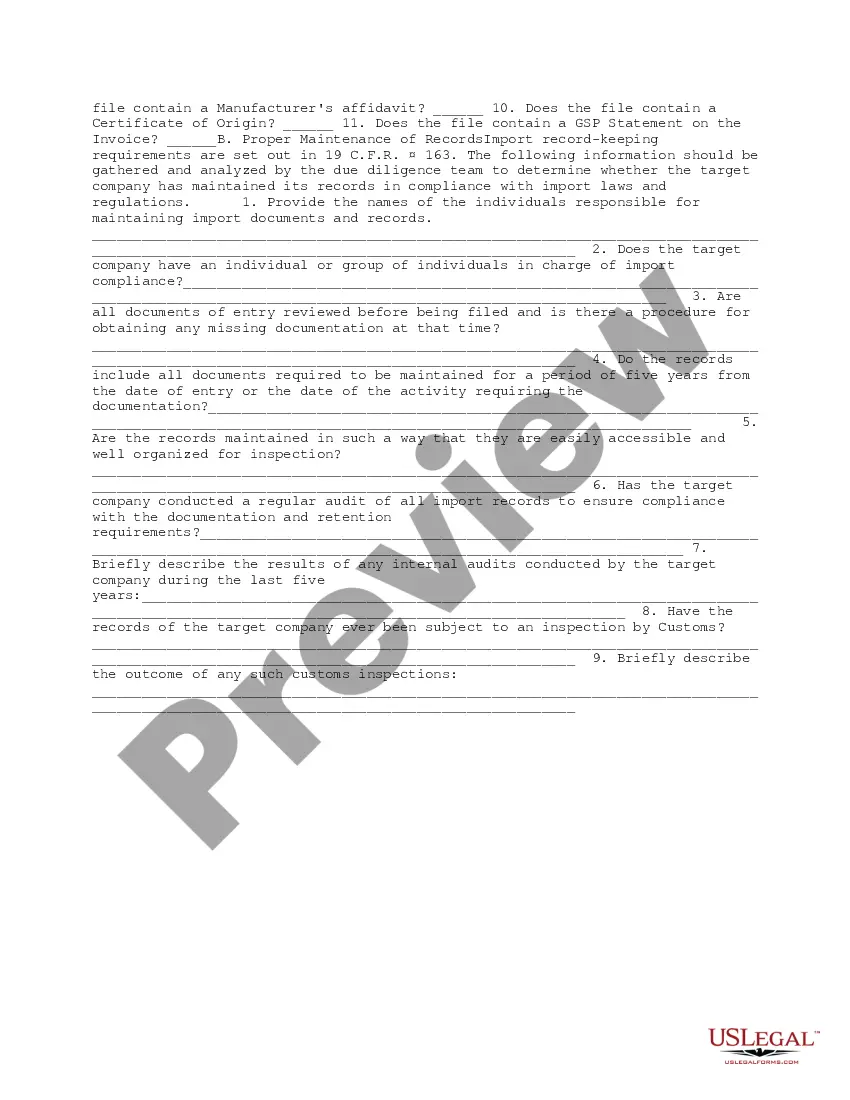

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Arizona Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

Locating the appropriate legal document template can pose a challenge. Clearly, there are numerous templates accessible online, but how can you identify the legal form you require? Utilize the US Legal Forms website. The service offers a plethora of templates, including the Arizona Import Compliance and Records Review Due Diligence, suitable for both business and personal purposes. Every form is reviewed by specialists and adheres to federal and state regulations.

If you are already a registered user, Log In to your account and click on the Download button to retrieve the Arizona Import Compliance and Records Review Due Diligence. Use your account to access the legal forms you may have previously purchased. Navigate to the My documents section of your account and obtain an additional copy of the document you require.

For those who are new to US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for your state/region. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are confident the form is appropriate, select the Buy now button to acquire the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Arizona Import Compliance and Records Review Due Diligence.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to obtain professionally crafted paperwork that meets state requirements.

- The platform ensures that all documents are verified for legal compliance.

- You can easily manage and access your legal documents through your account.

- The process is streamlined for ease of use, allowing quick acquisition of legal forms.

- Multiple payment options are available for your convenience.

Form popularity

FAQ

Acquiring an import-export license involves submitting applications to the relevant federal and state agencies. You may need to apply for permits depending on the type of goods you import or export. Understanding Arizona Import Compliance and Records Review Due Diligence will help ensure you meet all requirements effectively, making the process smoother.

Checklist for Due Diligence of CompanyBusiness Due Diligence.Documents Required During Company Due Diligence.Review of MCA Documents.Review of Articles of Association.Review of Statutory Registers of Company.Review of Book of Accounts and Financial Statements.Review of Taxation Aspects.Review of Legal Aspects.More items...

How to Conduct Successful Due DiligenceHow to Conduct Successful Due Diligence.USE A VIRTUAL DATA ROOM.REVIEW THE COMPANY'S BUSINESS STRUCTURE AND PRACTICES.REVIEW CORPORATE FINANCIALS.INVENTORY AND REVIEW ASSETS.INVESTIGATE OUTSTANDING LIABILITIES.

What Is Due Diligence? Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

Enhanced Due Diligence ChecklistUnderstand your customers' risk profile;Obtain additional information where necessary;Conduct extensive background checks and monitor transactions;Organize and secure your data in line with compliance standards;Keep the data available for regulators.

There are seven necessary steps to conduct effective IT due diligence.Step 1: Initiate.Step 2: Prepare.Step 3: Conduct the on-site discovery.Step 4: Discovery defines the issues.Step 5: Analyze the information and prioritize your initiatives.Step 6: Develop an IT due diligence report.More items...?

Enhanced due diligence (EDD) is a KYC process that provides a greater level of scrutiny of potential business partnerships and highlights risk that cannot be detected by customer due diligence. EDD goes beyond CDD and looks to establish a higher level of identity assurance by obtaining the customer's identity and

Enhanced Due Diligence Procedures for High-Risk CustomersAML.Business intelligence.Compliance.Document verification.Identity verification.KYC.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

Due diligence is a process of research and analysis that is initiated before an acquisition, investment, business partnership or bank loan, in order to determine the value of the subject of the due diligence or whether there are any major issues involved.