Arizona A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

You are able to devote hours online searching for the legal record design that meets the state and federal specifications you will need. US Legal Forms offers 1000s of legal varieties which are reviewed by pros. You can actually down load or printing the Arizona A Summary of Your Rights Under the Fair Credit Reporting Act from my services.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Acquire button. Afterward, it is possible to comprehensive, revise, printing, or indicator the Arizona A Summary of Your Rights Under the Fair Credit Reporting Act. Each and every legal record design you acquire is your own property permanently. To have one more duplicate for any purchased type, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms site initially, stick to the easy directions below:

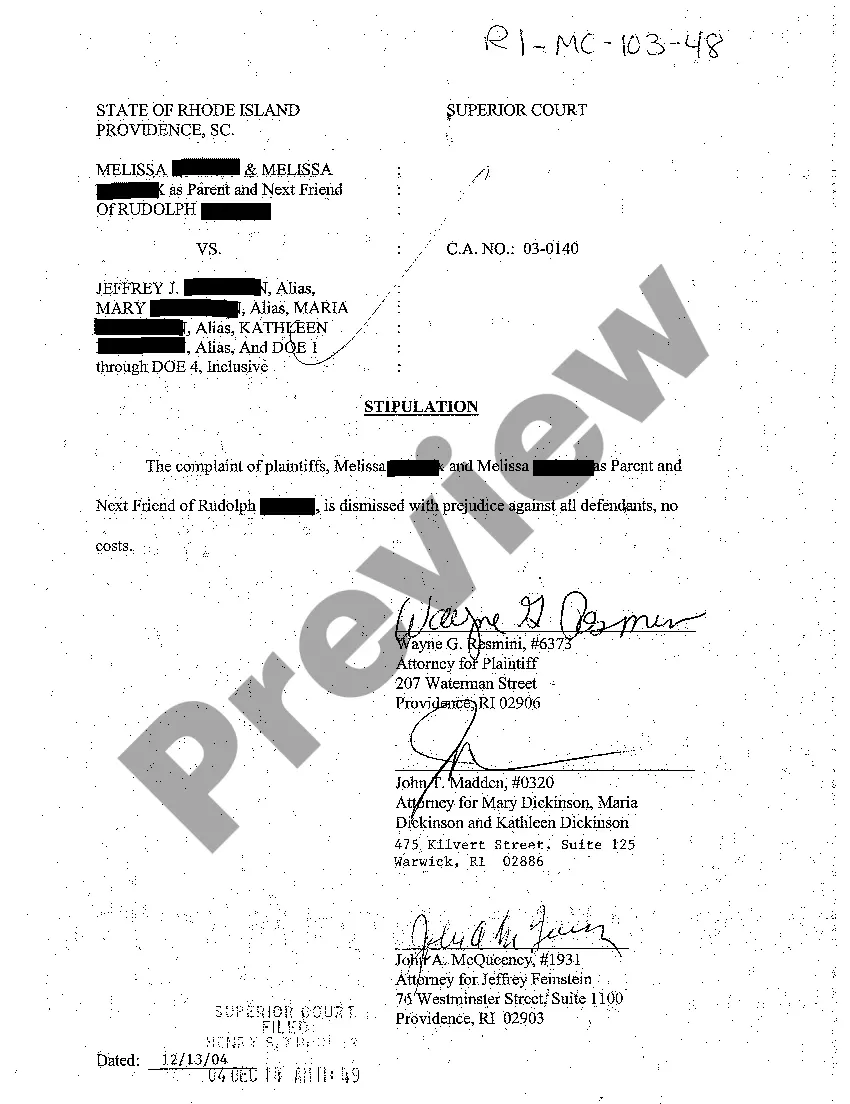

- Initially, ensure that you have selected the correct record design for the area/town of your choosing. Browse the type description to ensure you have picked out the proper type. If accessible, take advantage of the Review button to search with the record design as well.

- If you would like get one more version of the type, take advantage of the Lookup field to discover the design that suits you and specifications.

- Once you have identified the design you want, just click Buy now to proceed.

- Choose the pricing plan you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to fund the legal type.

- Choose the format of the record and down load it for your device.

- Make alterations for your record if necessary. You are able to comprehensive, revise and indicator and printing Arizona A Summary of Your Rights Under the Fair Credit Reporting Act.

Acquire and printing 1000s of record web templates using the US Legal Forms Internet site, that provides the most important variety of legal varieties. Use skilled and status-certain web templates to take on your small business or person demands.

Form popularity

FAQ

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Step 1: Before you take the adverse action, you must give the individual a pre-adverse action disclosure that includes a copy of the individual's consumer report and a copy of "A Summary of Your Rights Under the Fair Credit Reporting Act" - a document prescribed by the Federal Trade Commission.

Under the Fair Credit Reporting Act, you have a right to: You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request. Protected Access ? The act limits access to your file to those with a valid need.

Fix Errors on Your Credit Report: 8 Tips for Writing an Effective Complaint Letter to the Credit Reporting Agency Provide identification information. ... Clearly identify the mistake. ... Be brief and to the point. ... Type the letter. ... Don't quote Fair Credit Reporting Act laws. ... Include proof, if you have it. ... Proofread!

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

Candidate Rights Under FCRA The candidate may dispute the information provided by the consumer reporting agency. This action allows for the correction of misreported, outdated, or otherwise incorrect data.