California Cash Assets On Hand At Beginning Of Account Period is the amount of cash held by the company on the date the accounting period begins. It includes all cash and cash equivalents such as cash in bank accounts, investments in money market accounts, short-term certificates of deposit, marketable securities, and cash in hand. It does not include accounts receivable or accounts payable, which are recorded as liabilities and assets, respectively. Types of California Cash Assets On Hand At Beginning Of Account Period include: — Cash in Bank Accounts: This includes both checking and saving accounts. — Investments in Money Market Accounts: These are liquid investments that offer a higher return than traditional savings accounts. — Short-term Certificates of Deposit: These are fixed-term investments that typically offer higher interest rates than traditional savings accounts. — Marketable Securities: These are investments in stocks, bonds, and other securities that are readily convertible into cash. — Cash in Hand: This is cash that is physically held by the company in a safe or other secure location.

California Cash Assets On Hand At Beginning Of Account Period

Description

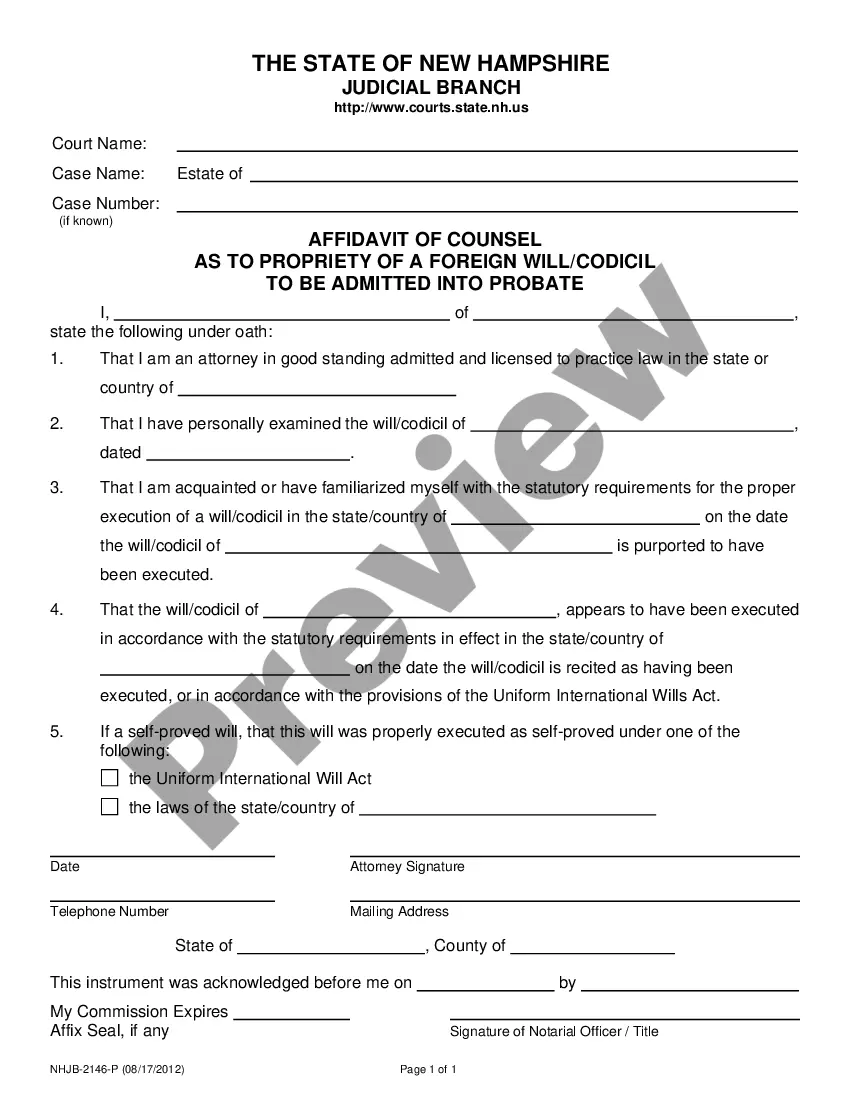

How to fill out California Cash Assets On Hand At Beginning Of Account Period?

If you’re looking for a method to properly prepare the California Cash Assets On Hand At Beginning Of Account Period without employing a legal specialist, then you’re just in the correct location.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business situation. Every document you encounter on our online platform is crafted in accordance with national and state regulations, so you can be assured that your paperwork is in order.

Another excellent aspect of US Legal Forms is that you will never lose the documents you acquired - you can locate any of your downloaded templates in the My documents section of your profile whenever necessary.

- Ensure the document you view on the page aligns with your legal situation and state regulations by reviewing its textual description or browsing through the Preview mode.

- Enter the form title in the Search tab located at the top of the page and select your state from the dropdown list to find an alternative template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are certain about the document's compliance with all requirements.

- Log In to your account and click Download. Create an account with the service and choose the subscription plan if you don’t have one yet.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available for download immediately thereafter.

- Choose the format in which you prefer to save your California Cash Assets On Hand At Beginning Of Account Period and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out for manual preparation of your hard copy.

