California Prenuptial Premarital Agreement with Financial Statements

About this form

The California Prenuptial Premarital Agreement with Financial Statements is a legal document that outlines the financial rights and obligations of prospective spouses before marriage. This agreement is especially useful for individuals with prior marriage experiences or those entering their first marriage. It provides important details about asset and debt disclosure, property rights, and spousal support, aiming to minimize conflict and ensure an orderly resolution of financial matters in the event of divorce or death.

Main sections of this form

- Asset disclosure: outlines separate and community property rights.

- Debt responsibilities: clarifies who is liable for debts incurred during the marriage.

- Support obligations: details spousal support conditions and waivers.

- Child custody and support: explains the authority of the court regarding children.

- Enforceability: outlines conditions for a valid prenuptial agreement under California law.

- Execution requirements: emphasizes the need for independent legal counsel and waiting periods.

When to use this form

This form is typically used when couples want to establish clear financial expectations before entering marriage. It is particularly valuable when one or both partners have significant assets, children from previous relationships, or business interests. By completing this agreement, couples can protect their individual property and reduce the potential for conflict regarding financial matters in the future.

Who should use this form

- Individuals who have been previously married.

- Couples planning to marry who want to protect their assets.

- Those with significant debt or assets they wish to exclude from community property.

- Partners with children from previous relationships looking to clarify financial support.

- People who wish to avoid potential disputes in the event of divorce or death.

Instructions for completing this form

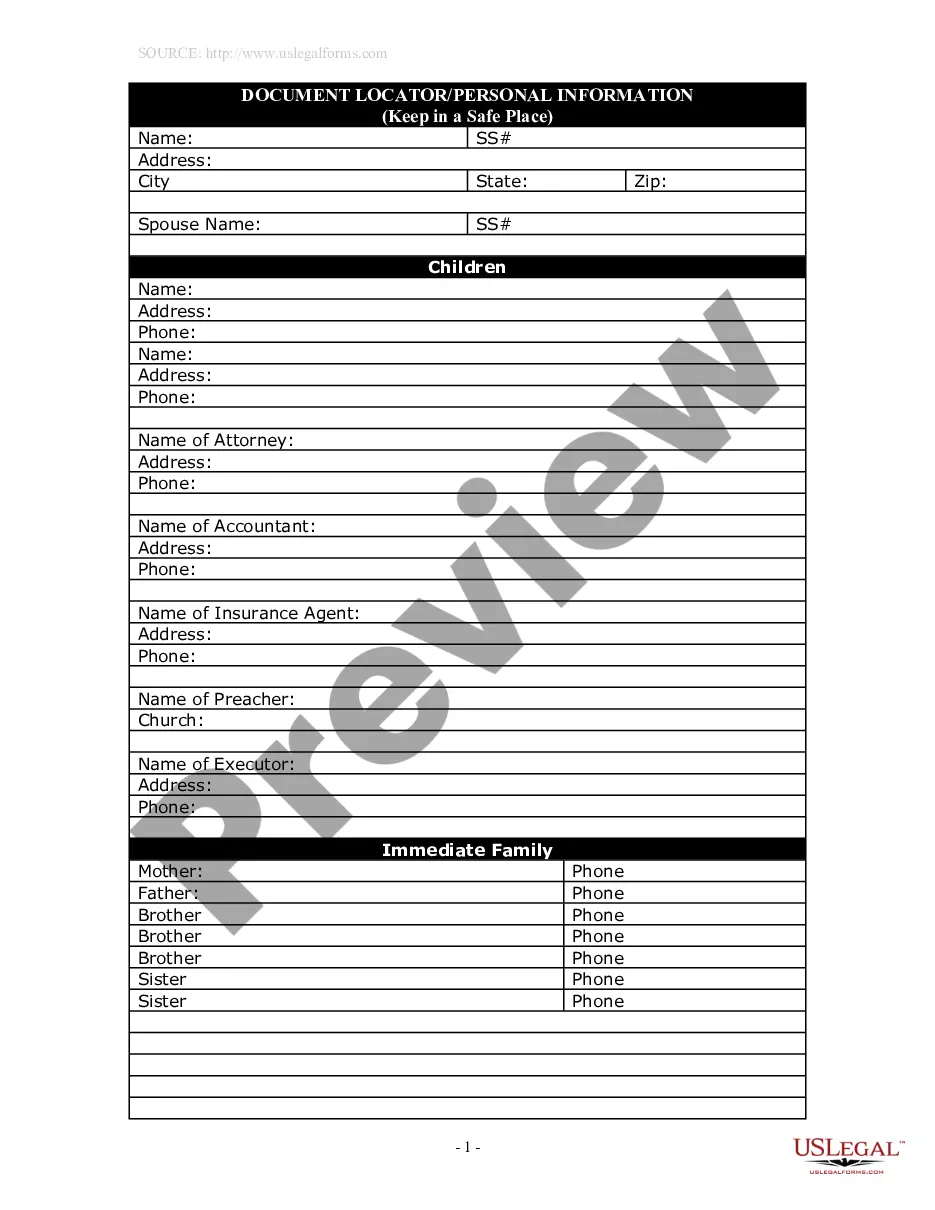

- Identify the parties: enter the names and contact information of both individuals.

