Arizona Proposal to amend the restated articles of incorporation to create a second class of common stock

Description

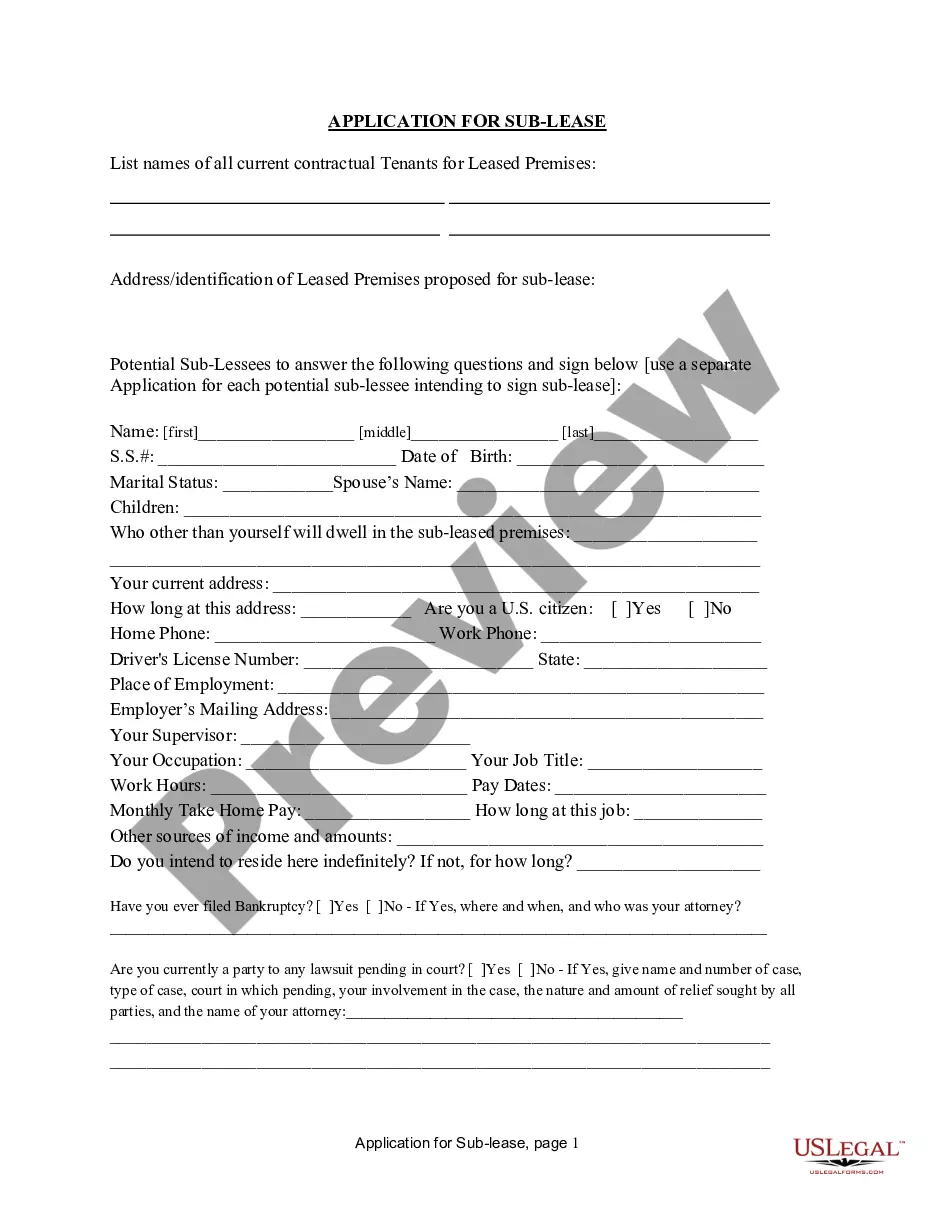

How to fill out Proposal To Amend The Restated Articles Of Incorporation To Create A Second Class Of Common Stock?

If you wish to complete, down load, or print legal papers layouts, use US Legal Forms, the largest collection of legal varieties, that can be found on-line. Utilize the site`s simple and convenient look for to obtain the files you will need. A variety of layouts for business and personal reasons are sorted by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Arizona Proposal to amend the restated articles of incorporation to create a second class of common stock within a number of mouse clicks.

Should you be presently a US Legal Forms buyer, log in to the accounts and click on the Down load button to obtain the Arizona Proposal to amend the restated articles of incorporation to create a second class of common stock. Also you can accessibility varieties you earlier saved within the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the correct area/country.

- Step 2. Take advantage of the Preview solution to check out the form`s information. Don`t neglect to read through the explanation.

- Step 3. Should you be not satisfied using the form, use the Search industry near the top of the display to find other models from the legal form design.

- Step 4. When you have identified the form you will need, click the Get now button. Opt for the pricing program you favor and include your references to sign up for the accounts.

- Step 5. Method the financial transaction. You should use your charge card or PayPal accounts to perform the financial transaction.

- Step 6. Pick the structure from the legal form and down load it on your system.

- Step 7. Full, revise and print or signal the Arizona Proposal to amend the restated articles of incorporation to create a second class of common stock.

Every single legal papers design you buy is your own for a long time. You might have acces to every single form you saved in your acccount. Click the My Forms section and pick a form to print or down load again.

Contend and down load, and print the Arizona Proposal to amend the restated articles of incorporation to create a second class of common stock with US Legal Forms. There are thousands of expert and state-distinct varieties you can use to your business or personal requirements.

Form popularity

FAQ

Restated Articles of Incorporation are an updated and consolidated version of a company's foundational document, outlining its structure, purpose, and key provisions, which may be amended to reflect changes in the company's structure or goals.

The corporation is required by law to adopt bylaws. Bylaws are written rules that govern how the corporation operates internally, such as how the Board of Directors will be elected and what votes are required for a particular action. Bylaws can have any provision in them that is not prohibited by law. See A.R.S.

Corporation. An Arizona Corporation has to file 2 copies of the completed Articles of Amendment Form with the Arizona Corporations Commission along with the filing cover sheet. You can do this by mail, fax, or in person. You also need to include $25 for the filing fee.

A corporation restating its Articles of Incorporation must submit to the Arizona Corporation Commission both the Restated Articles and a Certificate setting forth certain required information about how the Restated Articles were approved by the corporation. See A.R.S. § 10-11007.

Yes. See A.R.S. § 29-3201. A notice of the filing of the Articles of Organization is required to be published.

Regulates several hundred public utilities serving the state, including setting the rates and charges for service and ensuring adequate, reliable service, Registers corporations and limited liability companies, and. Enforces regulations to ensure railroad and pipeline safety.