Form popularity

FAQ

In California, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500. It typically occurs when the deceased person died without a will, but it can occur even if the deceased person did have a will if they owned real property that is subject to probate.

When can I close the estate and distribute the assets? A final account and petition for distribution can be filed by the Personal Representative when there are sufficient funds available to pay all debts and taxes, the time for filing creditors' claims has expired, and the estate is in a condition to be closed.

One way to avoid probate in California is to use a living trust. A living trust is a legal document that allows you to transfer ownership of your assets to another person. This means that your assets will not go through probate when you die.

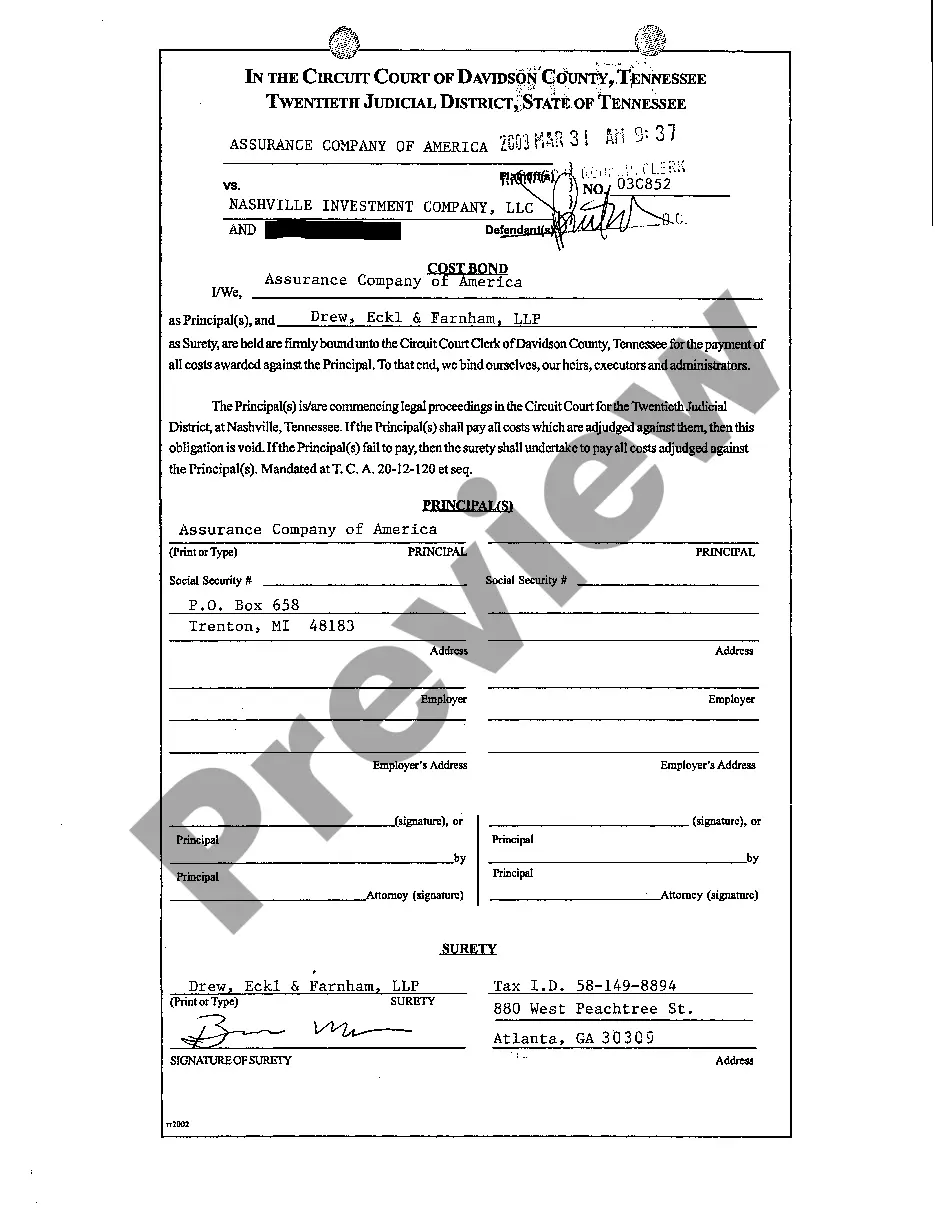

Cal Prob Code § 16063. The trustee's compensation for the last complete fiscal year of the trust or since the last account. The agents hired by the trustee, their relationship to the trustee, if any, and their compensation, for the last complete fiscal year of the trust or since the last account.

Assets Subject to the California Probate Court Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

Q: Will Banks Release Money Without Probate in California? A: Yes, if you are a named beneficiary on a decedent's account, the bank holding the account should release the funds to you if you can provide them with proper identification and a certified death certificate.

Assets Not Subject to California Probate Property that is not owned individually by a decedent can be considered a non-probate asset by operation of law. For example, real estate is a common non-probate asset. Many times people hold real estate jointly with the right to survivorship.