Arizona Loan Modification Agreement - Multistate

Description

How to fill out Loan Modification Agreement - Multistate?

Finding the right lawful document format might be a struggle. Naturally, there are a lot of templates available online, but how do you get the lawful form you want? Utilize the US Legal Forms site. The assistance offers 1000s of templates, including the Arizona Loan Modification Agreement - Multistate, that you can use for organization and private requires. All the types are inspected by specialists and satisfy federal and state needs.

Should you be presently listed, log in to the bank account and click on the Acquire button to obtain the Arizona Loan Modification Agreement - Multistate. Make use of bank account to search throughout the lawful types you possess bought formerly. Go to the My Forms tab of the bank account and get an additional copy from the document you want.

Should you be a brand new user of US Legal Forms, listed here are straightforward directions that you can comply with:

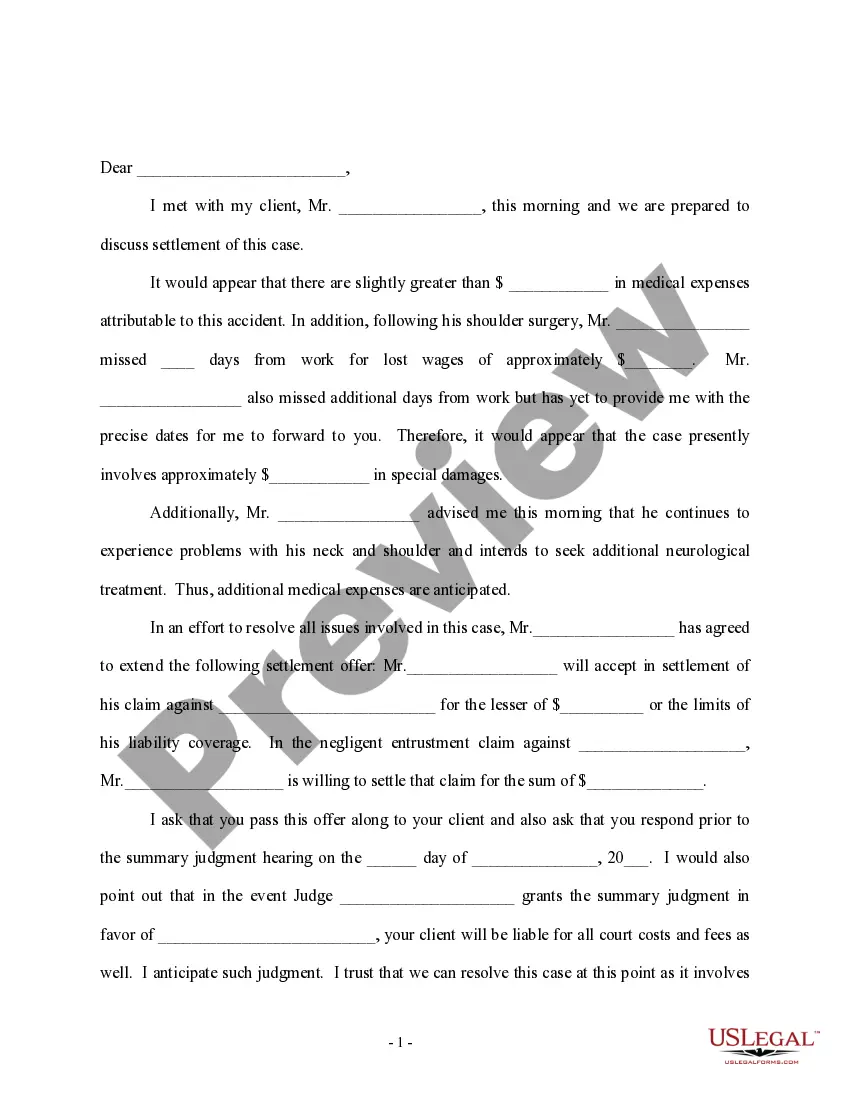

- First, make sure you have chosen the proper form to your city/region. You may check out the form while using Review button and study the form explanation to make sure this is basically the right one for you.

- When the form does not satisfy your requirements, make use of the Seach field to find the proper form.

- When you are certain the form is acceptable, click on the Get now button to obtain the form.

- Select the pricing prepare you would like and enter in the essential info. Design your bank account and pay money for your order using your PayPal bank account or credit card.

- Select the document file format and acquire the lawful document format to the device.

- Complete, edit and print and signal the received Arizona Loan Modification Agreement - Multistate.

US Legal Forms will be the biggest local library of lawful types where you can see numerous document templates. Utilize the company to acquire skillfully-manufactured files that comply with express needs.

Form popularity

FAQ

Paying more interest over time. If you have agreed to a lower monthly payment without significantly reducing your interest rate, you may end up paying more money in total because you are paying interest for a longer time than you otherwise would have.

How to Get a Mortgage Modification Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

Recordation is necessary to ensure that the modified mortgage loan retains its first lien position and is enforceable in ance with its terms at the time of the modification, throughout its modified term, and during any bankruptcy or foreclosure proceeding involving the modified mortgage loan; or.

Could be reported as a settlement: Because you're changing the terms of your loan, some lenders may report your loan modification to the credit bureaus (Experian, TransUnion and Equifax) as a settlement, which can wreak havoc on your credit scores and remain on your credit reports for several years.

Ideally before you miss any payments, take these steps to learn your mortgage modification options. Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

Required documentation for a loan modification usually includes a formal application, pay stubs, financial statements, proof of income, bank statements, and tax returns, as well as a hardship statement.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Because these represent mutual agreements, they should be signed by both the borrowers and the plaintiff (who may or may not be the lender or servicer but may be an assignee of the mortgage). There is no doubt that foreclosing plaintiffs understand that they need to sign those mortgage modification agreements.