This due diligence form is used to document "for the record" the scope, character, findings and recommendations of the entire diligence effort in business transactions.

Arizona Diligence Compendium

Description

How to fill out Diligence Compendium?

If you aim to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Take advantage of the website's user-friendly and convenient search feature to locate the documents you require.

A range of templates for corporate and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you’ve found the form you need, click the Buy now button. Select your preferred pricing plan and provide your details to register for an account.

Step 5. Finalize the transaction. You can use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to access the Arizona Diligence Compendium within a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to access the Arizona Diligence Compendium.

- You can also find forms you've previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions outlined below.

- Step 1. Ensure that you have chosen the form for the correct area/region.

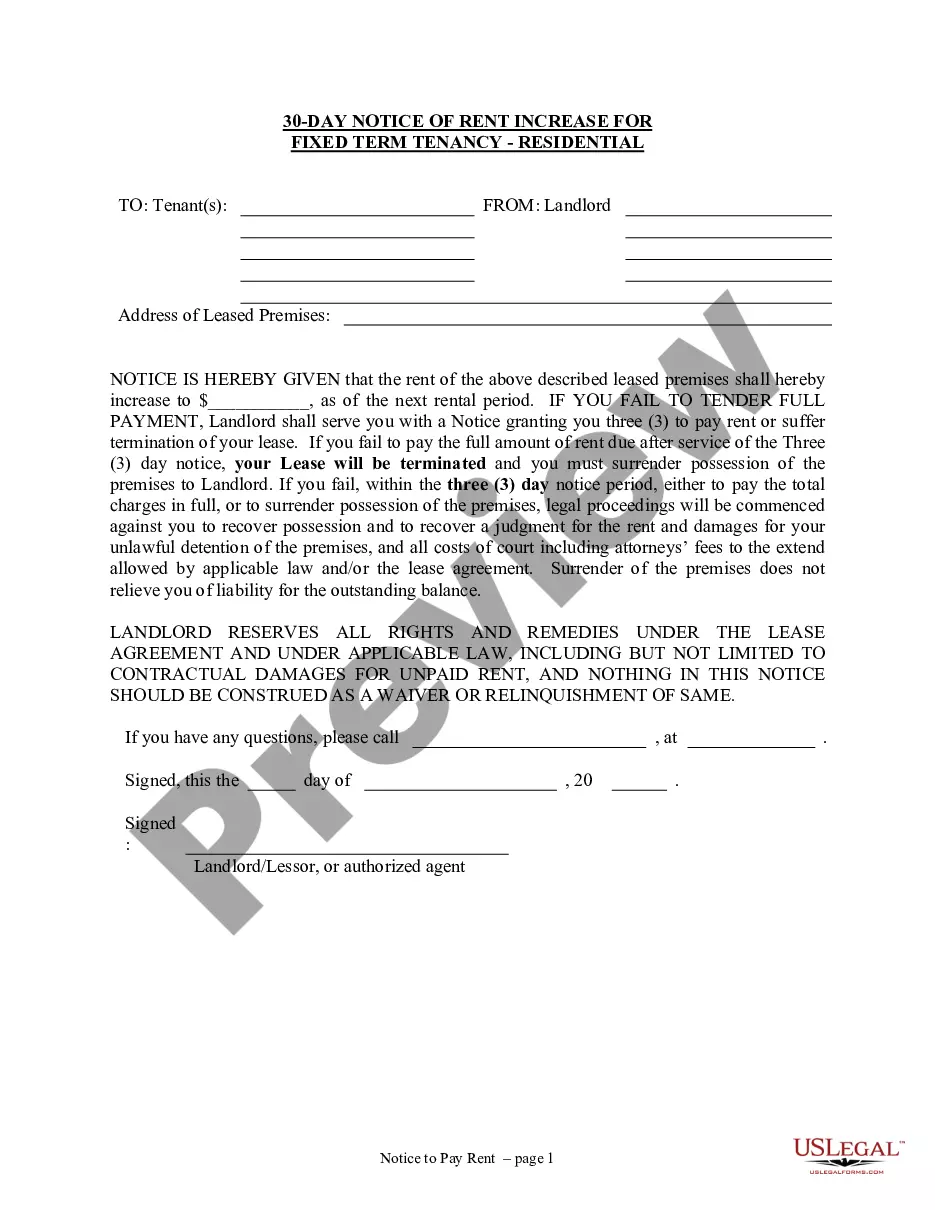

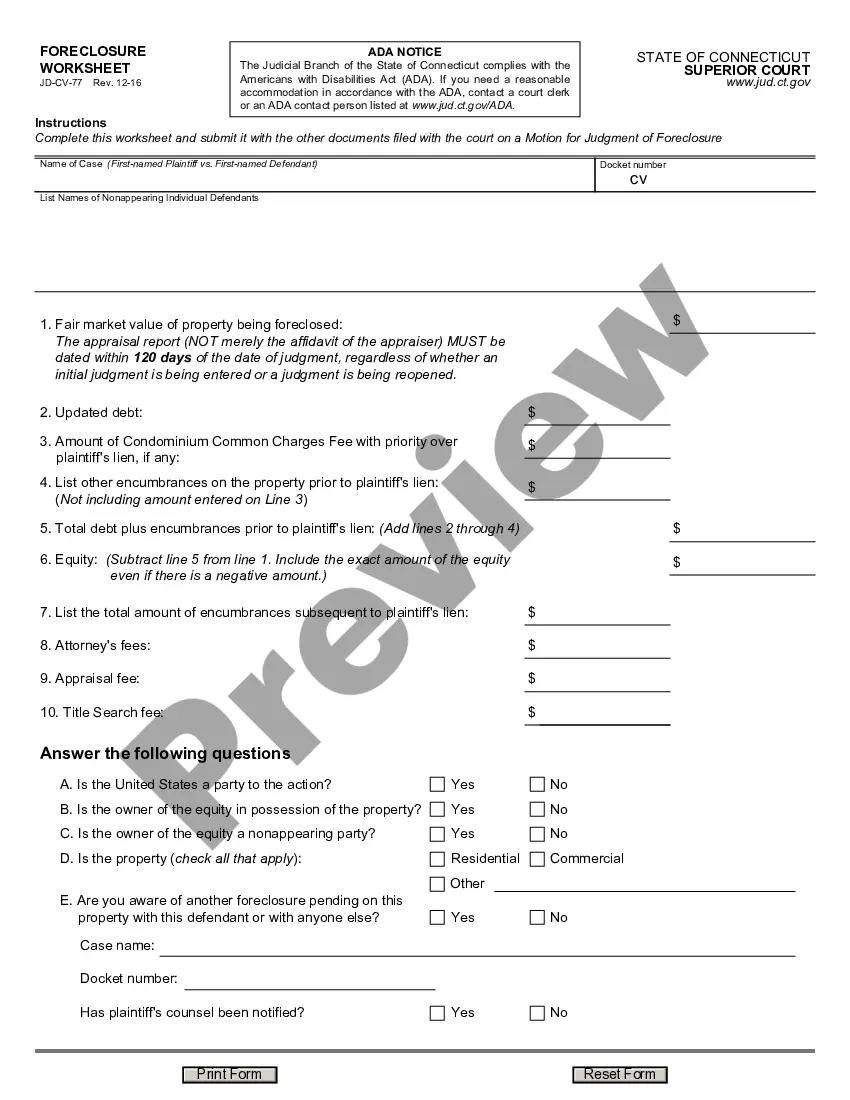

- Step 2. Utilize the Review option to examine the content of the form. Be sure to review the description.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

When starting your business, the decision between a DBA and an LLC depends on your long-term goals. If you need a business name but do not require the liability protection of an LLC, filing a DBA may be your first step. However, if you want to safeguard your personal assets while operating under a specific name, establish your LLC first. The Arizona Diligence Compendium offers valuable insights to help you make the best choice for your business journey.

In Arizona, a DBA remains valid for a period of five years from the date of registration. After that, you’ll need to renew your registration to keep your business name active. Staying informed about your DBA status is crucial, and the Arizona Diligence Compendium can help you track important deadlines and ensure compliance.

