Arizona Check Requisition Worksheet

Description

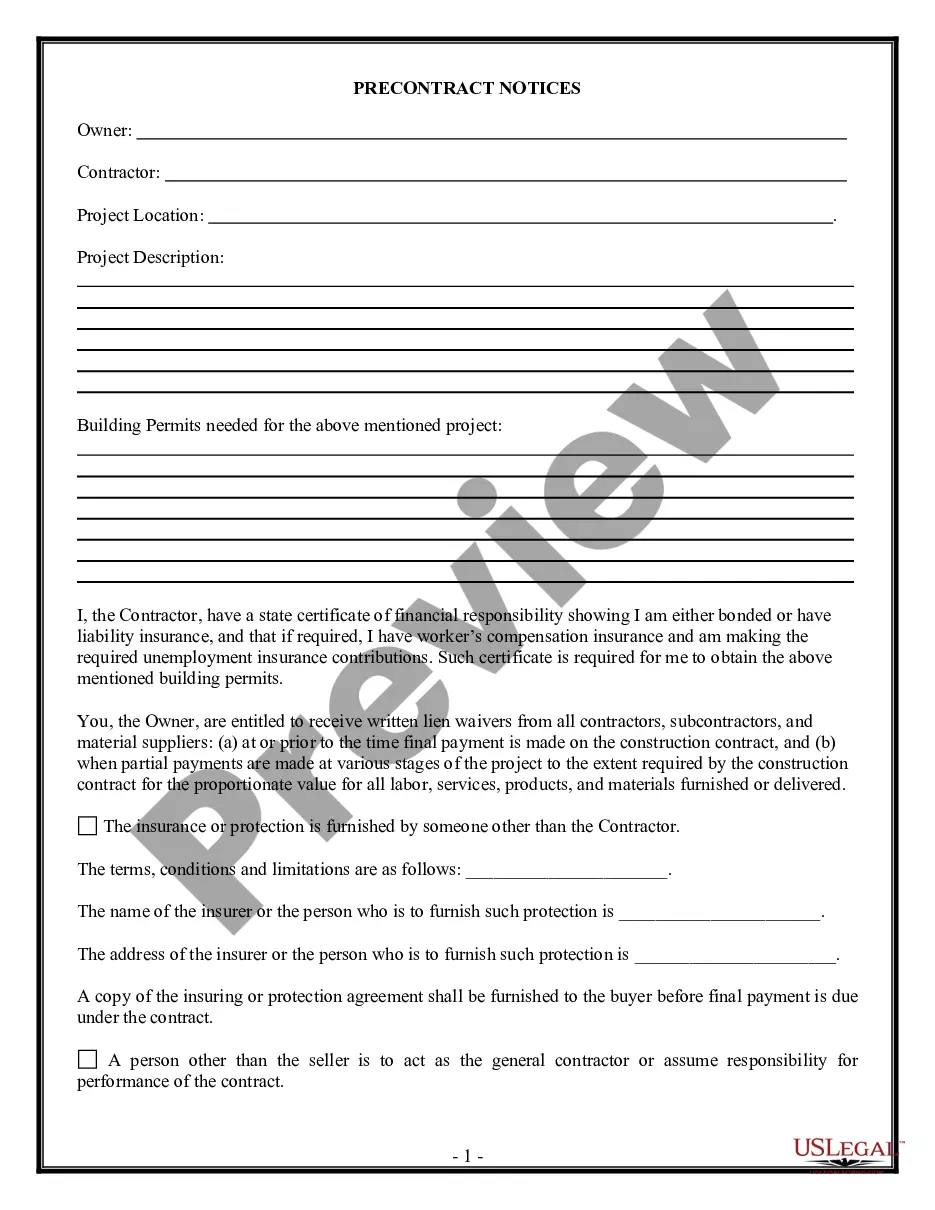

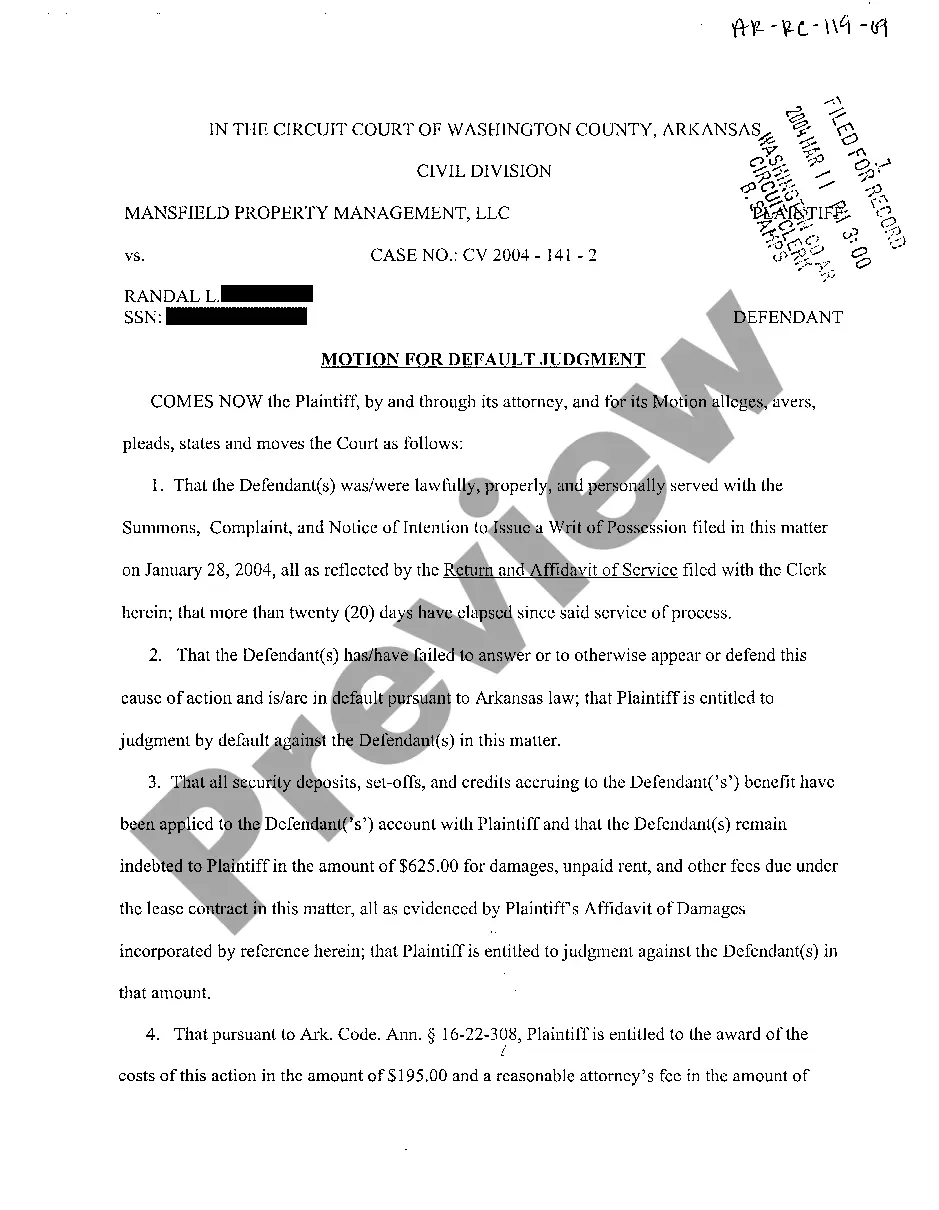

How to fill out Check Requisition Worksheet?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad assortment of legal form templates that you can download or print.

Using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest versions of forms such as the Arizona Check Requisition Worksheet in just minutes.

If you hold a monthly subscription, Log In and download the Arizona Check Requisition Worksheet from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form onto your device.

Make modifications. Fill out, edit, print, and sign the saved Arizona Check Requisition Worksheet.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the contents of the form.

- Check the form details to confirm you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you want and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The main difference lies in their purpose and application. A planning worksheet is focused on budgeting and financial organization, while a requisition worksheet is used specifically for requesting items or funds. When you leverage an Arizona Check Requisition Worksheet, you see how this tool can fit into your planning by clarifying your requests and helping you stay on top of your financial strategies.

Arizona's child support formula considers each parent's income and how much each pays toward children's health insurance, child care and education. It also considers the number of children in the case and their ages, as well as parenting time (counted according to Arizona's unique method, described below).

