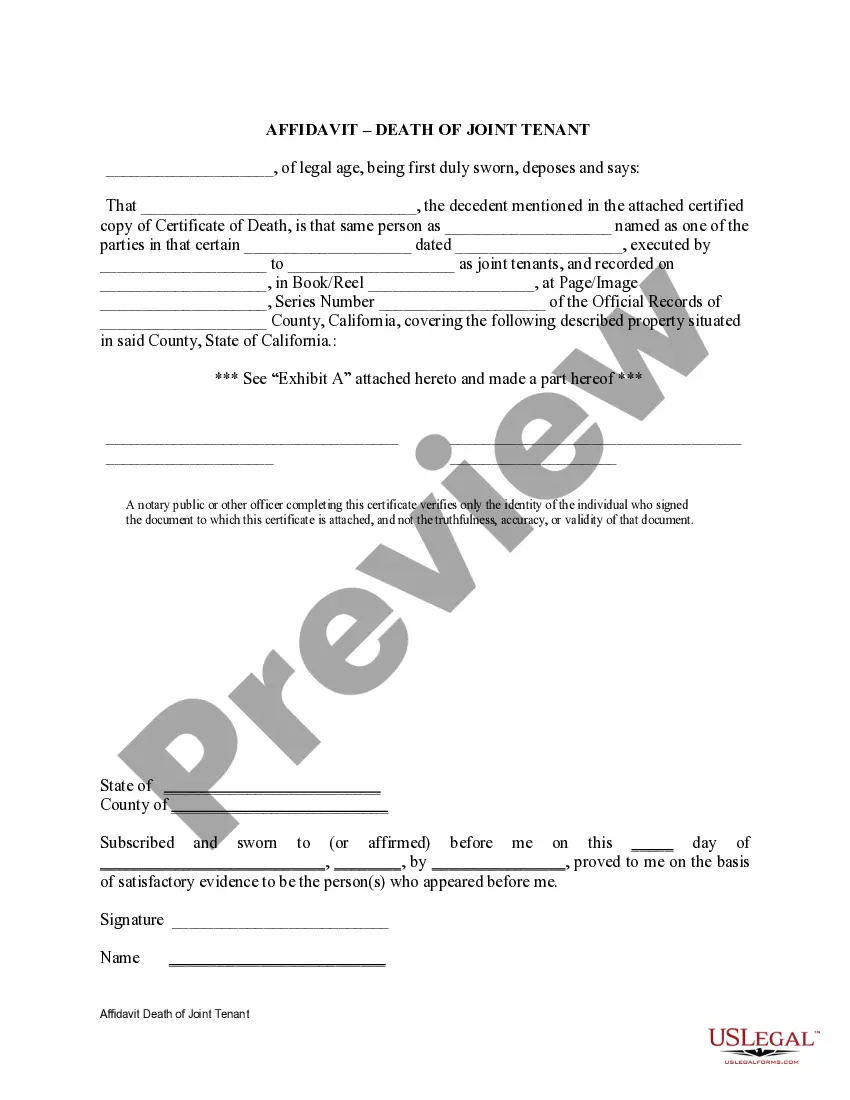

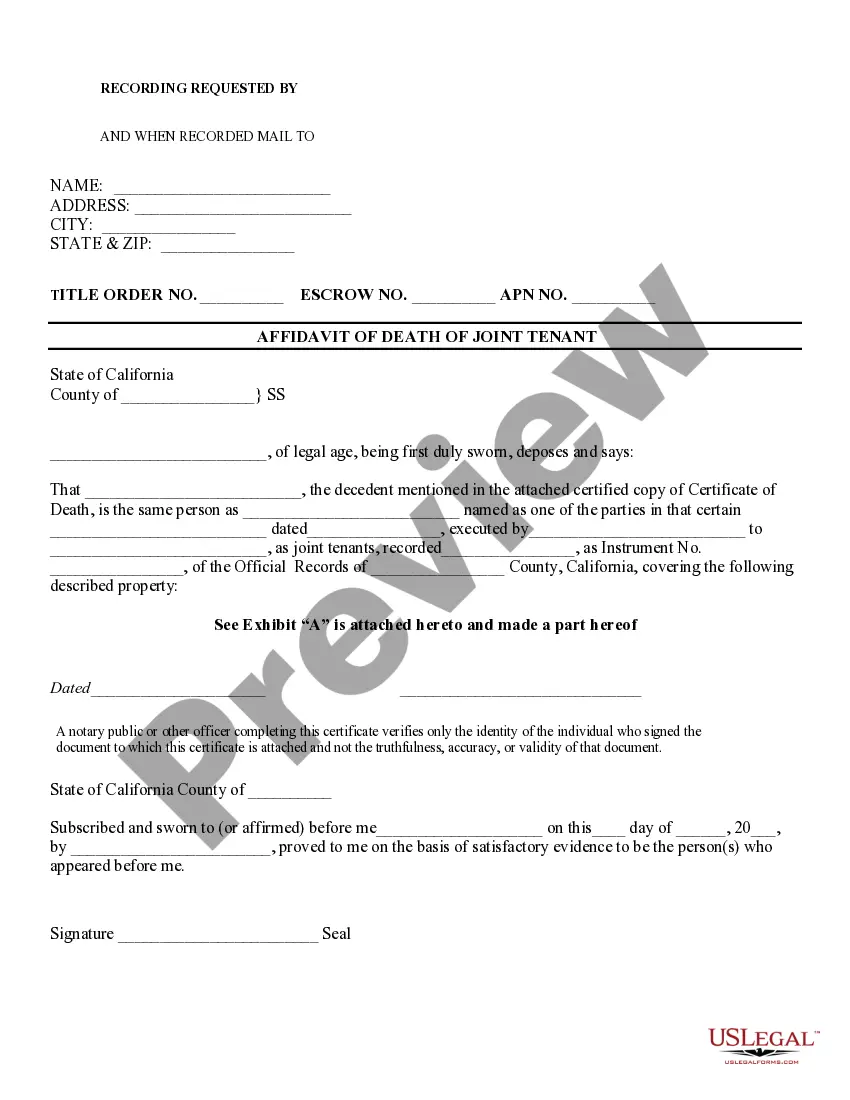

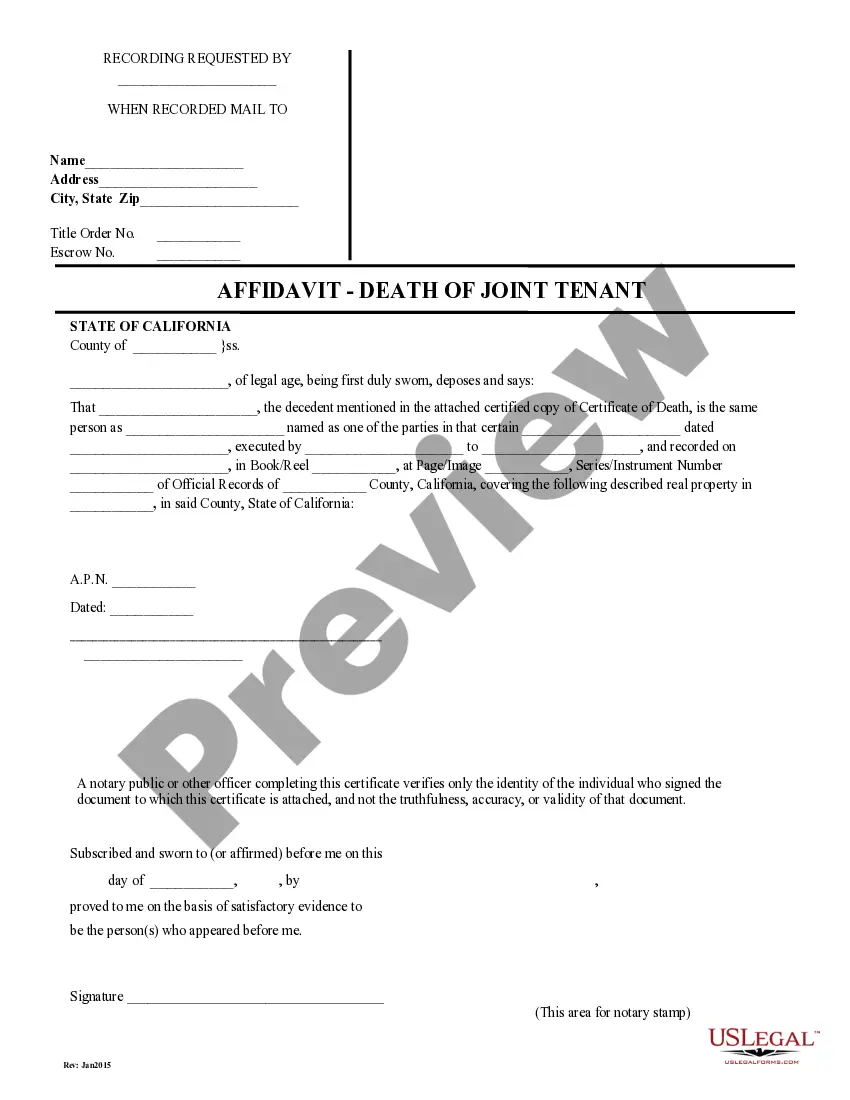

A California Affidavit- Death of Joint Tenant is a document used to transfer the ownership of a property when one or more joint tenants have died. This document is used to terminate the joint tenancy agreement in California and to transfer the property's title into the name(s) of the surviving joint tenants. Depending on the circumstances, there are three types of California Affidavit- Death of Joint Tenant: (1) Affidavit of Death of Joint Tenant by Surviving Joint Tenant, (2) Affidavit of Death of Joint Tenant by Heirs of Deceased Joint Tenant, and (3) Affidavit of Death of Joint Tenant by Personal Representative of Deceased Joint Tenant. The Affidavit of Death of Joint Tenant by Surviving Joint Tenant is used by a surviving joint tenant to transfer the ownership of the property to themselves or other joint tenants. This type of affidavit must include information about the deceased joint tenant, such as their name, date of death, and the county in which they resided. It must also include information about the property, such as the address, legal description, and the current owner(s). The Affidavit of Death of Joint Tenant by Heirs of Deceased Joint Tenant is used by the heirs of the deceased joint tenant to transfer the ownership of the property to the surviving joint tenants. This type of affidavit must include information about the deceased joint tenant, such as their name, date of death, and the county in which they resided. It must also include information about the property, such as the address, legal description, and the current owner(s). The Affidavit of Death of Joint Tenant by Personal Representative of Deceased Joint Tenant is used by the personal representative of the deceased joint tenant to transfer the ownership of the property to the surviving joint tenants. This type of affidavit must include information about the deceased joint tenant, such as their name, date of death, and the county in which they resided. It must also include information about the property, such as the address, legal description, and the current owner(s). Additionally, it must include information about the personal representative, such as their name and the court that appointed them. In all cases, the California Affidavit- Death of Joint Tenant must be notarized and filed with the county recorder's office where the property is located.

California Affidavit- Death of Joint Tenant

Description

How to fill out California Affidavit- Death Of Joint Tenant?

