California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

Key Concepts & Definitions

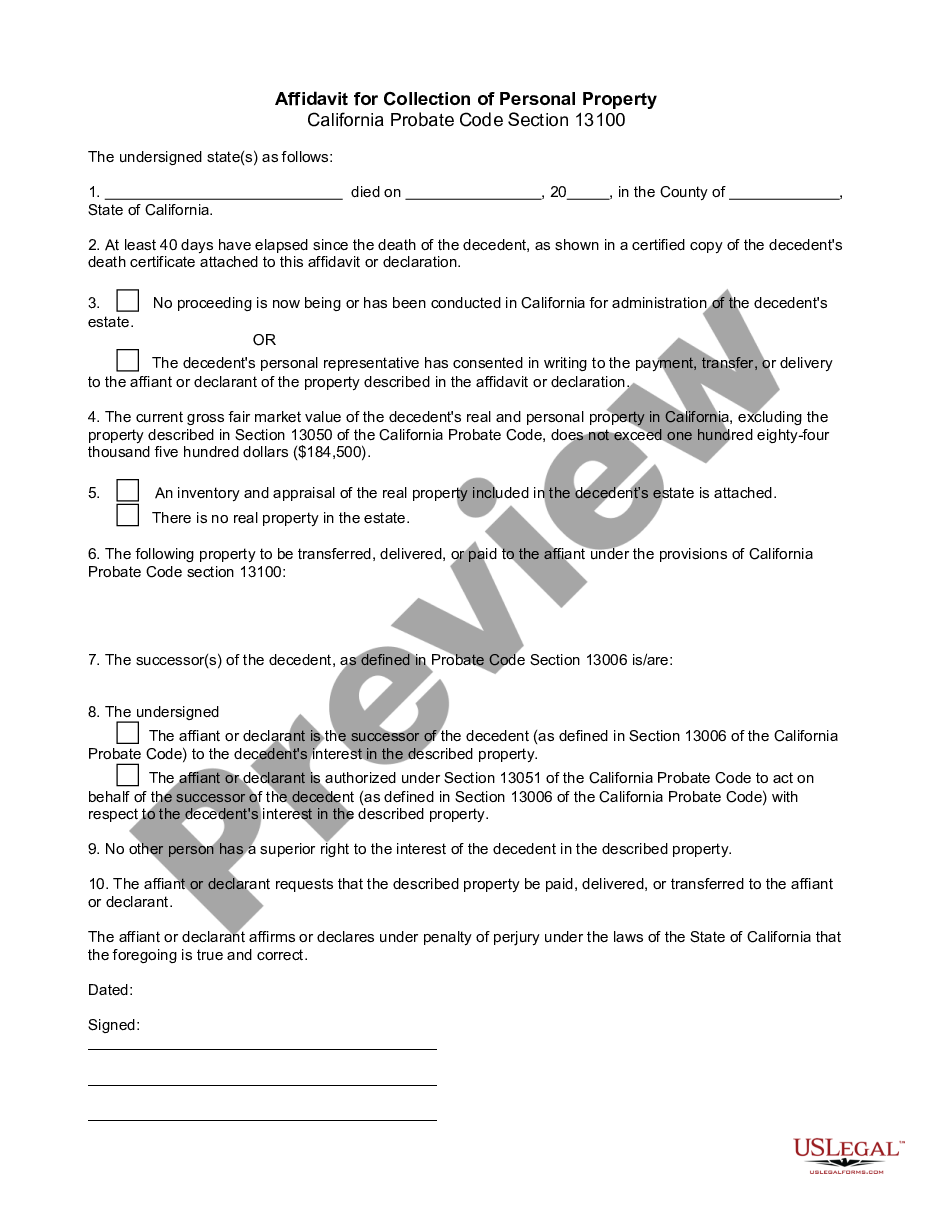

Affidavit for Collection of Personal Property: An affidavit for collection of personal property is a legal document used in the United States to facilitate the transfer of personal property of a deceased person to their rightful heir or beneficiary without formal probate. This document is typically used when the total value of the estate meets specific state-defined thresholds, which vary by state.

Step-by-Step Guide

- Verify Eligibility: Confirm that the total value of the estate qualifies for small estate proceedings under your state's law.

- Obtain the Form: Acquire the correct affidavit form from your local court or online legal resources specific to your state.

- Complete the Form: Fill out the affidavit with the required information, including details of the deceased, the heirs, and the property to be collected.

- Notarize the Affidavit: Sign the form in front of a notary public to validate the document.

- Present to Holder of Property: Provide the notarized affidavit to the entity holding the personal property (e.g., bank, brokerage) to transfer the assets to the designated beneficiaries.

Risk Analysis

- Legal Challenges: Incorrectly filed affidavits can lead to disputes among heirs or claims from creditors, potentially requiring more detailed probate proceedings.

- State Variations: Each state has different thresholds and rules for using affidavits for collection of personal property, leading to possible complications if not properly followed.

- Financial Risks: Mishandling the transfer could lead to financial losses or tax implications for the beneficiaries.

