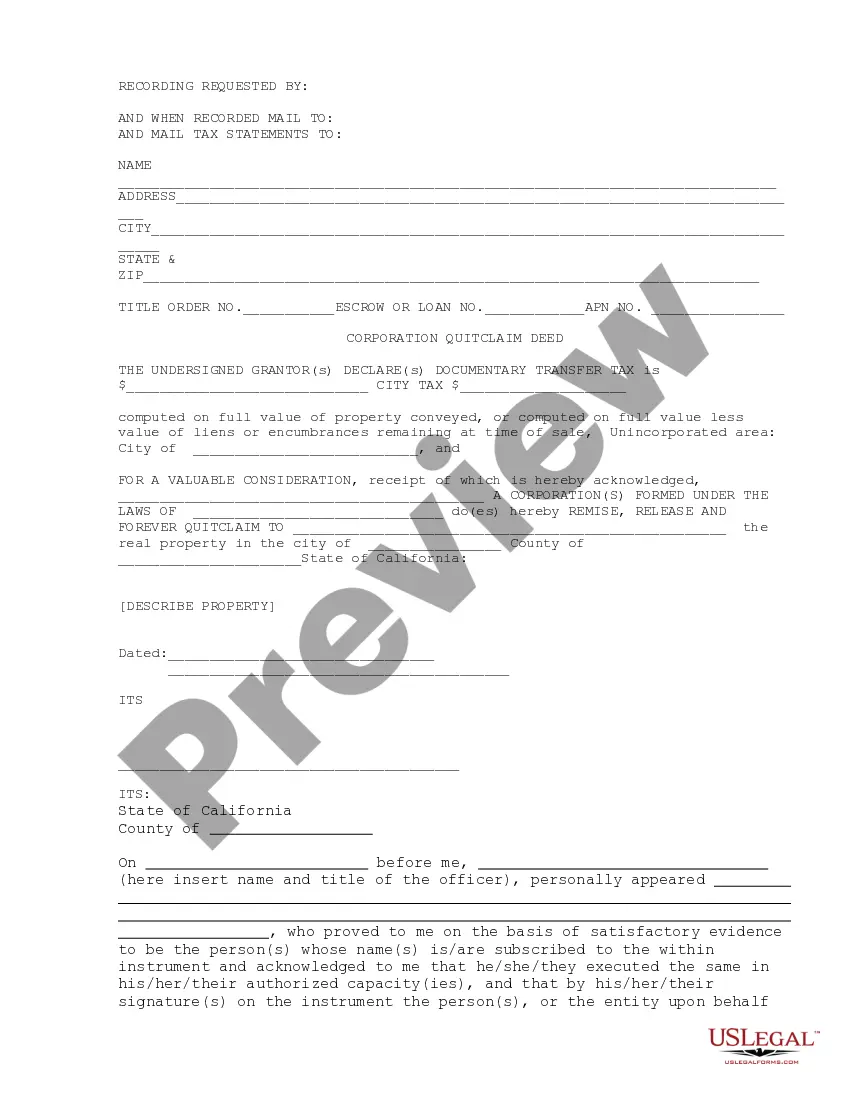

California Quitclaim Deed for Corporation

About this form

The Quitclaim Deed for Corporation is a legal document used to transfer property ownership from a grantor corporation to a grantee. This deed allows the grantor to relinquish any claim they hold on the property, conveying their interest directly to the grantee without any warranties. Unlike other deed types, such as warranty deeds, quitclaim deeds do not guarantee that the title is free of disputes. It is the simplest method of property transfer, making it especially useful for business entities looking to streamline transactions.

What’s included in this form

- Grantor and grantee information: Names and addresses of both parties involved in the transfer.

- Property description: Details about the real property being transferred, including the city and county.

- Documentary transfer tax declaration: A statement regarding the transfer tax applicable to the property.

- Signature and notarization section: Area for signing and official acknowledgment to validate the deed.

- Date of execution: The date on which the deed is signed.

When to use this form

This form is typically used when a corporation wants to transfer its interest in a property to another entity or individual without any warranty of title. Common scenarios include transferring property in business mergers, liquidating assets, or simply selling property held under corporate ownership. It can also be useful in transferring assets between related corporations or partnerships.

Who can use this document

- Corporate entities looking to transfer real property ownership.