US Legal Forms offers the simplest and most lucrative means to discover appropriate formal templates.

It boasts the largest online collection of business and personal legal documents crafted and validated by attorneys.

Here, you will locate printable and fillable templates that adhere to federal and regional regulations - just like your California Affidavit- Death of Joint Tenant.

Review the form description or preview the document to ensure it meets your needs, or search for another one using the tab above.

Click Buy now when you are certain of its compatibility with all the stipulations and select your preferred subscription plan.

- Acquiring your template entails only a few easy steps.

- Users with an existing account and valid subscription simply need to Log In to the website and download the form to their device.

- Subsequently, they can find it in their profile under the My documents section.

- And here’s a guide on how to get a professionally drafted California Affidavit- Death of Joint Tenant if you’re using US Legal Forms for the first time.

Form popularity

FAQ

To file an Affidavit of death in Texas, you must prepare the California Affidavit - Death of Joint Tenant, ensuring it complies with state requirements. Typically, this involves gathering necessary documentation, signing before a notary, and submitting it to the local county clerk. It's vital to follow the specific procedures outlined by Texas law to ensure a smooth filing process. Platforms like US Legal Forms can provide guidance and templates to simplify this process for you.

If a California Affidavit - Death of Joint Tenant is not notarized, it may be considered invalid. Notarization adds a layer of authenticity and ensures the document meets legal standards. Without this crucial step, the transfer of property can be contested or delayed, leading to potential complications for the surviving tenant. It is advisable to ensure proper notarization to avoid such issues.

A California Affidavit - Death of Joint Tenant does not override a will. Instead, it serves a specific purpose in transferring property after a joint tenant's death. The affidavit simplifies the process of transferring ownership, but the will still governs the distribution of other assets. Understanding the relationship between wills and affidavits can ensure a smooth transition of your estate.

When a joint tenant dies in California, their interest in the property automatically transfers to the surviving joint tenant without going through probate. This transfer is facilitated by filing a California Affidavit - Death of Joint Tenant, which serves as evidence of the change. As a result, the surviving tenant continues to own the property without significant disruption.

