Arizona Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

If you wish to be thorough, obtain, or produce official document templates, utilize US Legal Forms, the largest variety of legal forms that are available online.

Leverage the site's simple and user-friendly search to locate the documents you require. Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Employ US Legal Forms to acquire the Arizona Guaranty of Payment of Open Account in just a few clicks.

Every legal document template you acquire is yours forever. You have access to each form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Arizona Guaranty of Payment of Open Account with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to receive the Arizona Guaranty of Payment of Open Account.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct region/state.

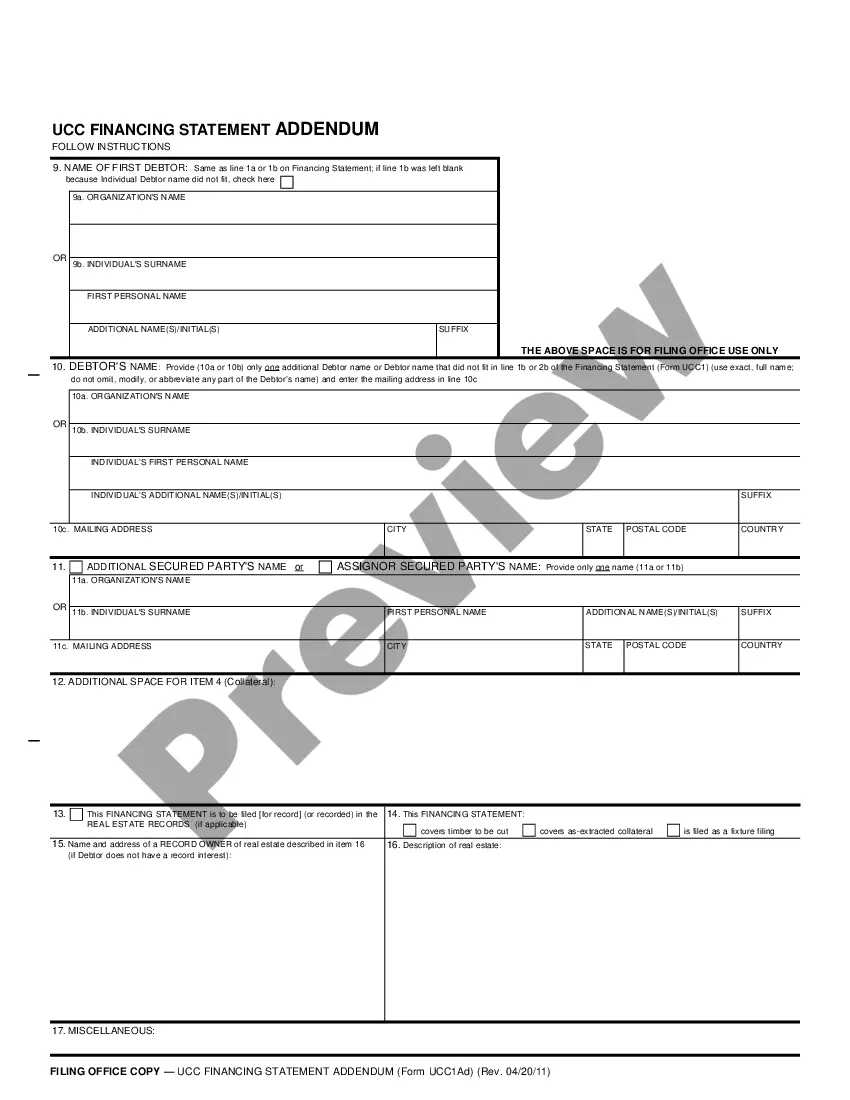

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. After finding the form you need, click on the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arizona Guaranty of Payment of Open Account.

Form popularity

FAQ

Proof of financial responsibility in Arizona refers to the ability to demonstrate that you can cover potential debts, including those arising from a guaranty of payment of open account. This proof is essential for many businesses and individuals to establish their creditworthiness and maintain trust with creditors. In Arizona, this can include various forms of documentation, such as insurance policies or financial statements. By utilizing the US Legal Forms platform, you can easily access templates and resources to help you create the necessary documents to support your financial responsibility.

In Arizona, debt collectors have up to six years to pursue old debt before it becomes uncollectible. This timeline applies to various types of debts, reinforcing the importance of being aware of your rights under the Arizona Guaranty of Payment of Open Account. If you encounter persistent debt collection efforts, it may be wise to explore legal avenues or utilize platforms like USLegalForms to better understand your situation. Being informed helps you manage debt effectively.

In Arizona, a debt typically becomes uncollectible after six years. This time frame applies to most debts, including those covered under the Arizona Guaranty of Payment of Open Account. It is crucial to understand this limit, as pursuing a claim beyond this period may not yield results. If you find yourself dealing with debts, consider exploring legal resources to navigate your options effectively.

A guarantor clause typically states that a designated individual agrees to take responsibility for the payment of a debtor’s obligations. For instance, it may read, 'The guarantor hereby guarantees the timely payment of all amounts due under this agreement.' Such clauses are vital for the enforcement of the Arizona Guaranty of Payment of Open Account, ensuring that all parties understand their responsibilities.

Filling a guarantee form requires clarity and accuracy. Enter the names and addresses of the parties involved, specify the amount guaranteed, and include any other necessary details, like the due date for payment. By utilizing resources from USLegalForms, you can find templates and guidance tailored to the Arizona Guaranty of Payment of Open Account.

To fill out a guarantee form, you will need to provide essential information such as the guarantor's details, the borrower’s information, the amount guaranteed, and the purpose of the guaranty. Additionally, ensure that both parties review the form together to avoid any misunderstandings. Using a reliable platform like USLegalForms can simplify the process of creating an effective Arizona Guaranty of Payment of Open Account.

Filling out a guaranty form involves providing specific details about the guarantor and the primary party involved. You should include the names and addresses of all parties, along with the amount being guaranteed. It's essential to ensure that all information is accurate, as the Arizona Guaranty of Payment of Open Account relies on these details for legal enforceability.

Guaranty associations are funded mainly through membership fees, fines, and premiums from policies issued to businesses. In some cases, additional funding may come from investment income earned on the association’s reserve. This effective funding model ensures protection for creditors and promotes stability in credit transactions, particularly under the Arizona Guaranty of Payment of Open Account.

The primary purpose of the Arizona Guaranty Fund is to protect creditors by guaranteeing payments on open accounts. This fund helps maintain confidence in the business sector, allowing companies to extend credit without undue risk. With the Arizona Guaranty of Payment of Open Account, both small and large businesses can thrive, knowing they have added security in financial transactions.

The Guarantee Fund is typically financed through contributions from member businesses and insurance premiums. This structure ensures that the fund has sufficient resources to cover potential losses incurred by the Guaranty Association. By participating in the fund, businesses enhance their protection under the Arizona Guaranty of Payment of Open Account.