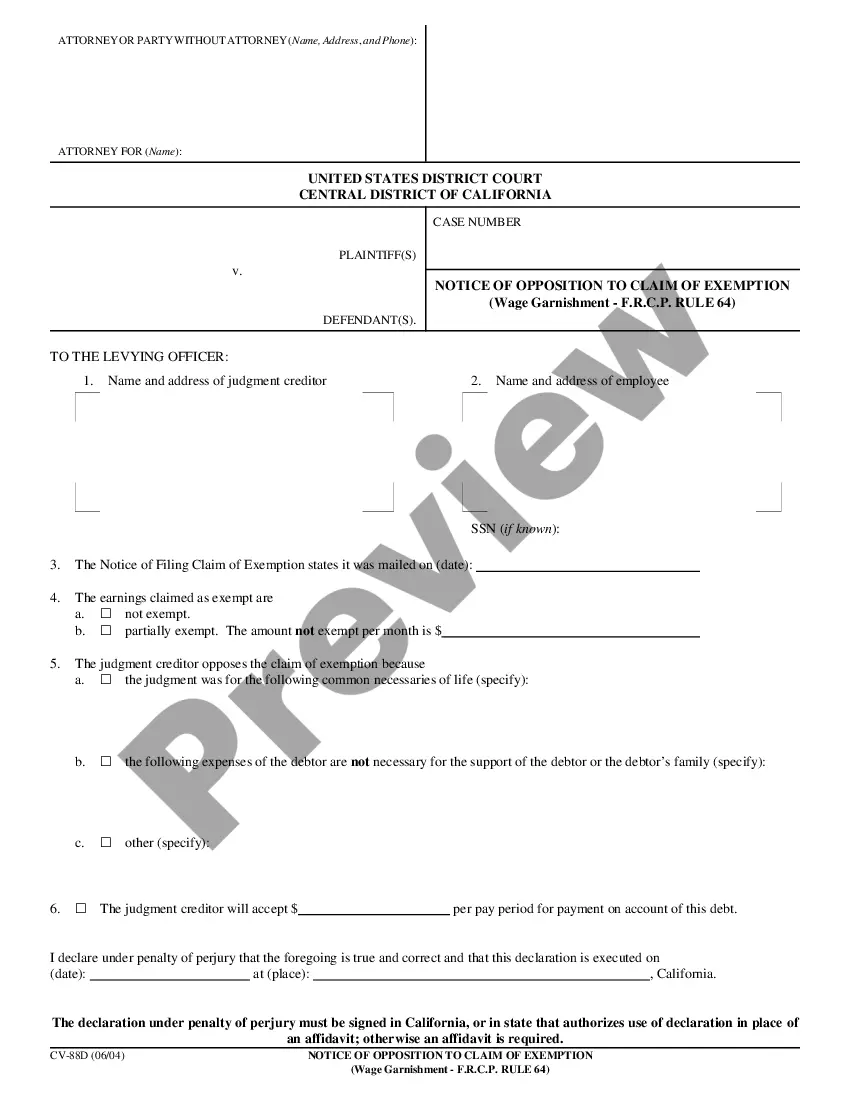

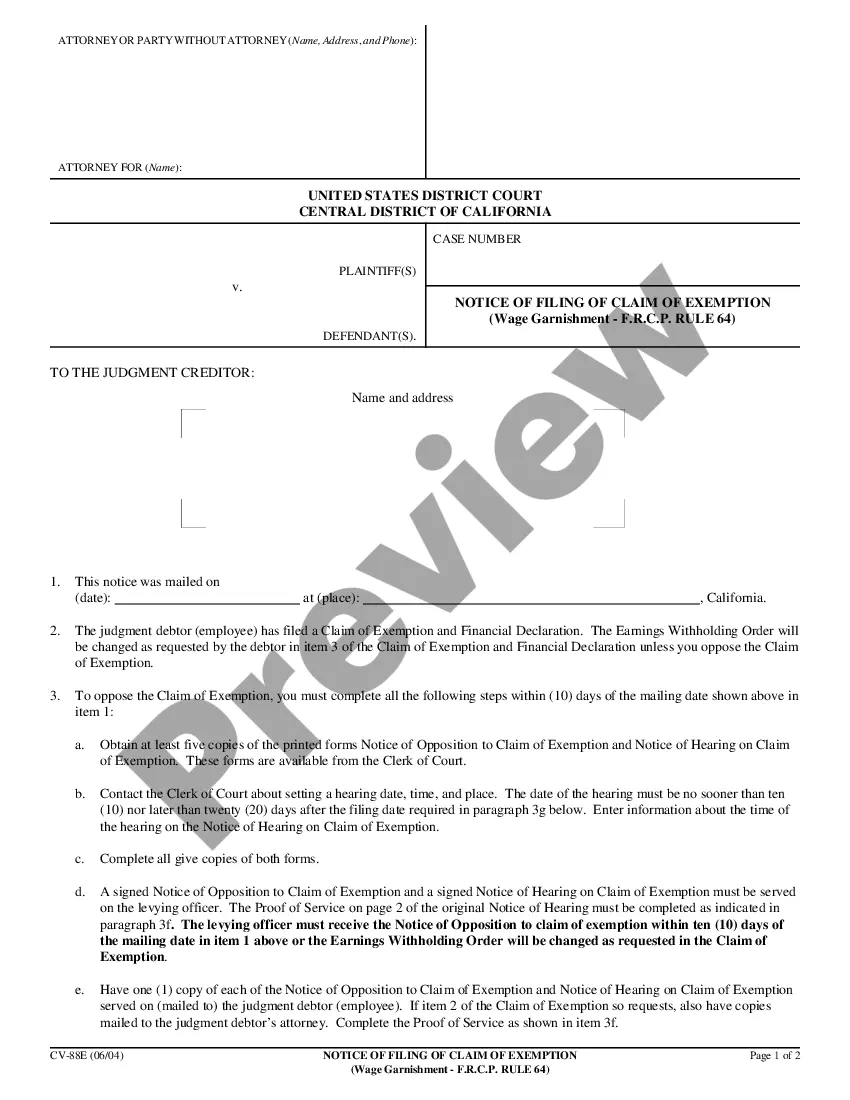

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Claim Of Exemption And Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64?

If you're looking to locate precise California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 forms, US Legal Forms is exactly what you require; obtain documents crafted and reviewed by state-authorized lawyers.

Using US Legal Forms not only spares you from complications related to legal documents; moreover, you conserve time, effort, and funds! Acquiring, printing, and submitting a professional document is considerably more affordable than hiring an attorney to do it for you.

And that's all. In just a few straightforward steps, you obtain an editable California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64. Once you register, all future orders will be processed even more easily. If you have a US Legal Forms membership, simply Log In and click the Download button found on the form's page. Then, whenever you need to access this template again, you can always find it in the My documents section. Don't waste your time comparing countless forms across various platforms. Purchase accurate documents from a single secure source!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and locate the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 template to fulfill your requirements.

- Use the Preview feature or examine the document details (if available) to confirm that the template is the one you require.

- Verify its validity in your region.

- Click on Buy Now to place an order.

- Select a recommended pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable format and download the form.

Form popularity

FAQ

To write a hardship letter for wage garnishment, describe your financial situation in detail. Clearly outline how the garnishment affects your ability to meet essential expenses like housing and food. Use the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 to support your claims, showing that your current financial burdens are genuine. Conclude by requesting a review of your circumstances to seek relief from the garnishment.

Writing a letter to stop a garnishment requires you to clearly state your intention and provide relevant information. Include your name, contact information, and details about the garnishment. Explain your circumstances, referencing the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 if applicable. Be polite and concise, making sure to request a response for confirmation.

Filling out a challenge to garnishment form involves gathering necessary information regarding your case. Provide personal details, the amount being garnished, and reasons for your challenge. Make sure to include any supporting documentation that strengthens your case. You can reference the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 to understand your rights better during this process.

