Arizona Farm Hand Services Contract - Self-Employed

Description

How to fill out Farm Hand Services Contract - Self-Employed?

Are you presently in a scenario where you require documents for either business or personal use almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms offers a vast array of form templates, including the Arizona Farm Hand Services Contract - Self-Employed, designed to comply with state and federal regulations.

Once you have the correct form, simply click Buy now.

Choose the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- After that, you can obtain the Arizona Farm Hand Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

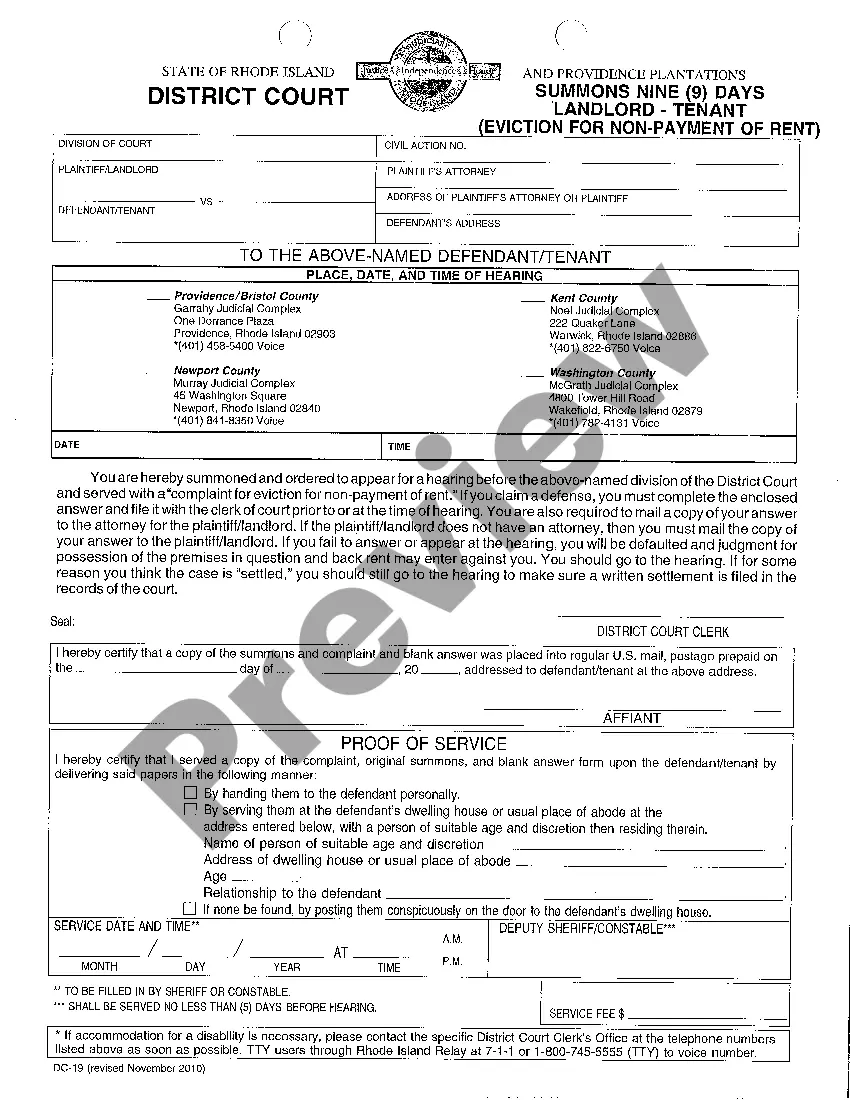

- Use the Preview option to examine the form.

- Review the description to confirm you have selected the right form.

- If the form isn't what you are looking for, utilize the Lookup section to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, contract work is considered self-employment. When you take on contract jobs, you operate as an independent entity rather than an employee. This means you are responsible for your income tax and other obligations, which can be managed effectively with an Arizona Farm Hand Services Contract - Self-Employed. Utilizing proper agreements ensures you maintain clarity and compliance in your self-employment journey.

You can absolutely have a contract when you're self-employed. A contract helps you set clear terms for services rendered and ensures that both parties understand their obligations. By using an Arizona Farm Hand Services Contract - Self-Employed, you can establish a professional framework for your work, making it easier to handle any disputes that may arise during your farming operations.

Yes, a self-employed person can certainly have a contract. Contracts are essential for outlining expectations, responsibilities, and payment terms between parties. If you are working as a self-employed farmhand, an Arizona Farm Hand Services Contract - Self-Employed can clearly define your role and protect your rights. This approach builds trust and professionalism in your farming agreements.

The new rules for self-employed individuals often focus on tax provisions and reporting requirements. Recent changes aim to encourage self-employment by offering clearer guidelines on deductible expenses and income reporting. Staying informed about these rules is essential, especially if you operate under an Arizona Farm Hand Services Contract - Self-Employed. Using resources like US Legal Forms can help you navigate these changes effectively.

Yes, farm income is generally subject to self-employment tax. When you earn income from farming activities as a self-employed individual, you need to report that income on your tax return. This also means you should keep meticulous records to ensure compliance and maximize your tax benefits. Consider utilizing an Arizona Farm Hand Services Contract - Self-Employed to formalize your farming operations and simplify your financial tracking.

Whether to say self-employed or independent contractor often depends on your specific role. In the context of an Arizona Farm Hand Services Contract - Self-Employed, both terms can be used interchangeably, but 'independent contractor' may emphasize your business relationship with clients. Choosing the right terminology is important as it clarifies your status and may affect contracts and tax implications.

An independent contractor will generally fill out a W9 form and may need to complete additional forms depending on the nature of the work. It's also wise to have a signed contract outlining the terms of the Arizona Farm Hand Services Contract - Self-Employed, which can protect both parties. If you're unsure, using resources from uslegalforms can provide clarity on necessary paperwork based on your situation.

An independent contractor typically needs to fill out a W9 form when starting work. This form provides your taxpayer information, which is essential for the filing of a 1099 form at the end of the year. For your Arizona Farm Hand Services Contract - Self-Employed, ensure that the contractor submits the W9 promptly to avoid delays in payment processing.

To write an effective self-employed contract, start by clearly defining the roles, responsibilities, and scope of work. For an Arizona Farm Hand Services Contract - Self-Employed, include details about payment terms, deadlines, and confidentiality clauses if necessary. You can utilize platforms like uslegalforms to access templates that guide you through structuring your contract properly, ensuring you cover all legal bases.

For an Arizona Farm Hand Services Contract - Self-Employed, it's crucial to have the right paperwork in place. You'll need to gather a signed contract, a W9 form from your contractor, and proof of insurance if applicable. Having these documents prepared not only helps in establishing clear terms but also protects your business interests and ensures a smooth working relationship.