California Social Security Mismatch Notice

Overview of this form

The Social Security Mismatch Notice is a form used by employers to inform an employee that their social security number (SSN) does not match the name registered with the U.S. Social Security Administration. This form serves to prompt the employee to take corrective action regarding their SSN to ensure compliance with legal employment requirements. It helps maintain accurate records and proper tax reporting, distinguishing it from other employment-related notices.

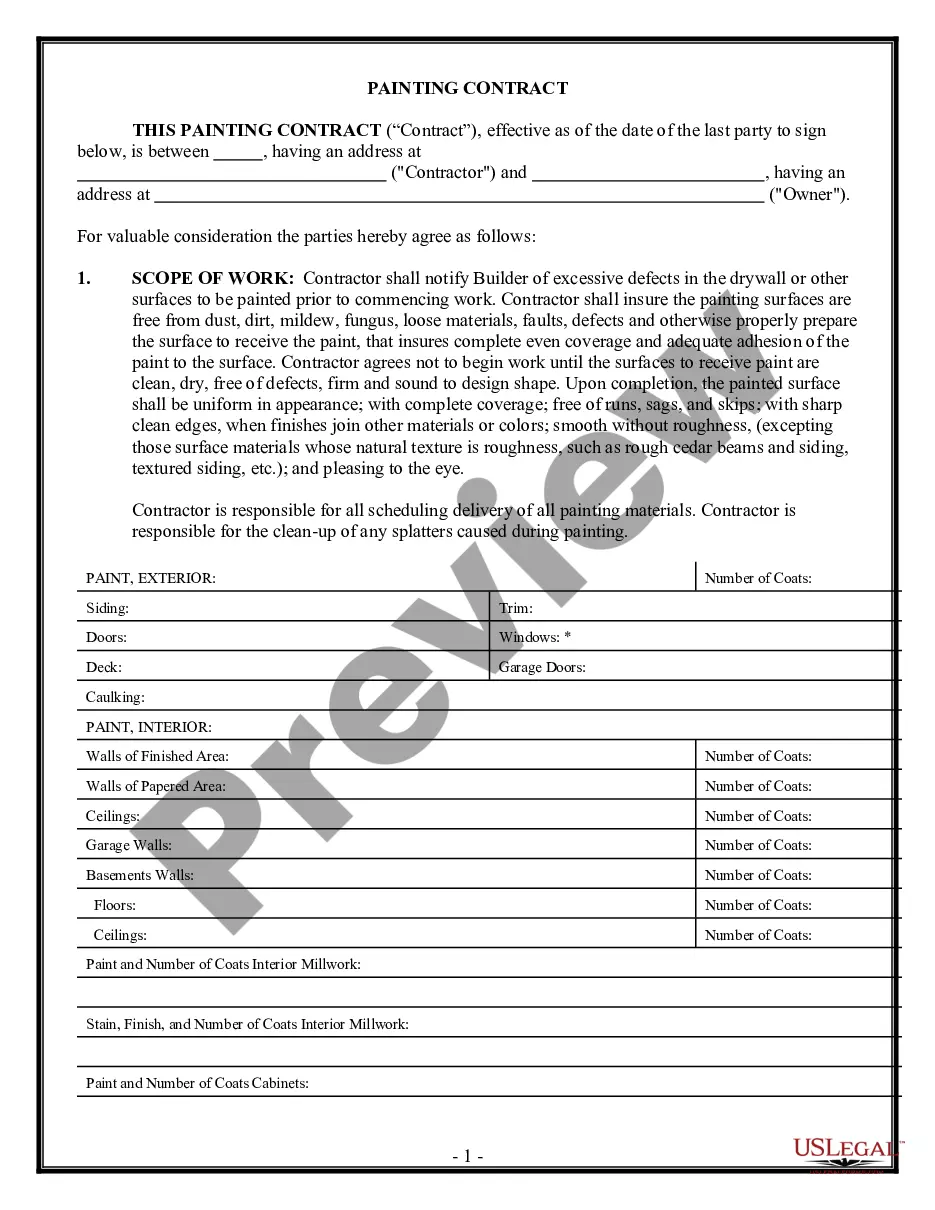

Form components explained

- Date of issuance

- Employeeâs name and contact information

- Specific details regarding the reported mismatch

- Instructions for the employee on correcting the SSN issue

- Contact information for the U.S. Social Security Administration

- Deadline for resolution

When to use this form

An employer should use the Social Security Mismatch Notice when they receive a notification from the U.S. Social Security Administration indicating that an employee's SSN is invalid or does not correspond with the registered name. This can happen during the verification process for new hires or when an employeeâs information is updated in the system.

Who should use this form

This form is intended for:

- Employers who need to address discrepancies related to an employee's social security number

- HR departments responsible for compliance with employment regulations

- Employees who must rectify their social security information

Instructions for completing this form

- Enter the date of the notice.

- Fill in the employee's name and address details.

- Specify the nature of the mismatch as reported by the Social Security Administration.

- Provide a deadline for correcting the issue and instructions for acceptable documentation to verify employment eligibility.

- Include any necessary contact information for the Social Security Administration.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a clear deadline for the employee to respond.

- Not including accurate contact information for the Social Security Administration.

- Neglecting to attach a list of acceptable documents from the I-9 Form.

- Using outdated or incorrect employee information.

Why complete this form online

- Easy access to downloadable templates created by licensed attorneys.

- Quick completion and editing of the document to suit specific needs.

- Reliable and up-to-date resources for legal compliance.

- Secure storage options for completed documents.

Key takeaways

- The Social Security Mismatch Notice is essential for compliance with employment verification laws.

- Timely corrections of SSN mismatches are crucial for maintaining employment status.

- This form can help avoid potential legal issues related to employment eligibility verification.

Looking for another form?

Form popularity

FAQ

The letters at the end of a SSN indicate the claim number for a SSI or Social Security beneficiary."If you are an SSI beneficiary, your claim number is your nine-digit Social Security Number (SSN) (000-00-0000) followed by two letters such as EI, DI, DS, DC.

Inform affected employees of the no-match notice and ask that they confirm the name and Social Security number reflected in their employment records. Advise the workers to contact the SSA to correct their SSA records. Give employees a reasonable period of time to do this.

Any employer that uses the failure of the information to match SSA records to take inappropriate adverse action against a worker may violate State or Federal law. The information you receive from SSNVS does not make any statement regarding a worker's immigration status.

Once you have gathered your documents, contact Social Security at 800-772-1213 to begin the process of correcting your earnings record. What are possible reasons for the error? An employer may have reported your earnings incorrectly or reported your earnings using the wrong name or Social Security number.

If you did look at your earnings record and notice a mistake, the burden is yours to prove it. You might want to start by checking out the SSA's Request For Correction of Earnings Record form. You should be prepared to locate documents that prove the error such as tax forms, W-2 forms or pay stubs.

A no-match letter can expose an employer to liability under IRCA for knowingly continuing to employ an unauthorized individual.Employers cannot simply ignore them, but can potentially face discrimination lawsuits for being too keen in responding to no-match letters.

"No-match letters notify employers of a discrepancy in an employee's information between the SSA's records and the employee's Form W-2," Karcutskie said.

To seek correction of information related to individual records, benefits, or earnings, please call us at 1-800-772-1213 or contact us. The Social Security Administration has received no requests for correction to information under Section 515.