The amount that can be garnished from your paycheck is generally limited by federal and state laws. Under the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64, creditors typically cannot take more than 25% of your disposable earnings. Factors such as your income and family size might affect the final calculation, so it's essential to understand your rights.

To negotiate a garnishment settlement, start by reviewing your financial situation and determining what you can realistically afford. Contact the creditor or their representative and present your case, referencing the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 for support. Offer a lump-sum payment or establish a payment plan that works for both parties to resolve the garnishment.

When writing an objection letter for wage garnishment, begin by addressing it to the court or creditor involved. Include your personal details, your case number, and clearly articulate your objections based on the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64. Be concise, and ensure you provide supporting evidence to strengthen your claim.

The best way to stop a garnishment involves filing a California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64. This legal document allows you to declare financial hardships and potentially halt the garnishment process. Additionally, you can negotiate directly with the creditor to reach a settlement, which may further expedite the resolution.

To fill out a challenge to garnishment form, begin by providing your personal information, including your name, address, and case number. Clearly state your reasons for opposing the garnishment, referencing the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 where relevant. Make sure to review the form carefully and submit it by the required deadline to initiate the process.

In California, certain assets are exempt from garnishment, which includes income that falls below specific limits, government benefits, and items necessary for basic living. This exemption helps ensure you maintain a standard of living while dealing with financial obligations. When navigating these protections, utilizing a California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 can clarify and advocate for your rights.

To file a claim of exemption for wage garnishment in California, begin by completing the required forms, including the California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64. Submit these forms to the court handling your case and provide a copy to the creditor. It's advisable to gather documentation to support your claim, as this can strengthen your argument for the exemption.