California Prenuptial Premarital Agreement with Financial Statements

Definition and meaning

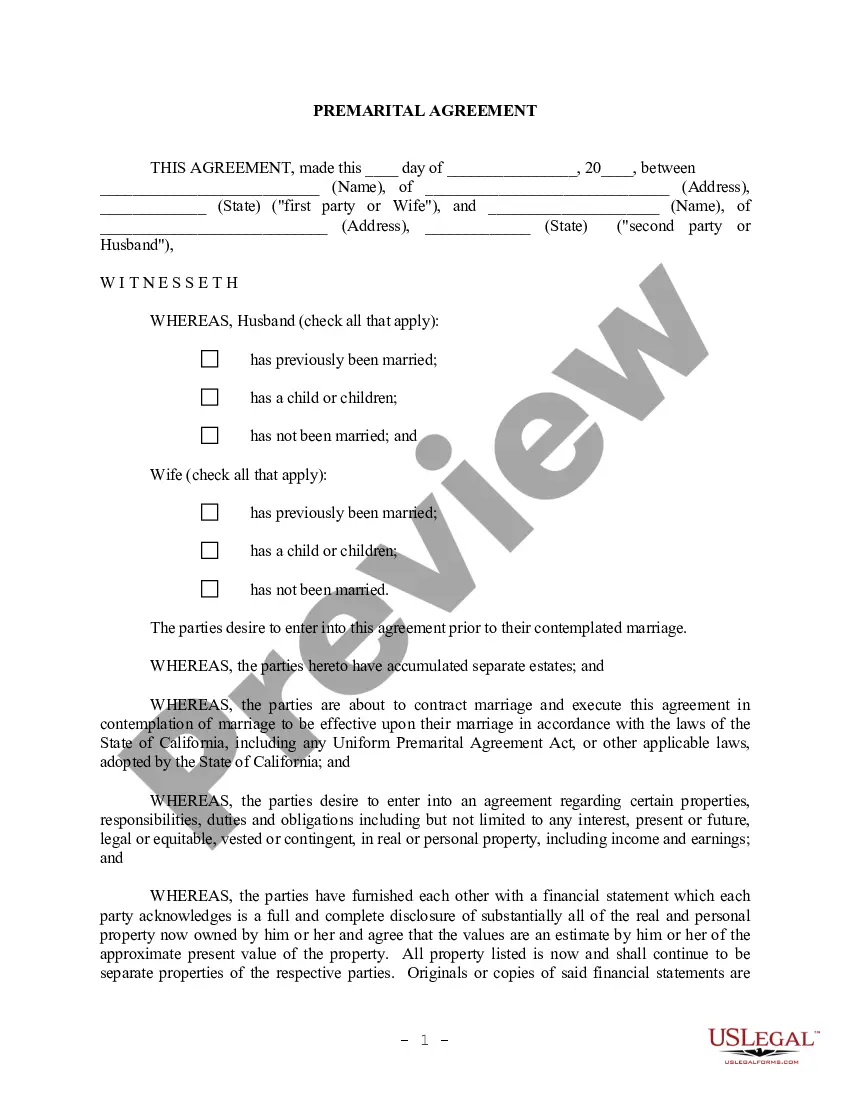

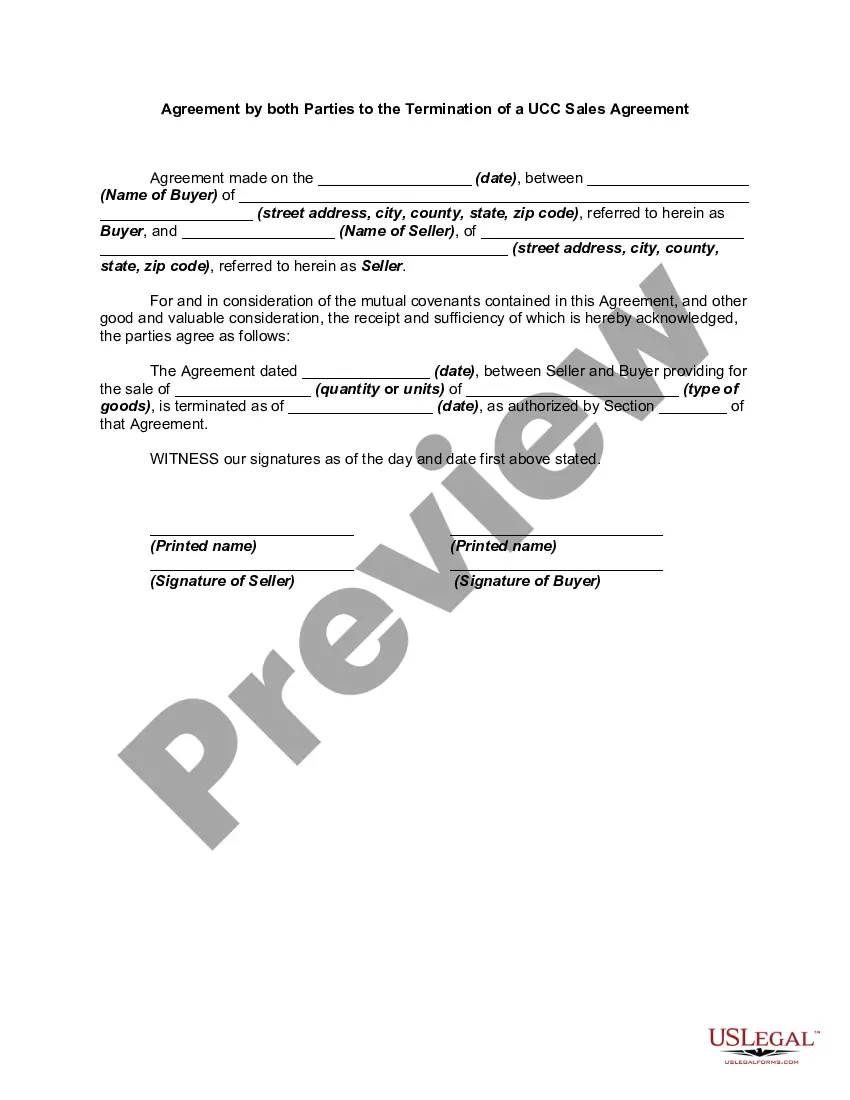

The California Prenuptial Premarital Agreement with Financial Statements is a legal document that outlines the terms and conditions governing the financial aspects of a marriage before it occurs. This agreement is specifically tailored for couples intending to marry in California. It addresses how assets and liabilities will be treated during the marriage and in the event of a divorce, separation, or death.

Such agreements commonly include detailed financial disclosures from both parties, ensuring transparency regarding individual assets and debts. This helps to protect each party's rights and expectations concerning property and financial support.

Who should use this form

This prenuptial agreement is ideal for couples who wish to clarify financial interests before marriage. It is particularly beneficial for:

- Individuals entering a marriage with significant pre-existing assets.

- Couples with children from previous relationships who want to protect their family's inheritance.

- Those who own businesses that may be affected by marital changes.

- Partners who wish to avoid potential conflicts regarding asset division in the future.

Key components of the form

The California Prenuptial Premarital Agreement contains several critical components, including:

- Identification of parties: Names and personal details of both parties entering the agreement.

- Financial disclosures: Detailed statements outlining each party’s assets, liabilities, income, and expenses.

- Asset management: Provisions detailing how assets acquired during the marriage will be treated.

- Provisions for debts: Clarifications on how existing and future debts will be handled.

- Spousal support: Any agreements regarding spousal support obligations in the event of separation or divorce.