Arizona's child support formula considers each parent's income and how much each pays toward children's health insurance, child care and education. It also considers the number of children in the case and their ages, as well as parenting time (counted according to Arizona's unique method, described below).

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

So even if the parties "agree" not to pay child support to each other, the court will have an independent legal obligation to ensure that your agreement doesn't hurt the kids. A 50-50 division of parenting time often results in a minimal - or even nonexistent - need for child support payments.

Taxpayers receiving pre-populated Form TPT-EZ through the mail can file and pay at AZTaxes.gov or print the form at azdor.gov. Attention Temporarily Closed Businesses: Remember even if you had no sales and/or tax due for a filing period, you must still file a $0 TPT return.

Electronic payments can be made using AZTaxes.gov under the Make a Payment link. Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state, but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file.

2713 Make your check or money order payable to Arizona Department of Revenue. 2713 Write your SSN and 2017 Tax on your payment. 2713 Include your payment with this form. 2713 Mail to Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Voters in November 2020 approved Proposition 208 with 51.7% of the vote. It imposed a 3.5% surcharge on taxable incomes over $250,000 for single filers and $500,000 for joint filers. The tax was set to be collected when people and businesses filed their 2021 taxes, due next month.

If you do not owe Arizona income taxes by the tax deadline of April 18, 2022, you do not have to prepare and file a AZ tax extension. In case you expect a AZ tax refund, you will need to file or e-File your AZ tax return in order to receive your tax refund money.