Arizona Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

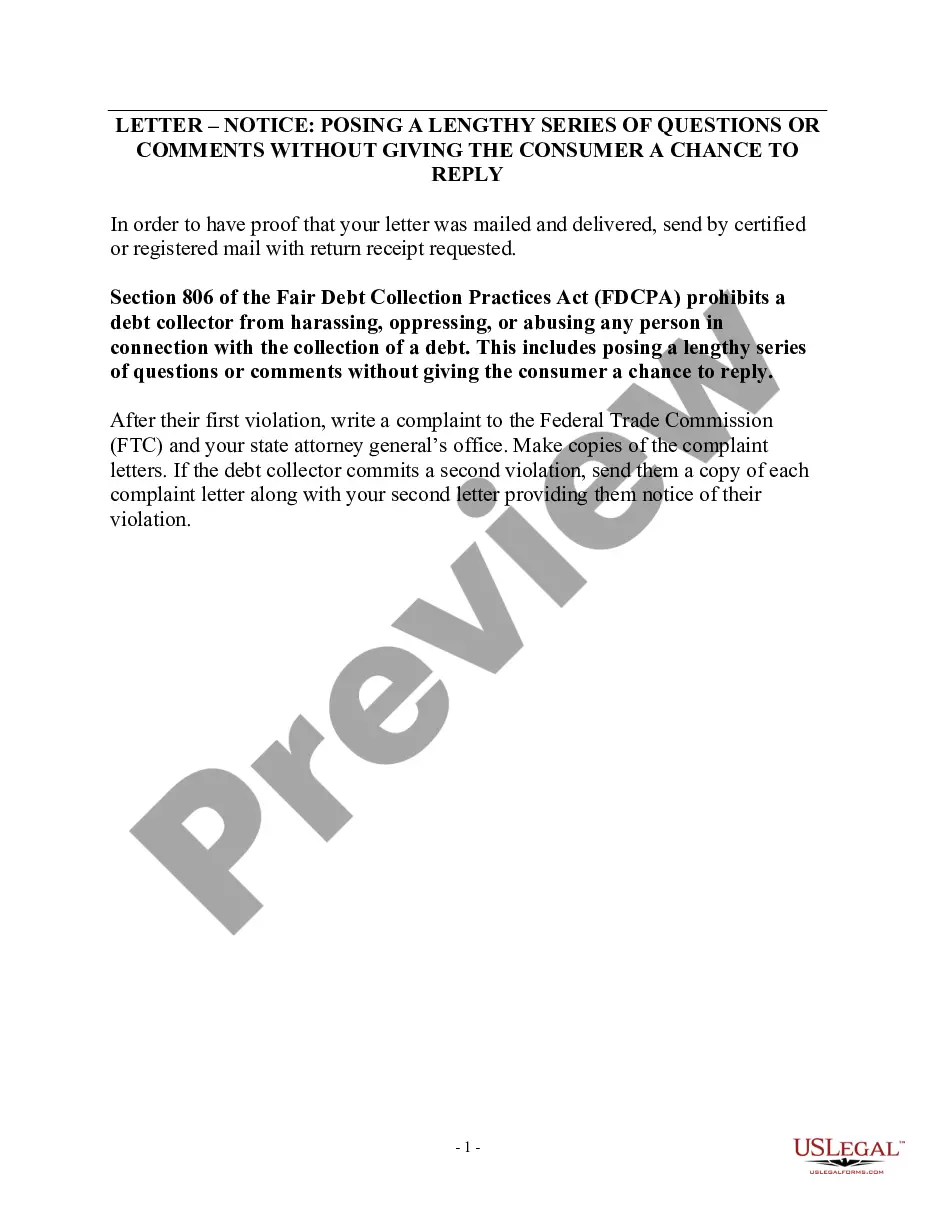

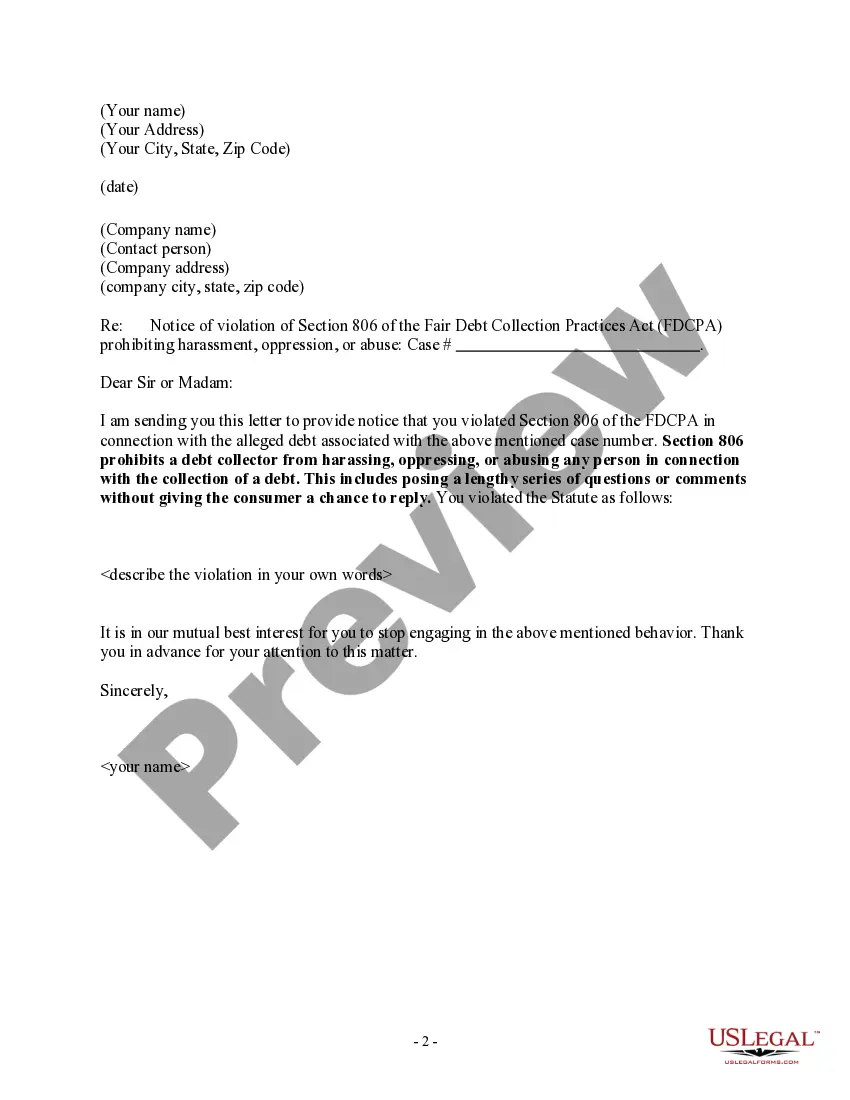

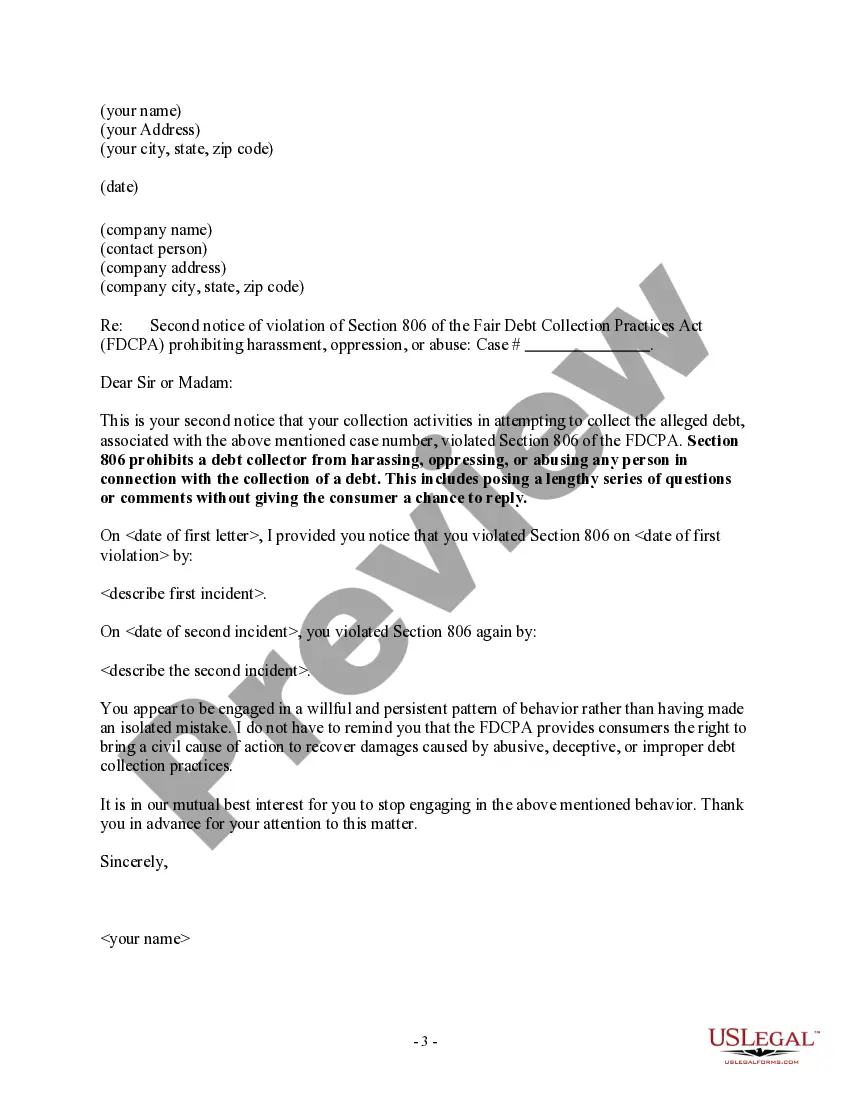

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

Locating the appropriate valid document template can be a challenge. Clearly, there are numerous templates available online, but how can you find the correct form you need? Utilize the US Legal Forms website. This service offers a multitude of templates, such as the Arizona Notice to Debt Collector - Posing Lengthy Series of Questions or Comments, which can be utilized for business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Arizona Notice to Debt Collector - Posing Lengthy Series of Questions or Comments. Use your account to search for the valid forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps for you to follow: First, ensure you have selected the right document for your city/state. You can review the