California Form 425B (Small Business Disclosure Statement)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Form 425B (Small Business Disclosure Statement)?

Handling official paperwork necessitates focus, precision, and utilizing well-drafted templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your California Form 425B (Small Business Disclosure Statement) template from our service, you can be assured it complies with federal and state standards.

Engaging with our service is simple and efficient. To obtain the necessary documentation, all you need is an account with an active subscription. Here’s a concise guide for you to acquire your California Form 425B (Small Business Disclosure Statement) within moments.

All documents are created for multiple uses, such as the California Form 425B (Small Business Disclosure Statement) you see on this page. If you need them later, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever you require it. Experience US Legal Forms and execute your business and personal paperwork swiftly and in complete legal compliance!

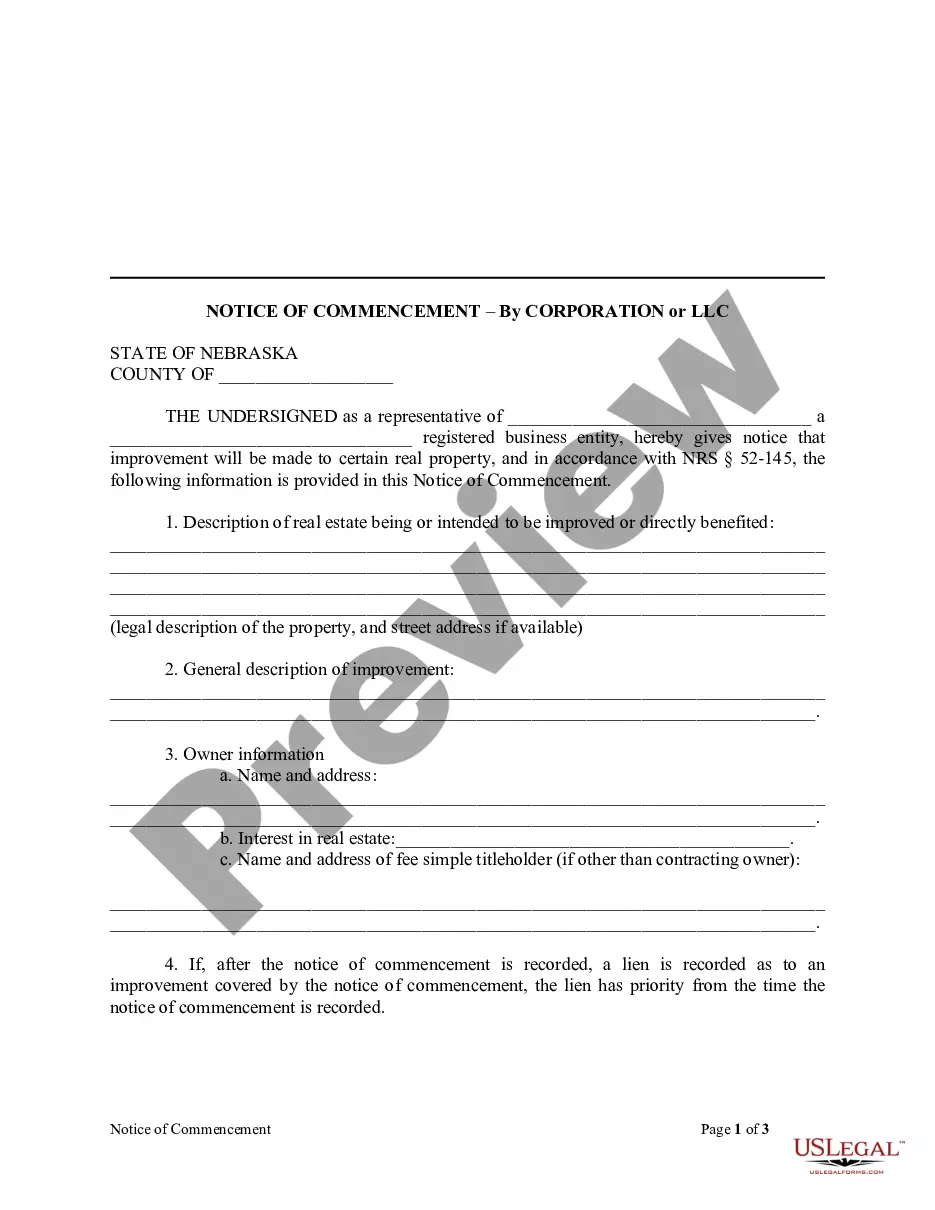

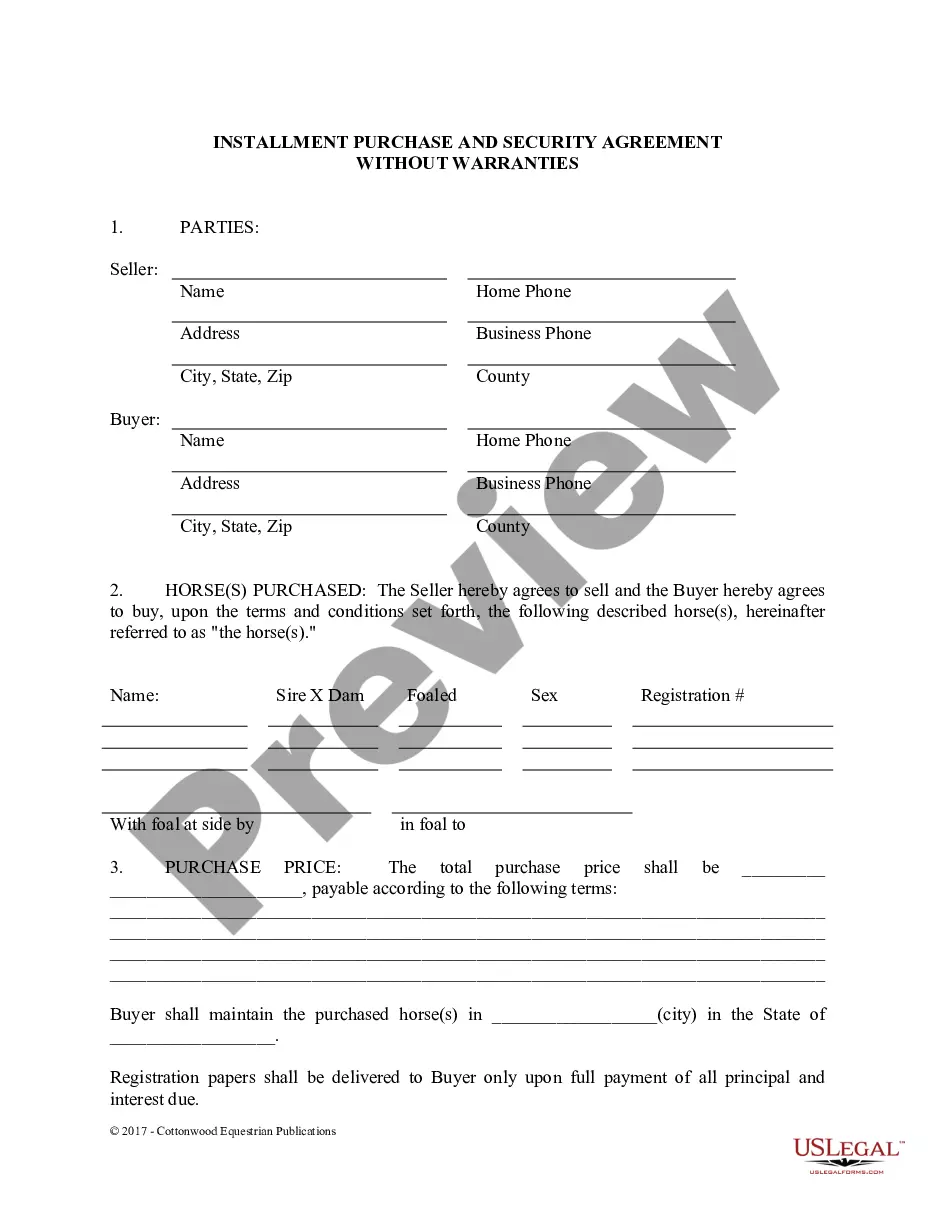

- Ensure to diligently review the form’s content and its alignment with general and legal requirements by previewing it or going through its description.

