This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Arizona Related Entity

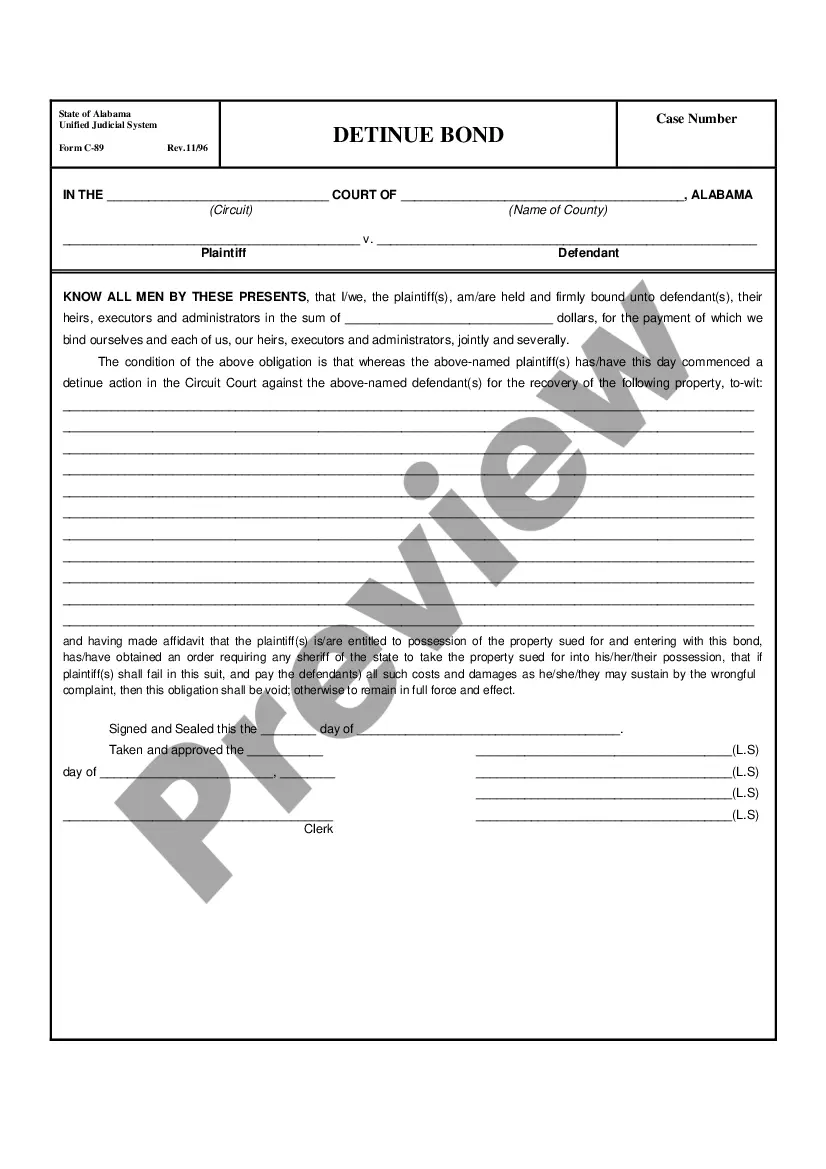

Description

How to fill out Related Entity?

Are you within a position the place you require documents for possibly organization or individual purposes virtually every working day? There are a variety of lawful document layouts available online, but locating versions you can rely on isn`t easy. US Legal Forms gives a huge number of form layouts, such as the Arizona Related Entity, that happen to be composed in order to meet state and federal needs.

Should you be already informed about US Legal Forms site and also have a free account, merely log in. Next, you may obtain the Arizona Related Entity template.

Unless you offer an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is for your proper city/county.

- Utilize the Preview switch to analyze the form.

- See the description to ensure that you have chosen the proper form.

- If the form isn`t what you`re looking for, utilize the Lookup industry to get the form that meets your requirements and needs.

- Once you find the proper form, just click Purchase now.

- Pick the pricing plan you desire, complete the specified information to generate your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient file format and obtain your duplicate.

Get every one of the document layouts you may have purchased in the My Forms menu. You can obtain a additional duplicate of Arizona Related Entity at any time, if possible. Just click the needed form to obtain or print the document template.

Use US Legal Forms, the most considerable collection of lawful varieties, in order to save time and stay away from errors. The services gives appropriately made lawful document layouts that can be used for a range of purposes. Make a free account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

State Tax Obligations A worker may have tax obligations in any state where they reside and possibly the state where their employer's worksite is located. A permanent remote worker will file their personal income taxes in their state of residence, whether they are a W-2 employee or a 1099-NEC independent contractor.

The Arizona Pass-Through Entity (PTE) income tax is assessed at a rate of 2.98%11 of the income attributable to the partnership's or S Corporation's resident partners or shareholders, and the income derived from sources within Arizona attributable to the nonresident partners or shareholders.

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.

Arizona state income tax withholding is a percentage of the employee's gross taxable wages. Gross taxable wages refers to the amount that meets the federal definition of wages contained in U.S. Code § 3401. Generally, this is the amount included in box 1 of the employee's federal Form W-2.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%.