Arizona Proposal to approve agreement of merger with copy of agreement

Description

How to fill out Proposal To Approve Agreement Of Merger With Copy Of Agreement?

If you need to complete, acquire, or printing legitimate file layouts, use US Legal Forms, the biggest assortment of legitimate varieties, that can be found on the web. Take advantage of the site`s basic and hassle-free research to obtain the documents you require. Different layouts for organization and individual purposes are sorted by groups and claims, or key phrases. Use US Legal Forms to obtain the Arizona Proposal to approve agreement of merger with copy of agreement in just a couple of mouse clicks.

When you are previously a US Legal Forms customer, log in in your account and then click the Download option to have the Arizona Proposal to approve agreement of merger with copy of agreement. You can also gain access to varieties you previously delivered electronically within the My Forms tab of the account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for that appropriate area/land.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Never forget about to see the information.

- Step 3. When you are not happy using the develop, use the Look for industry on top of the screen to find other variations of the legitimate develop template.

- Step 4. When you have located the form you require, click on the Buy now option. Choose the prices prepare you like and add your qualifications to sign up for the account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal account to complete the purchase.

- Step 6. Pick the formatting of the legitimate develop and acquire it in your gadget.

- Step 7. Full, revise and printing or indication the Arizona Proposal to approve agreement of merger with copy of agreement.

Each and every legitimate file template you acquire is your own property permanently. You possess acces to every develop you delivered electronically with your acccount. Go through the My Forms area and pick a develop to printing or acquire once more.

Compete and acquire, and printing the Arizona Proposal to approve agreement of merger with copy of agreement with US Legal Forms. There are thousands of expert and status-specific varieties you can utilize for your personal organization or individual demands.

Form popularity

FAQ

In a merger, because the surviving, merged corporation is essentially a continuation of the merging companies, it will take on all assets and liabilities of the merging companies. The survivor company owns the merging companies' debts and obligations, including any lawsuits filed by or against the merging companies.

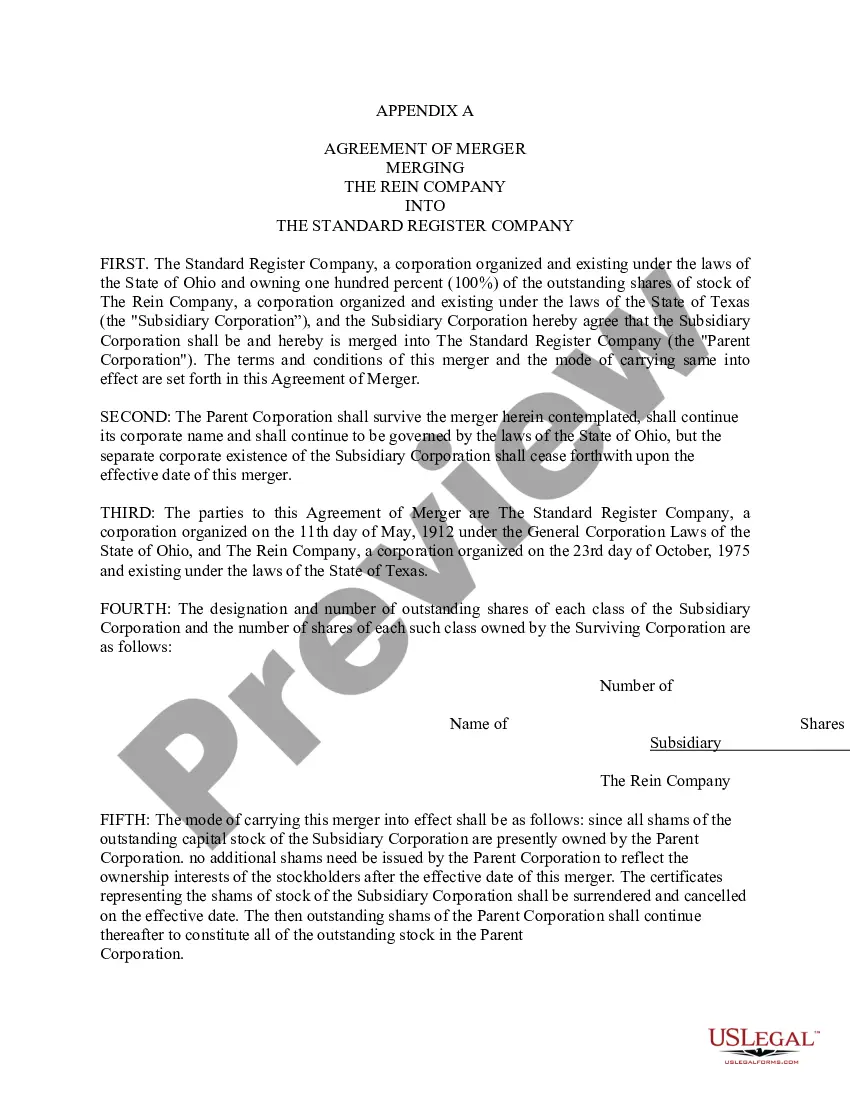

An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

The new owner can assume or reject existing contracts when a business sells. If they choose to accept a contract, they become legally bound to fulfill the terms of the agreement, just as the previous owner was.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

The purpose of the merger clause is to limit any disputes regarding the meaning of the contract to the terms contained within its four corners.

A merger clause is a provision in a contract that declares the writing to be the complete and final agreement between the parties. Merger clauses typically are found at the end of a contract or agreement, among the other ?boilerplate? provisions, and, as such, are often neglected or ignored during negotiations.

The merger agreement will already assign the rights and obligations under existing contracts to the buyer without a new, specific process for each existing agreement.