- Complete financial disclosures: each party must list their assets and debts.

- Include specific terms: outline how assets and debts will be managed during and after marriage.

- Sign with legal counsel: both parties should sign the agreement in the presence of independent legal representation.

- Wait seven days if required: ensure the waiting period is observed before signing.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to fully disclose all assets and debts.

- Not seeking independent legal advice prior to signing.

- Forgetting the seven-day waiting period before execution.

- Neglecting to keep signed copies of the agreement.

- Assuming the agreement automatically covers child custody and support matters.

Why complete this form online

- Convenience of downloading and completing forms at your own pace.

- Editability allows customized terms to fit your unique situation.

- Access to forms drafted by licensed attorneys, ensuring legal accuracy.

- Secure storage and retrieval options for future reference.

- Time-saving compared to traditional methods of obtaining legal forms.

Summary of main points

- A prenuptial agreement clarifies financial rights before marriage.

- Transparency about assets and debts is crucial for enforceability.

- Legal representation is important to ensure both parties understand their rights.

- The agreement helps prevent future disputes related to financial matters.

- For couples with children or significant assets, this form offers essential protection.

Looking for another form?

Form popularity

FAQ

Indeed, you can include provisions for future earnings in a California Prenuptial Premarital Agreement with Financial Statements. This allows you to specify how earnings generated during the marriage will be categorized and managed. By clearly defining these terms, you can avoid misunderstandings and ensure financial stability in case of separation. Utilizing a service like USLegalForms can simplify the process and provide templates that cater to your specific needs.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can secure your future inheritance. The agreement may include terms that clarify how any inheritance received during the marriage will be treated, thus protecting it from being viewed as marital property. Addressing this matter in a prenup helps ensure that both spouses understand their rights regarding inheritances. It is wise to discuss this with a legal expert to accurately reflect your intentions.

A prenup can indeed protect future business in the context of a California Prenuptial Premarital Agreement with Financial Statements. This agreement can outline how ownership and profits from a business started during the marriage will be handled. By specifying these details upfront, both partners can avoid potential disputes regarding business assets should the marriage end. Consulting with an attorney who specializes in prenuptial agreements is crucial to creating an effective and nuanced arrangement.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can allow you to prenup future earnings. This type of agreement can specify how income generated during the marriage will be treated in the event of a divorce. By addressing future earnings in the prenup, both partners can establish clear financial expectations and protect their interests. It’s essential to work with a knowledgeable attorney to ensure your agreement is comprehensive and legally enforceable.

To protect future earnings in a California Prenuptial Premarital Agreement with Financial Statements, it's essential to clearly outline your earnings and assets. You can specify how future income will be treated, whether it remains separate or shared. Discussing these terms upfront with your partner sets a solid foundation and reduces potential conflicts later. Utilizing platforms like UsLegalForms can simplify this process and ensure that all aspects are professionally handled.

Several factors can invalidate a prenuptial agreement in California. If there was coercion, fraud, or an absence of informed consent, a court may not recognize the agreement. Additionally, if the financial statements were inaccurate or misleading, this can also disqualify the contract. To avoid these pitfalls, it is wise to create your California Prenuptial Premarital Agreement with Financial Statements through experienced legal professionals.

Certainly, prenups can be challenged in California if one party believes the agreement was not made in good faith. For instance, if there was a lack of full financial disclosure or if pressure was applied during the signing process, the agreement can be contested. A California Prenuptial Premarital Agreement with Financial Statements requires transparency to be valid. Legal advice is key when facing a challenge to ensure proper representation.

Yes, a California Prenuptial Premarital Agreement with Financial Statements can be voided under certain circumstances. If one party did not sign voluntarily, or if there was fraud involved in the agreement, a court may choose to void it. Additionally, if the terms are found to be unconscionable or unfair, they may not be enforceable. It's important to consult with legal experts to ensure the agreement holds up.

A financial statement for a prenuptial agreement outlines each partner's assets, liabilities, income, and expenses. In the context of a California Prenuptial Premarital Agreement with Financial Statements, it provides a complete financial picture before marriage. This document is crucial for transparency and helps both parties make informed decisions. You can find helpful resources and templates on platforms like US Legal Forms to assist you.

Writing a prenuptial agreement in California involves several clear steps. First, both partners should gather financial information and discuss their goals. Then, use a professional template or consult a legal expert to draft the California Prenuptial Premarital Agreement with Financial Statements. This ensures compliance with California law and protects both parties’ interests.