To file a DBA in Arizona, you must complete a few simple steps. Begin by choosing a unique name that complies with state regulations. Next, submit your application to the county where your business operates, along with any required fees. For a seamless experience, consider using the Arizona Diligence Compendium as a resource for guidance and clarity on the DBA filing process.

When performing financial due diligence, you will need several key documents to ensure a thorough assessment. Typically, these include financial statements, tax returns, bank statements, and accounts receivable reports. Additionally, you might also require contracts, leases, and any pending litigation documents. Using the Arizona Diligence Compendium can help you organize and identify all necessary documentation effectively.

Completing due diligence requires planning, investigation, and verification. Begin by clearly defining your objectives and identifying the necessary documentation, as detailed in the Arizona Diligence Compendium. Then, conduct a systematic review of all information obtained to identify potential risks. Using resources from our platform can enhance your ability to conduct a thorough and effective due diligence process.

The 4 P's of due diligence include People, Product, Process, and Property. Understanding these aspects is crucial when assessing risks in business transactions. The Arizona Diligence Compendium outlines how to analyze each 'P,' ensuring you cover all necessary bases. Utilizing our platform allows you to access tools and templates designed to facilitate the review of these essential components.

Completing due diligence involves several key steps, beginning with gathering relevant information about the subject matter. Leveraging the Arizona Diligence Compendium, you can analyze contracts, financial statements, and legal records. It is vital to verify all findings through trusted sources. Our platform provides streamlined access to the essential resources needed to conduct thorough due diligence successfully.