- Seek an alternative official template if the one previously accessed doesn’t correspond with your circumstances or state regulations (the tab for that is on the upper page corner).

- Log In to your account and save the California Form 425B (Small Business Disclosure Statement) in your preferred format. If it’s your first visit to our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Decide in which format you wish to save your form and click Download. Print the document or add it to a professional PDF editor for electronic preparation.

Form popularity

FAQ

Schedule J is instrumental in financial planning as it outlines essential living expenses that must be met. Understanding your expenditure helps in budgeting and managing finances, particularly during bankruptcy. When paired with the California Form 425B (Small Business Disclosure Statement), this schedule can guide small business owners in maintaining a clear view of both personal and business financial responsibilities.

Schedule I focuses on your income, while Schedule J details your expenses in Chapter 7 bankruptcy filings. Together, these schedules provide a comprehensive view of your financial situation to the court. When completing these forms, including the California Form 425B (Small Business Disclosure Statement) if relevant, you help ensure that your case demonstrates both your income and necessary expenses effectively.

Schedule J is a part of the Chapter 7 bankruptcy filing that outlines your monthly living expenses. This schedule allows you to detail your necessary expenditures, which can help the court understand your financial obligations. Accurately completing Schedule J is important as it may impact your discharge eligibility, especially when paired with the California Form 425B (Small Business Disclosure Statement).

California Form 410, also known as the Statement of Information, is used to provide essential information about a business entity. This form helps to maintain transparency in business operations and may be required during various legal proceedings. Understanding forms like the California Form 410 and the California Form 425B (Small Business Disclosure Statement) is crucial for small business owners navigating legal responsibilities.

When filing Chapter 13, you'll need to gather several documents, including your income statements, a list of debts, and your credit report. You will also want to include the California Form 425B (Small Business Disclosure Statement) if you're a small business owner. This documentation plays an essential role in demonstrating your financial situation and establishing a feasible repayment plan.

Filing Chapter 7 on your own requires careful preparation of documentation detailing your debts, assets, and income. You will need to complete the necessary forms, including the California Form 425B (Small Business Disclosure Statement) if applicable. It's crucial to follow all procedural requirements, as errors can delay your case or lead to rejection.

Settling debts can be a viable option for some individuals, but it often depends on the amount owed and your financial situation. If debts are insurmountable, filing Chapter 7 may provide a fresh start by discharging unsecured debts. Remember that the California Form 425B (Small Business Disclosure Statement) may need to be filed in certain situations, particularly if you're operating your own business during this process.

Failing to file your statement of Information can lead to penalties and potential dissolution of your business entity. The California Secretary of State may impose late fees for overdue filings. To avoid complications, it's crucial to file your California Form 425B (Small Business Disclosure Statement) on time. You can use platforms like uslegalforms to simplify your filing process and stay compliant.

Filing a California corporate disclosure statement online is straightforward. Begin by visiting the California Secretary of State's website. After selecting the online filing option, fill out your California Form 425B (Small Business Disclosure Statement) with accurate information, and submit your payment. Make sure to keep a copy of your submission for your records.

You should update your statement of Information whenever there are significant changes in your business. This includes changes in your business address, ownership, or management structure. Generally, you need to file your California Form 425B (Small Business Disclosure Statement) every two years to maintain compliance. However, staying proactive can help you avoid potential penalties.