Legal use and context

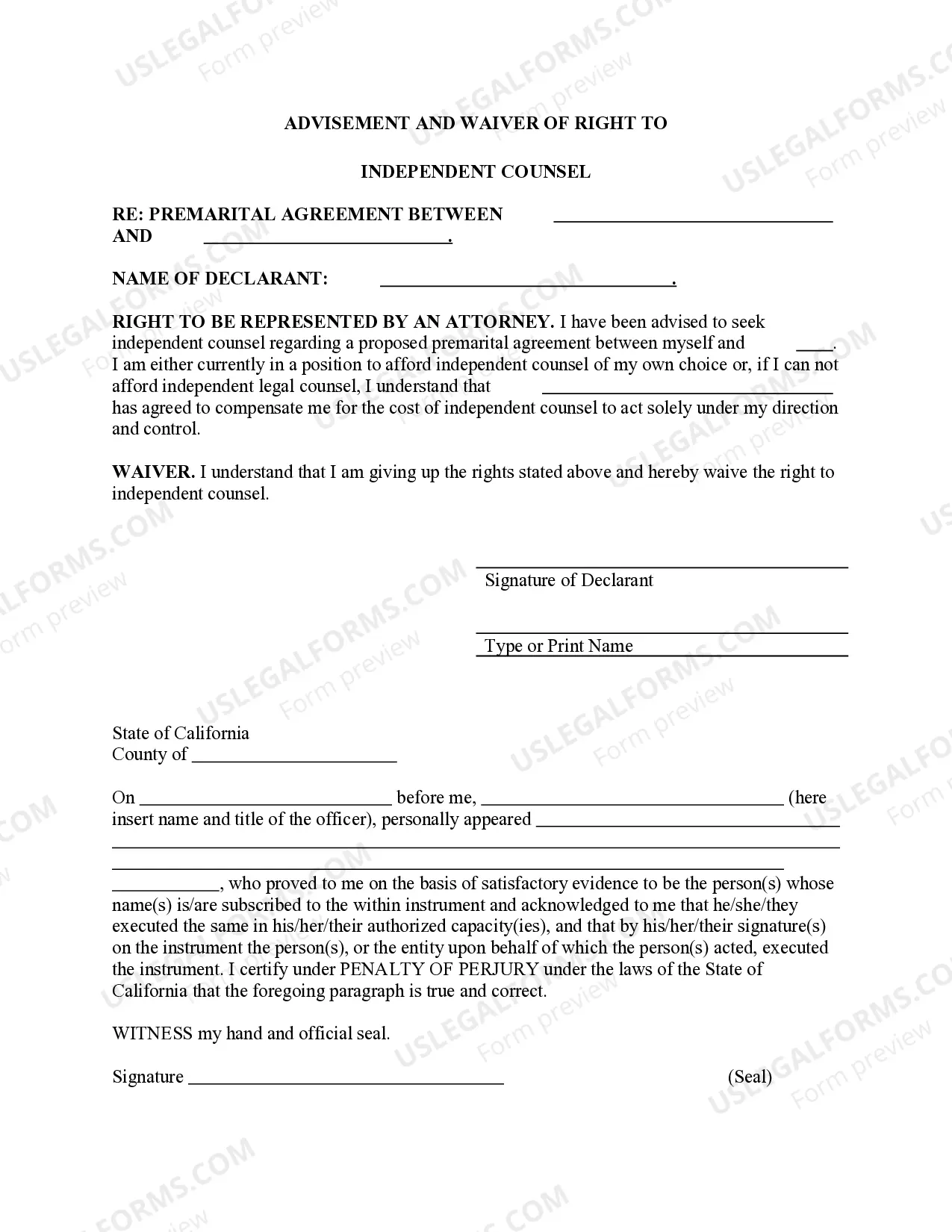

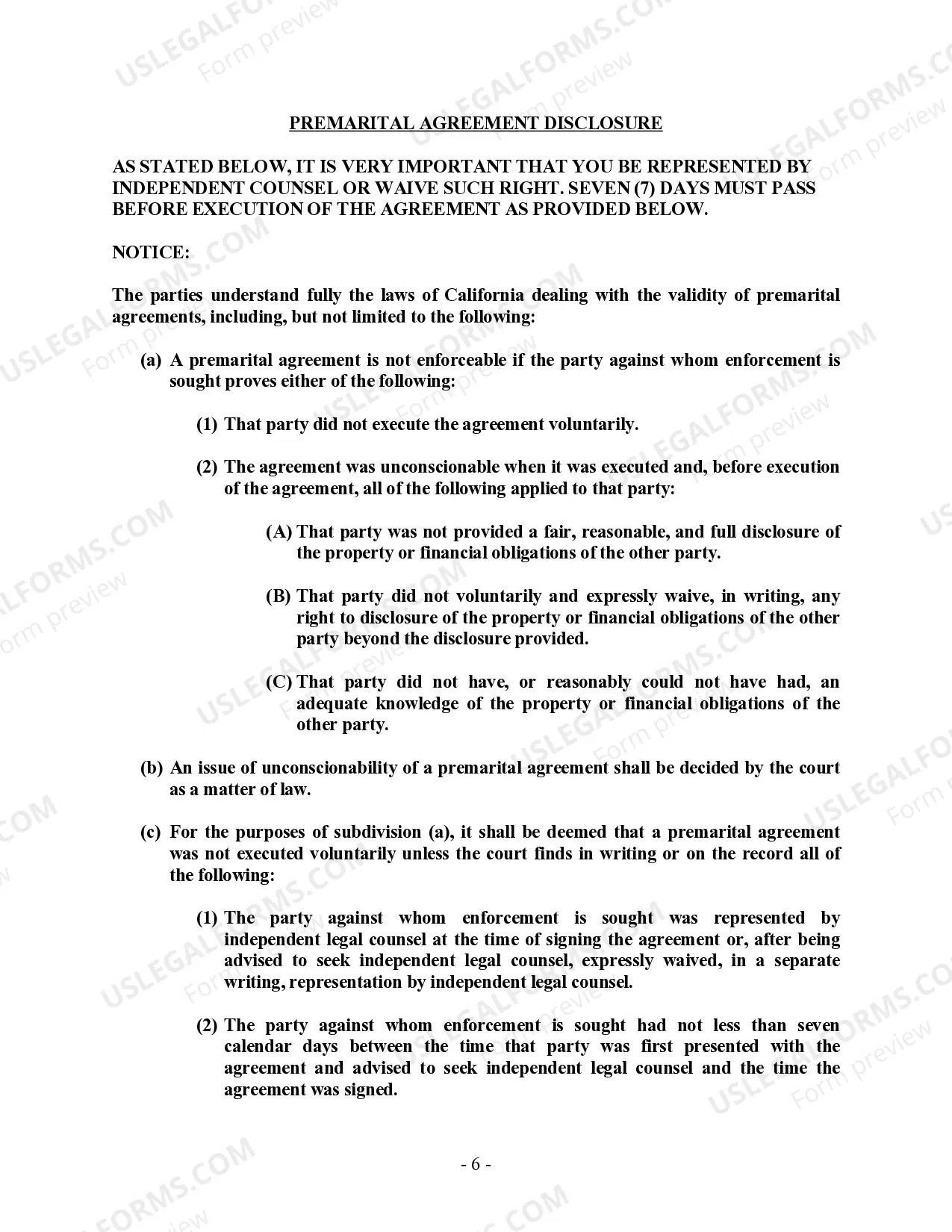

In California, prenuptial agreements are governed by the California Family Code. This agreement becomes legally enforceable once signed by both parties and notarized. It is crucial to adhere to state laws regarding prenuptial agreements to ensure that they are valid and enforceable. Usually, these agreements are created to protect individual interests and clarify financial responsibilities during the marriage.

It's advisable for each party to seek independent legal counsel before signing to ensure that both understand their rights and obligations as outlined in the agreement.

Common mistakes to avoid when using this form

When completing a California Prenuptial Premarital Agreement, several common mistakes should be avoided:

- Failing to disclose all assets and liabilities accurately.

- Not allowing enough time for both parties to review the agreement thoroughly.

- Neglecting to seek independent legal advice, which can lead to misunderstandings or unenforceability.

- Not considering future changes to financial situations or family structure.

- Signing the agreement under duress or without adequate time to reflect on its contents.

What documents you may need alongside this one

When preparing a California Prenuptial Premarital Agreement, it's essential to include several supporting documents for full disclosure:

