Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Arizona Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

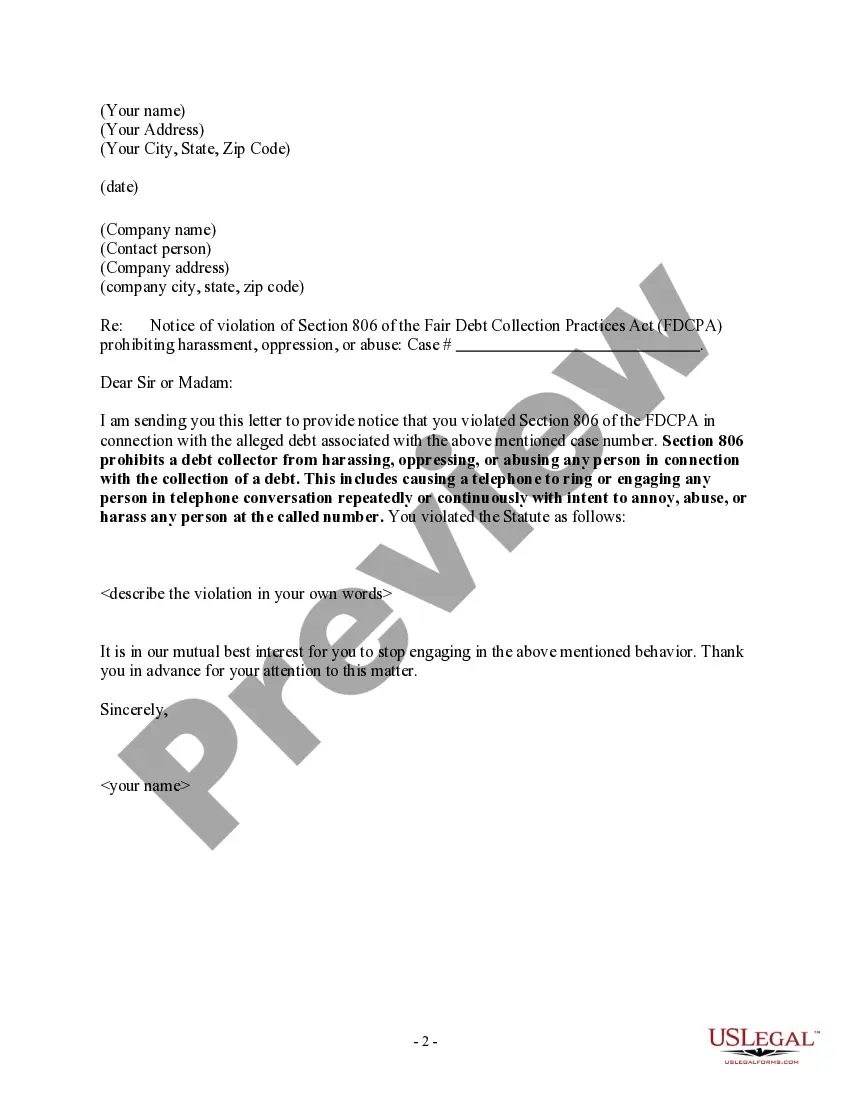

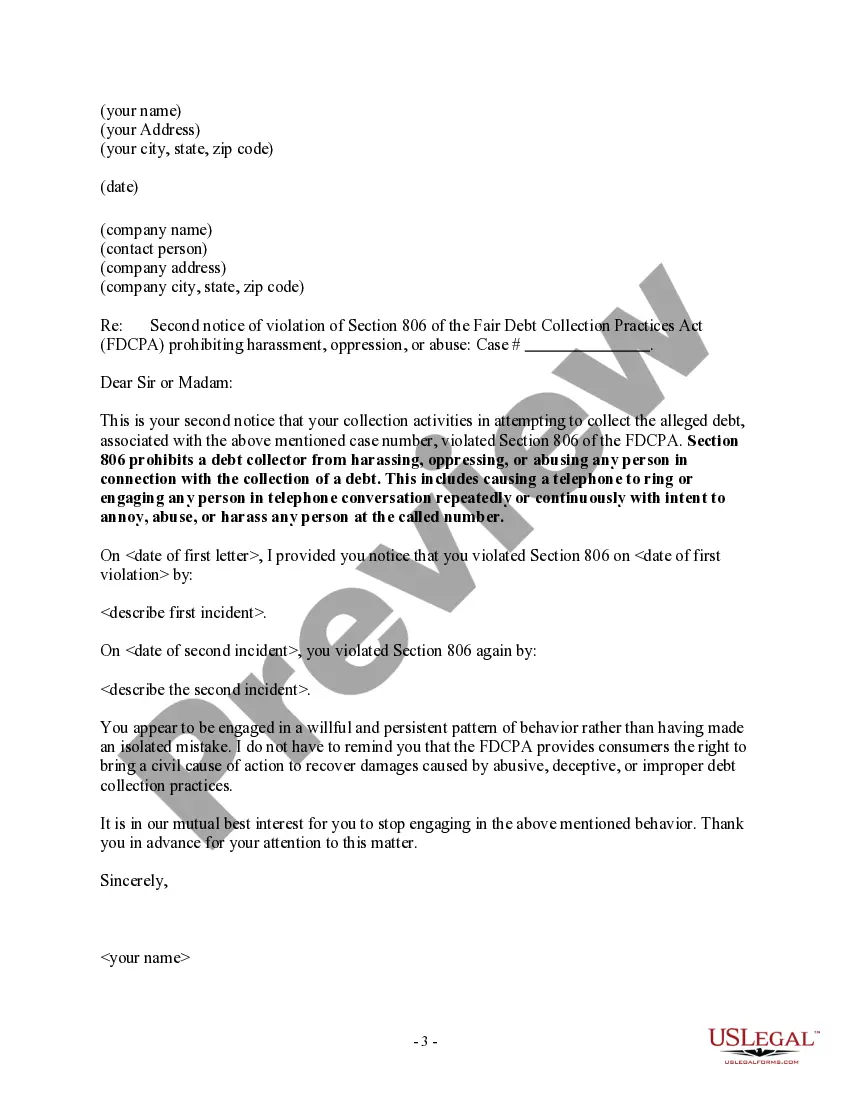

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

If you wish to complete, obtain, or print out legal document templates, use US Legal Forms, the greatest variety of legal kinds, that can be found on-line. Use the site`s simple and easy practical lookup to get the paperwork you need. A variety of templates for enterprise and person functions are categorized by types and claims, or keywords and phrases. Use US Legal Forms to get the Arizona Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls with a few mouse clicks.

If you are previously a US Legal Forms buyer, log in to the accounts and click on the Down load switch to get the Arizona Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls. You can also entry kinds you previously saved in the My Forms tab of your own accounts.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the form for that appropriate metropolis/country.

- Step 2. Utilize the Review solution to look over the form`s articles. Never forget to read through the information.

- Step 3. If you are unsatisfied with the develop, take advantage of the Research field on top of the screen to get other models of the legal develop design.

- Step 4. Upon having discovered the form you need, click on the Get now switch. Opt for the prices plan you prefer and put your credentials to sign up for the accounts.

- Step 5. Process the financial transaction. You can use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Find the file format of the legal develop and obtain it on the gadget.

- Step 7. Complete, change and print out or signal the Arizona Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

Every legal document design you buy is yours eternally. You possess acces to each and every develop you saved inside your acccount. Click the My Forms section and choose a develop to print out or obtain once again.

Contend and obtain, and print out the Arizona Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls with US Legal Forms. There are millions of specialist and condition-specific kinds you can utilize for the enterprise or person requirements.

Form popularity

FAQ

All unwanted phone calls do not come within the meaning of harassment. The factors that are required for an unwanted phone call to become a harassing one are as followsiv: Caller's intention to harass or threaten you by continually ringing the phone.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.