To avoid property tax reassessment in California after the death of a joint tenant, certain strategies can be employed. One effective approach is using a California Affidavit - Death of Joint Tenant to ensure the property remains under the surviving tenant's name without triggering a reassessment. Consulting with a legal professional can also help identify additional strategies tailored to your unique situation.

In California, several events can trigger a home reassessment, including change of ownership, construction that increases the property's value, or changes in property use. A transfer of title due to death may not always trigger reassessment, especially when using tools like a California Affidavit - Death of Joint Tenant. Staying informed about these triggers can help you manage property taxes effectively.

The death of a joint tenant typically does not trigger reassessment of the property in California, as the surviving tenant retains their interest. However, if the property changes significantly, or if it moves to a new owner, reassessment may occur. Utilizing a California Affidavit - Death of Joint Tenant can help ensure the transfer of title without triggering property tax reassessment.

To file an Affidavit of death for joint tenants in California, you need to gather required documents, including the death certificate and the original property deed. Once you have these, complete the California Affidavit - Death of Joint Tenant form. Finally, file this affidavit with the county recorder's office where the property is located, which officially updates the title to reflect the change in ownership.

When using a California Affidavit - Death of Joint Tenant, consider consulting with a legal expert or utilizing platforms like US Legal Forms to guide you through the process. They provide templates and resources to ensure you fill out your affidavit correctly. This approach can help you avoid common errors and streamline your experience while dealing with property matters after a joint tenant's death.

To file a California Affidavit - Death of Joint Tenant, you typically need to complete the affidavit form and have it notarized. Afterward, you can submit the document to the county recorder's office in the county where the property is located. Following this procedure ensures that your claim to ownership of the property is officially recognized and documented.