Common Mistakes & How to Avoid Them

- Ignores State Laws: Always check and follow your state-specific requirements to avoid legal issues. Consulting a local estate attorney can help.

- Filling Errors: Ensure that all information is accurate and thoroughly checked before submitting the affidavit to avoid delays or rejections.

- Lack of Documentation: Maintain thorough documentation of all assets, values, and related paperwork in case of future disputes or audits.

FAQ

- What is the typical threshold for using an affidavit instead of probate? The threshold varies by state, commonly ranging from $20,000 to $150,000.

- Can all types of property be transferred using this affidavit? Typically, this affidavit is used for personal property excluding real estate, but some states might allow for certain exceptions.

- How long does it take to process? Once filed, the process duration can vary from immediate to several weeks, depending on the institution holding the property.

Key Takeaways

Using an affidavit for collection of personal property can streamline the process of asset distribution of a deceased person's estate, making it a useful tool in specific scenarios dictated by state laws. Awareness and adherence to these laws is crucial for the smooth execution of the affidavit.

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

If you're trying to find precise California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 web templates, US Legal Forms is what exactly you need; reach files developed and verified by state-qualified attorneys. Benefiting US Legal Forms not merely keeps you from headaches relating to legitimate documentation; you additionally save time and energy, and cash! Downloading, printing, and submitting a professional template is really cheaper than requesting a solicitor to prepare it for you.

To get going, complete your sign up process by adding your email and building a security password. Stick to the guidance listed below to create your account and find the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 template to remedy your circumstances:

- Use the Preview option or look at the file information (if offered) to be certain that the web template is the one you need.

- Examine its applicability in your state.

- Just click Buy Now to make an order.

- Select a preferred pricing program.

- Make an account and pay out with the visa or mastercard or PayPal.

- Go with a convenient format and conserve the the form.

And while, that’s it. Within a few simple actions you own an editable California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250. After you create your account, all future purchases will be processed even simpler. If you have a US Legal Forms subscription, just log in account and click the Download option you see on the for’s web page. Then, when you need to use this sample once again, you'll always be able to find it in the My Forms menu. Don't squander your time comparing numerous forms on several web sources. Buy accurate documents from just one safe service!

Form popularity

FAQ

Excluded property as described in section 13050 of the California Probate Code refers to certain assets that do not count toward the small estate threshold of $184,500. This typically includes specific types of property such as joint tenancy accounts or assets held in trust. Knowing what constitutes excluded property ensures that individuals can properly navigate the California Affidavit for Collection of Personal Property for a smoother estate transfer.

According to California Probate Code section 13006, successors of the decedent include those individuals entitled to inherit the decedent’s property under the terms of a will or through the laws of intestacy. This typically involves heirs, beneficiaries, or those named in legal documents pertaining to the estate. Understanding who qualifies as a successor helps in properly utilizing the California Affidavit for Collection of Personal Property effectively.

California Probate Code 13100 provides specific guidelines for the transfer of small estates to streamline the process for heirs or beneficiaries. This code allows claimants to collect personal property directly, avoiding formal probate court proceedings if the estate value is under $184,500. This process saves time and resources, making the California Affidavit for Collection of Personal Property essential for efficient estate management.

Under the California Probate Code 13100 and 13115, a declaration allows successors to claim personal property by affirming their right to do so after following the prescribed process. This declaration verifies the value of the estate is within the $184,500 limit and that the decedent had no real property. By using the California Affidavit for Collection of Personal Property, individuals can simplify the transfer process while ensuring compliance with the relevant regulations.

Section 13100 of the California Probate Code outlines the process for transferring small estates valued under $184,500 without the need for a full probate proceeding. This section provides a streamlined method through the California Affidavit for Collection of Personal Property, enabling heirs or designated individuals to collect personal property of the decedent more efficiently. Utilizing this section helps beneficiaries avoid the lengthy and often costly probate process.

To fill out a small estate affidavit, start by obtaining the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. Carefully provide information about the estate and sign the document in front of a notary. For your convenience, UsLegalForms offers comprehensive resources and templates that walk you through each step of filling out the affidavit correctly.

A California affidavit is a legal document used to affirm facts under penalty of perjury. Specifically, the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 serves as a means for heirs to access a decedent's personal property without probate. This affidavit streamlines the distribution process, making it efficient for small estate management.

To fill out a lack of probate affidavit, you should obtain the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. Gather the required information about the decedent and the estate’s value. Completing the affidavit accurately is crucial, and UsLegalForms provides user-friendly templates and instructions to simplify the task.

In California, affidavits must comply with Probate Code Section 13100, particularly for small estates under $184,500. The affidavit allows heirs to collect personal property without going through formal probate. It is important to ensure that the affidavit is signed, notarized, and includes the necessary supporting documents to avoid complications.

To obtain a copy of a small estate affidavit, visit your local probate court or access their online services. You will need to complete the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. If you need assistance, resources from UsLegalForms can guide you through the process, ensuring you have the correct documentation.