Arizona Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options

Description

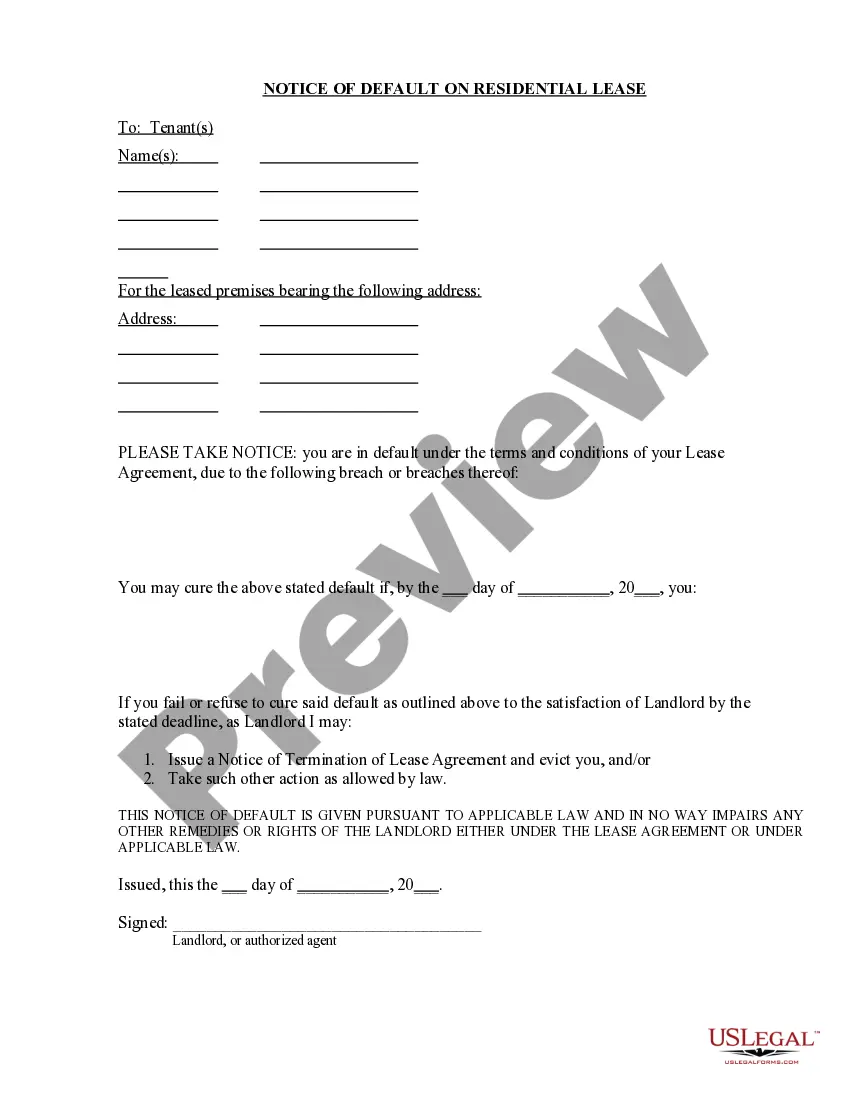

How to fill out Stock Option Plan Of Hayes Wheels International, Inc., Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options?

If you want to full, obtain, or print authorized papers themes, use US Legal Forms, the biggest variety of authorized types, that can be found on the web. Take advantage of the site`s simple and convenient research to get the paperwork you need. Different themes for enterprise and individual reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to get the Arizona Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options in a few click throughs.

If you are already a US Legal Forms client, log in to the profile and click on the Obtain switch to have the Arizona Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options. Also you can accessibility types you earlier downloaded in the My Forms tab of your own profile.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for that proper city/region.

- Step 2. Make use of the Preview method to check out the form`s content. Never neglect to see the information.

- Step 3. If you are not satisfied with all the type, utilize the Look for industry near the top of the screen to locate other models from the authorized type design.

- Step 4. When you have identified the form you need, click the Get now switch. Pick the prices prepare you favor and put your credentials to sign up on an profile.

- Step 5. Process the financial transaction. You may use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Select the file format from the authorized type and obtain it on the product.

- Step 7. Total, revise and print or sign the Arizona Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options.

Each and every authorized papers design you get is the one you have for a long time. You may have acces to every type you downloaded inside your acccount. Select the My Forms section and select a type to print or obtain yet again.

Contend and obtain, and print the Arizona Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options with US Legal Forms. There are many professional and condition-distinct types you may use for your personal enterprise or individual requirements.

Form popularity

FAQ

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

Incentive stock options (ISOs) are a type of employee stock option that can provide tax benefits for both the employer and the employee. ISOs are often used as a component of a compensation package to help with employee retention. ISOs are also used to compensate certain highly-valued employees.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.