form using the Preview feature and examine the form outline to ensure it is suitable for your needs. If the form does not meet your requirements, use the Search box to find the correct document. Once you are confident that the form is appropriate, click on the Buy now button to purchase the form. Select the pricing plan you prefer and enter the necessary information. Create your account and finalize your order using your PayPal account or credit card. Choose the document format and download the valid document template to your device. Finally, fill out, modify, print, and sign the completed Arizona Notice to Debt Collector - Posing Lengthy Series of Questions or Comments.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Leverage this service to download professionally crafted documents that adhere to state requirements.

- Ensure correct template selection.

- Utilize Preview function.

- Review form summary.

- Search for additional documents.

- Confirm form suitability.

- Proceed with purchase.

Form popularity

FAQ

When contacted by a debt collector, they'll usually ask for personal information to ensure that they're talking with the right person before they can start asking about the debt. The Fair Debt Collection Practices Act (FDCPA)

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Ask the debt collector to supply you with the details of the debt he or she is attempting to collect. Who is the original creditor? What was the original amount owed? How much of what you are attempting to collect is fees and interest accrued since he or she took possession of the debt?

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

Ask the debt collector to supply you with the details of the debt he or she is attempting to collect. Who is the original creditor? What was the original amount owed? How much of what you are attempting to collect is fees and interest accrued since he or she took possession of the debt?