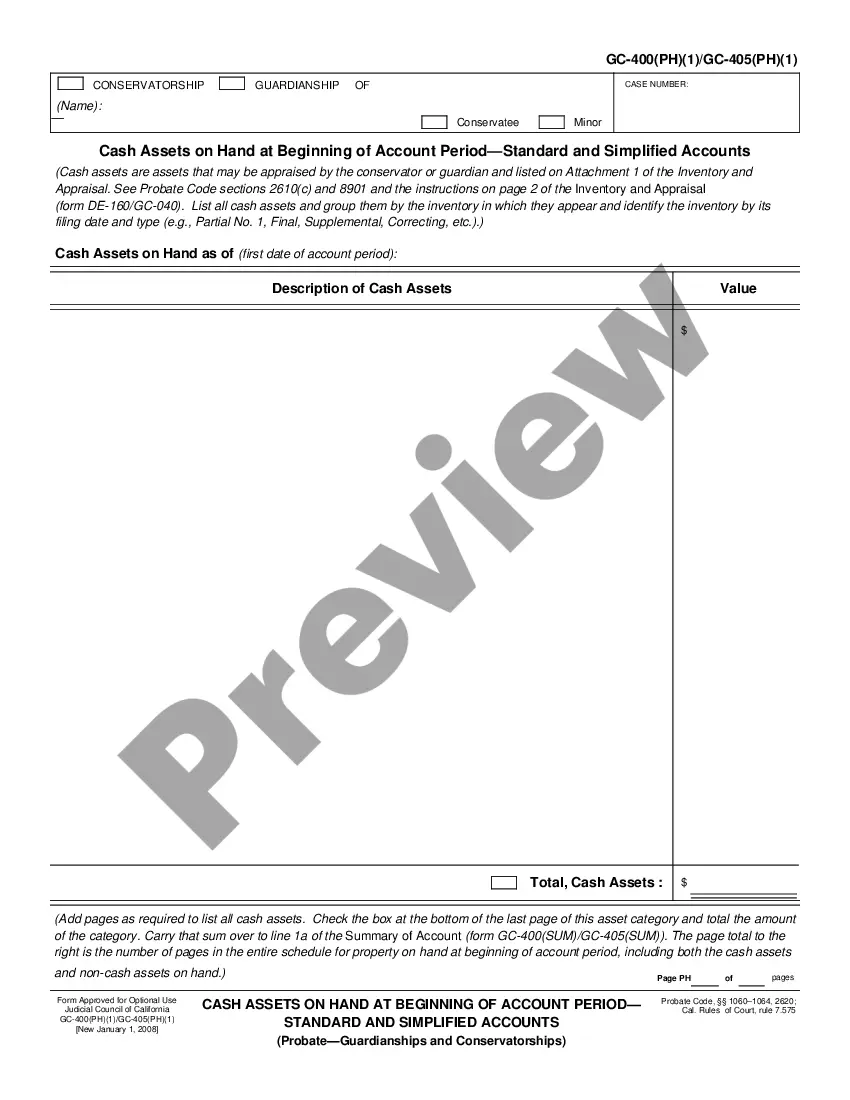

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Cash Assets on Hand at Beginning of Account Period-Standard and Simplified Accounts

Description

How to fill out California Cash Assets On Hand At Beginning Of Account Period-Standard And Simplified Accounts?

If you're looking to discover precise California Cash Assets on Hand at Beginning of Account Period-Standard and Simplified Accounts examples, US Legal Forms is precisely what you require; find documents created and reviewed by state-certified legal experts.

Utilizing US Legal Forms not only prevents you from issues related to legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional document is substantially more cost-effective than hiring an attorney to do it for you.

Select an appropriate format and save the documents. And that's it. With a few simple clicks, you have an editable California Cash Assets on Hand at Beginning of Account Period-Standard and Simplified Accounts. After you create an account, all subsequent purchases will be processed even more conveniently. If you have a US Legal Forms membership, just Log In and click the Download option visible on the form’s page. Then, whenever you need to access this document again, you will always find it in the My documents menu. Don't waste your time and effort comparing numerous forms on different platforms. Secure accurate templates from a single trustworthy platform!

- To begin, finish your registration process by providing your email and creating a password.

- Follow the instructions below to establish an account and obtain the California Cash Assets on Hand at Beginning of Account Period-Standard and Simplified Accounts template to meet your needs.

- Use the Preview feature or examine the document details (if available) to ensure that the template is the one you need.

- Verify its validity in your residing state.

- Click on Buy Now to place an order.

- Choose a preferred pricing option.

- Set up your account and pay using your credit card or PayPal.

Form popularity

FAQ

An amount of cash a company has available after all its costs have been paid:involving payment for goods or services immediately using cash, rather than by cheque, credit card, etc, especially when this is a way for the person being paid to avoid tax: He makes at least £300 a week, cash in hand.

There would be no definite entry for cash in hand. As per the main rules of accounting, every transaction should have a double effect. If we are talking only about cash in hand, there would be no definite journal entry for the same. Cash in hand is an asset and the most liquid asset.

Do a business cash flow analysis. Stick to your budget. Increase sales. Early payment discounts. Cut costs. Don't let late payments fall to the wayside. Keep a cash reserve. Get through periods of low cash.

As there are usually a large number of entries, cash at bank and in hand transactions are not normally recorded directly into the general ledger. Cash at bank movements are recorded in the Cash Book and cash in hand movements are usually recorded in the Petty Cash Book.

Making A Cash Sale. The source document for your cash sale is the sales receipt. Enter The Cash Receipt. Make The Sales Entry. Deposit The Cash.

Like other asset accounts, Cash on hand is said to carry a debit (DR) balance. Note that total debits and total credits to a single account are not necessarily equal, either for the period or the account's entire history.

To assess the amount of operating expenses, use an operating expenses subtotal in an income statement, and subtract the non-cash expenses (in the form of amortization and depreciation) and divide it by 365 to assess the cash outflow amount each day. Then, divide cashflow each day into the total balance of cash on hand.

Assets.Current assets include cash, accounts receivable, securities, inventory, prepaid expenses, and anything else that can be converted into cash within one year or during the normal course of business. Cash includes cash on hand, in the bank, and in petty cash.