Arizona Transaction Agreement

Description

How to fill out Transaction Agreement?

Finding the right legal record design could be a struggle. Needless to say, there are plenty of templates accessible on the Internet, but how can you obtain the legal develop you want? Make use of the US Legal Forms web site. The assistance gives thousands of templates, like the Arizona Transaction Agreement, that you can use for enterprise and personal requirements. Every one of the types are checked by professionals and meet state and federal requirements.

When you are currently signed up, log in for your accounts and click the Download key to get the Arizona Transaction Agreement. Use your accounts to appear with the legal types you have bought earlier. Visit the My Forms tab of your respective accounts and have another copy of your record you want.

When you are a fresh consumer of US Legal Forms, listed here are basic guidelines so that you can adhere to:

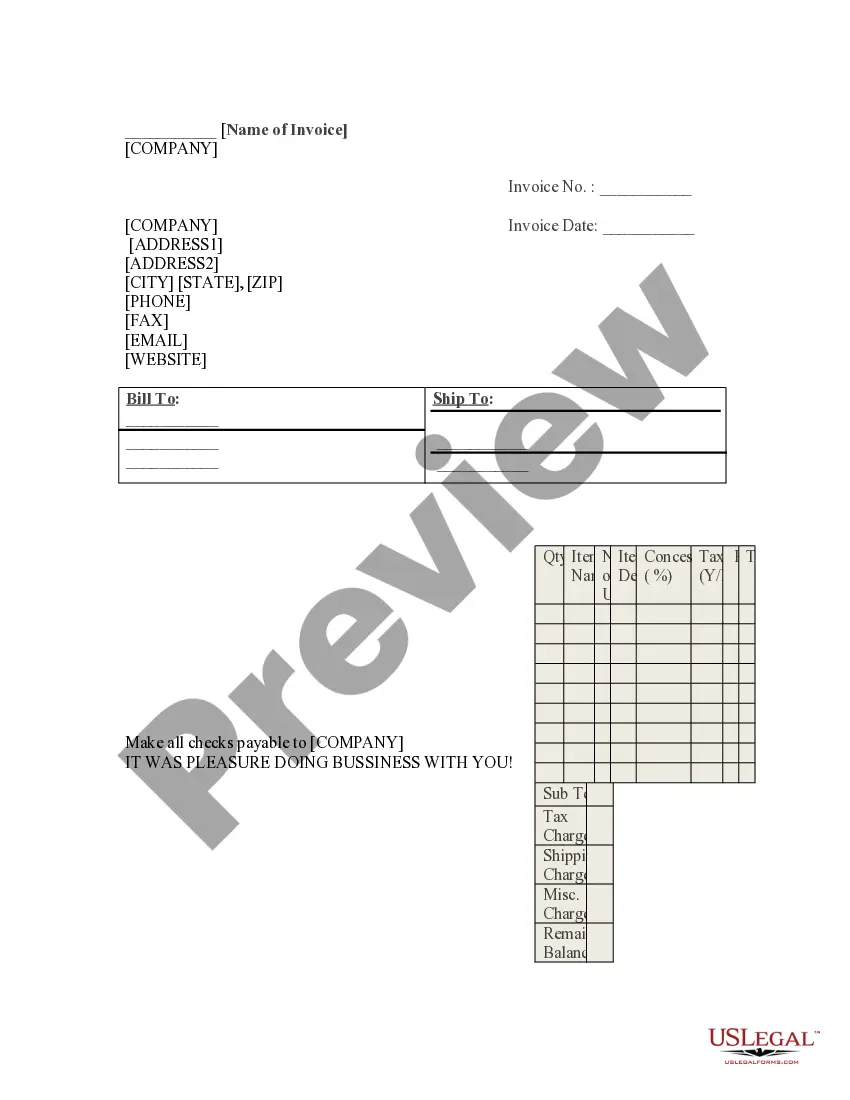

- First, make certain you have chosen the appropriate develop for the metropolis/county. It is possible to check out the shape utilizing the Review key and look at the shape information to guarantee this is the right one for you.

- In case the develop is not going to meet your preferences, take advantage of the Seach industry to get the appropriate develop.

- Once you are sure that the shape is acceptable, click the Acquire now key to get the develop.

- Choose the costs program you want and enter in the essential details. Design your accounts and pay money for an order making use of your PayPal accounts or Visa or Mastercard.

- Pick the data file structure and download the legal record design for your product.

- Total, edit and printing and indication the obtained Arizona Transaction Agreement.

US Legal Forms is the largest local library of legal types in which you can find a variety of record templates. Make use of the service to download expertly-made files that adhere to condition requirements.

Form popularity

FAQ

Arizona-based businesses should visit Business One Stop (B1S) if forming their business for the first time. Please note: New Business One Stop TPT licenses submissions will direct you to pay at AZTaxes.gov. TPT filings, payments, and renewals are only available at AZTaxes.gov at this time.

Taxable Contracting Activities All contractors are considered to be prime contractors and must have a transaction privilege license.

TPT and Use Tax: An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers. Arizona residents who purchase goods using a resale certificate, and the goods are used, stored or consumed in Arizona contrary to the purpose stated on the certificate.

In Arizona, contractors do not pay transaction privilege (sales) tax on the materials that they purchase. Instead, transaction privilege tax is calculated on the gross proceeds of the sales or gross income derived from the job, including labor.

An unlicensed entity may be a company or individual. To be a contractor in Arizona, an entity must be licensed. To be licensed, an entity must possess a bond; among other requirements. With the exception of workman's compensation insurance, the ROC does not require an entity to possess insurance to be licensed.

If a business is selling a product or engaging in a service subject to TPT, that business will likely need a license from the Arizona Department of Revenue (ADOR) and a TPT, or business/occupational license, from the city or cities in which the business has a base or operation.

Arizona first adopted a general state transaction privilege tax in 1933. Since that time, the rate has risen to 5.6%.

If a business is selling a product or engaging in a service subject to TPT, that business will likely need a license from the Arizona Department of Revenue (ADOR) and a TPT, or business/occupational license, from the city or cities in which the business has a base or operation.