- Business owners or executives authorized to execute deed transfers on behalf of their corporation.

- Legal representatives handling property transactions for corporations.

Instructions for completing this form

- Identify the parties: Clearly fill in the names and addresses of the grantor and grantee.

- Specify the property: Describe the real property being transferred, including its location details.

- Complete the tax declaration: Indicate any applicable documentary transfer taxes in the designated field.

- Sign the document: Ensure authorized representatives of the grantor corporation sign the deed.

- Notarize the deed: Have the document notarized to validate the signatures and formalize the transfer.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete grantor and grantee information.

- Leaving the property description incomplete or unclear.

- Not having the deed notarized when required.

- Overlooking the documentary transfer tax declaration, leading to potential legal issues.

- Not confirming that the signatory is authorized to act on behalf of the corporation.

Why use this form online

- Convenience: Easily download and fill out the form from anywhere with internet access.

- Editability: Make necessary adjustments to the form to suit your specific needs.

- Reliability: All forms are drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

To execute a California Quitclaim Deed for Corporation, you typically need to include the grantor's and grantee's names, a clear legal description of the property, and signatures from all involved parties. The deed must be notarized to validate the transfer, and recording the deed with the county office is essential for public notice. Utilizing uslegalforms can provide you with the necessary templates and support to ensure that all legal requirements are met effectively.

A California Quitclaim Deed for Corporation is most often used to transfer ownership between family members or within a corporation. This deed simplifies the transfer process, particularly when both parties trust each other and expect no disputes regarding ownership. It can also be useful for clearing up title issues or correcting property descriptions. Uslegalforms can guide you through the process seamlessly, making it easier to handle these transactions.

In real estate, the title usually holds more significance than the deed. The title denotes legal ownership of the property and includes all rights associated with it. While a deed, such as a California Quitclaim Deed for Corporation, transfers property ownership, it does not guarantee clear title. Therefore, ensuring a clear title is crucial for any transaction to protect your investment.

The strongest form of deed is typically a warranty deed, as it offers complete assurance regarding the property's title. Unlike a quitclaim deed, which transfers property without any guarantees, a warranty deed protects the buyer against future claims. When using a California Quitclaim Deed for Corporation, be aware that limitations exist, especially in terms of liability for the property's condition or title. For more security in property transfers, consider exploring other deed types.

A California Quitclaim Deed for Corporation would not be suitable when the buyer seeks warranty protection against claims or disputes. This deed fails to guarantee clear title, making it less ideal for situations involving sales or purchases. It is primarily used for transferring property among parties who know each other well. Always consider consulting legal advice for complex property transactions.

Yes, you can use a California Quitclaim Deed for Corporation to transfer property to a Limited Liability Company (LLC). This type of deed allows for a straightforward transfer of property rights without warranty claims. However, ensure that the ownership structure and fiduciary duties of the LLC are properly documented. Using uslegalforms can help you navigate these legal requirements effectively.

A quitclaim deed in California can be prepared by anyone with a basic understanding of real estate laws, although it is strongly recommended to engage a legal professional. For a California Quitclaim Deed for Corporation, a corporate officer or an attorney familiar with corporate property transfers should handle the preparation. This ensures accuracy and legality in your document, making services like uslegalforms an excellent choice for drafting and filing.

To obtain a quitclaim deed in California, you can either draft it yourself using a template or hire a lawyer to prepare it for you. If you decide to handle it independently, platforms like uslegalforms offer user-friendly templates specifically tailored for a California Quitclaim Deed for Corporation. After preparation, the deed must be signed and notarized, followed by recording it with the county recorder’s office to finalize the transfer.

In California, a quitclaim deed is typically signed by the person transferring the title, known as the grantor. For a California Quitclaim Deed for Corporation, the signature must often come from a corporate officer authorized to act on behalf of the corporation. This process is crucial to legally complete the transfer of property ownership. Ensuring proper signatures and documentation can be easily managed using resources from uslegalforms.

In California, a deed can be prepared by various individuals, including lawyers, real estate professionals, or the property owner themselves. However, for a California Quitclaim Deed for Corporation, it is advisable to consult with a legal expert to ensure compliance with state laws. This helps to avoid any potential disputes during the transfer of property. Using a reliable platform like uslegalforms can streamline the process and provide the necessary templates.