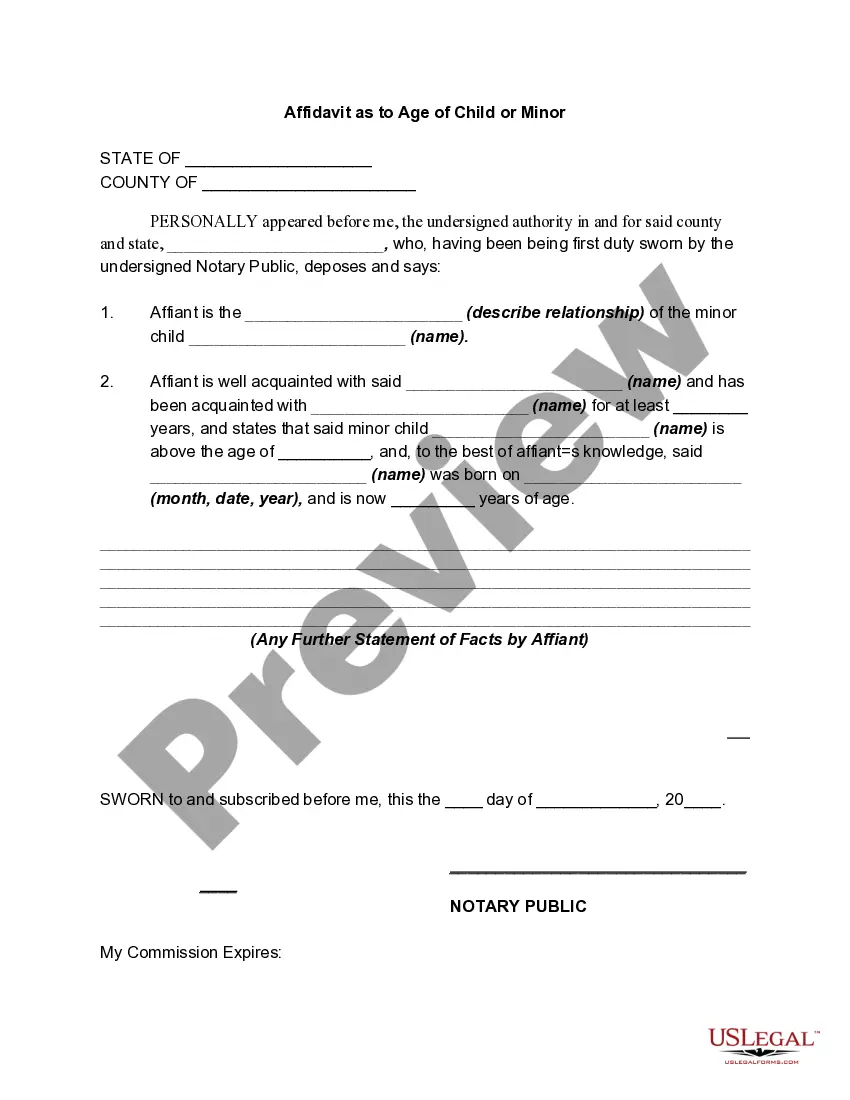

- Financial statements: Separate financial disclosures from both parties listing assets, liabilities, income, and expenses.

- Tax returns: Recent personal income tax returns can provide insight into financial status.

- Property deeds: Documentation of any property ownership.

- Business valuations: If applicable, a valuation of any business assets owned by either party.

Form popularity

FAQ

Indeed, you can include provisions for future earnings in a California Prenuptial Premarital Agreement with Financial Statements. This allows you to specify how earnings generated during the marriage will be categorized and managed. By clearly defining these terms, you can avoid misunderstandings and ensure financial stability in case of separation. Utilizing a service like USLegalForms can simplify the process and provide templates that cater to your specific needs.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can secure your future inheritance. The agreement may include terms that clarify how any inheritance received during the marriage will be treated, thus protecting it from being viewed as marital property. Addressing this matter in a prenup helps ensure that both spouses understand their rights regarding inheritances. It is wise to discuss this with a legal expert to accurately reflect your intentions.

A prenup can indeed protect future business in the context of a California Prenuptial Premarital Agreement with Financial Statements. This agreement can outline how ownership and profits from a business started during the marriage will be handled. By specifying these details upfront, both partners can avoid potential disputes regarding business assets should the marriage end. Consulting with an attorney who specializes in prenuptial agreements is crucial to creating an effective and nuanced arrangement.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can allow you to prenup future earnings. This type of agreement can specify how income generated during the marriage will be treated in the event of a divorce. By addressing future earnings in the prenup, both partners can establish clear financial expectations and protect their interests. It’s essential to work with a knowledgeable attorney to ensure your agreement is comprehensive and legally enforceable.

To protect future earnings in a California Prenuptial Premarital Agreement with Financial Statements, it's essential to clearly outline your earnings and assets. You can specify how future income will be treated, whether it remains separate or shared. Discussing these terms upfront with your partner sets a solid foundation and reduces potential conflicts later. Utilizing platforms like UsLegalForms can simplify this process and ensure that all aspects are professionally handled.

Several factors can invalidate a prenuptial agreement in California. If there was coercion, fraud, or an absence of informed consent, a court may not recognize the agreement. Additionally, if the financial statements were inaccurate or misleading, this can also disqualify the contract. To avoid these pitfalls, it is wise to create your California Prenuptial Premarital Agreement with Financial Statements through experienced legal professionals.

Certainly, prenups can be challenged in California if one party believes the agreement was not made in good faith. For instance, if there was a lack of full financial disclosure or if pressure was applied during the signing process, the agreement can be contested. A California Prenuptial Premarital Agreement with Financial Statements requires transparency to be valid. Legal advice is key when facing a challenge to ensure proper representation.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can be voided under certain circumstances. If one party did not sign voluntarily, or if there was fraud involved in the agreement, a court may choose to void it. Additionally, if the terms are found to be unconscionable or unfair, they may not be enforceable. It's important to consult with legal experts to ensure the agreement holds up.

A financial statement for a prenuptial agreement outlines each partner's assets, liabilities, income, and expenses. In the context of a California Prenuptial Premarital Agreement with Financial Statements, it provides a complete financial picture before marriage. This document is crucial for transparency and helps both parties make informed decisions. You can find helpful resources and templates on platforms like US Legal Forms to assist you.

Writing a prenuptial agreement in California involves several clear steps. First, both partners should gather financial information and discuss their goals. Then, use a professional template or consult a legal expert to draft the California Prenuptial Premarital Agreement with Financial Statements. This ensures compliance with California law and protects both parties’ interests.