Arizona Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

How to fill out Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

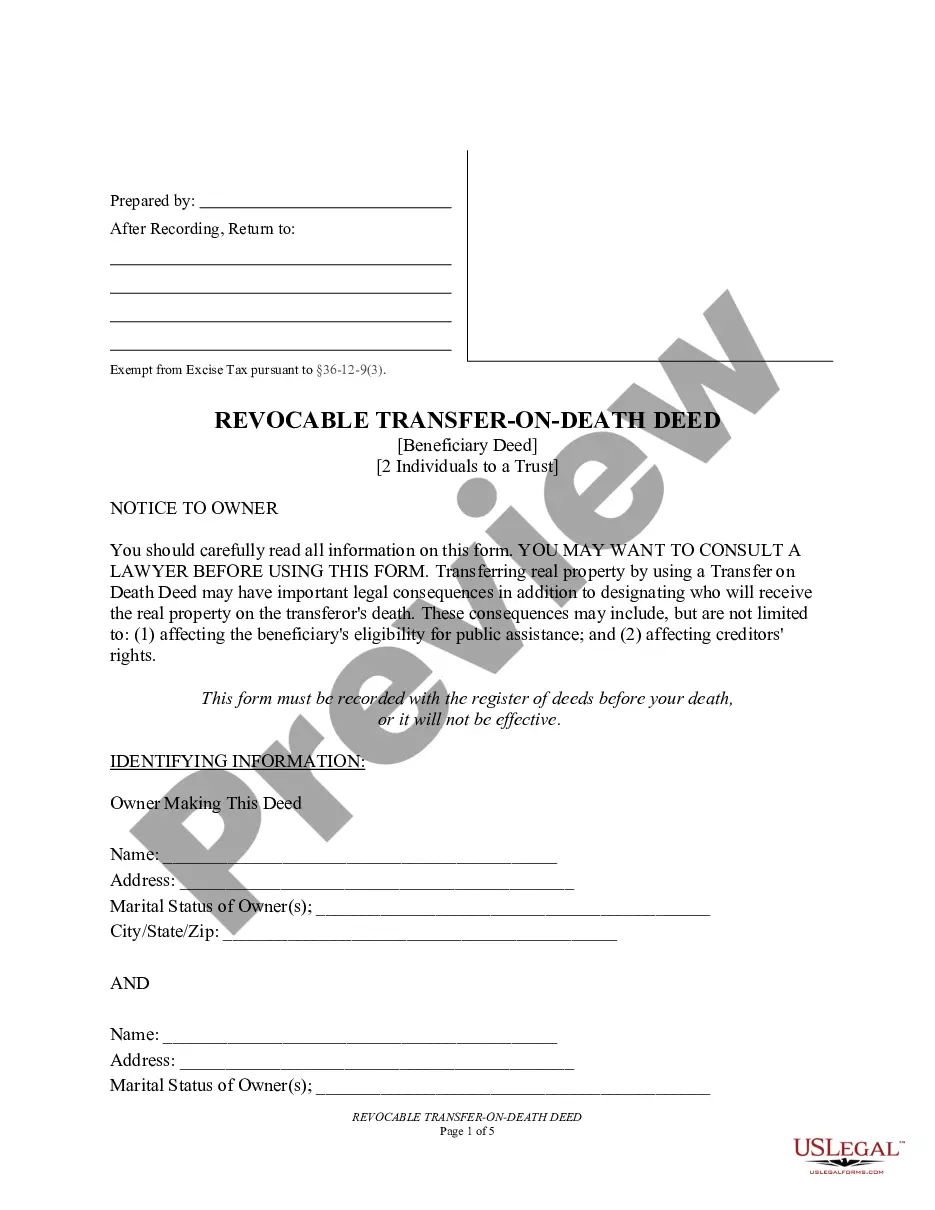

You are able to spend hours online looking for the legitimate document format that suits the state and federal requirements you require. US Legal Forms supplies thousands of legitimate varieties that are evaluated by experts. It is simple to down load or print the Arizona Stock Appreciation Right Plan of Helene Curtis Industries, Inc. from your services.

If you have a US Legal Forms profile, you may log in and click the Down load switch. Next, you may complete, change, print, or sign the Arizona Stock Appreciation Right Plan of Helene Curtis Industries, Inc.. Each and every legitimate document format you purchase is your own eternally. To have another copy associated with a acquired kind, visit the My Forms tab and click the related switch.

If you are using the US Legal Forms website for the first time, follow the straightforward directions beneath:

- Initial, be sure that you have selected the right document format for that area/metropolis of your choosing. Read the kind explanation to make sure you have picked the proper kind. If readily available, utilize the Review switch to check from the document format too.

- In order to locate another version of your kind, utilize the Lookup discipline to obtain the format that suits you and requirements.

- Upon having found the format you need, simply click Get now to proceed.

- Find the pricing program you need, type your credentials, and register for a merchant account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal profile to pay for the legitimate kind.

- Find the file format of your document and down load it in your gadget.

- Make changes in your document if necessary. You are able to complete, change and sign and print Arizona Stock Appreciation Right Plan of Helene Curtis Industries, Inc..

Down load and print thousands of document templates making use of the US Legal Forms Internet site, which offers the biggest variety of legitimate varieties. Use expert and express-particular templates to handle your small business or personal needs.

Form popularity

FAQ

Stock Appreciation Rights is a reward based on the performance of the company's stock for a specific period. The employee gets a reward either in cash or in the form of the company's share if the price of the company's stock goes up. However, Stock Appreciation Rights are subjected to a fixed period.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

With ESOPs, you need to realign the equity shares and the corresponding voting rights. Employees need not pay an exercise price to acquire SARs. They are either offered cash payout or share ownership (without having to pay for the shares).

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

A Stock Appreciation Right (a ?SAR?) provides the recipient with the right to the appreciation in the common stock of the Corporation (?Common Stock?) measured from the date of grant to the date of exercise. The number of SARs awarded and the SAR grant price are set forth in the Statement of Award.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.