Arizona Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

If you want to thoroughly access, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site`s user-friendly and efficient search option to find the documents you need.

A range of templates for business and personal use are organized by categories and states, or keywords.

Every legal document template you purchase belongs to you permanently. You will have access to every type you've downloaded in your account.

Visit the My documents section and select a form to print or download again. Compete and download, and print the Arizona Department Time Report for Payroll with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the Arizona Department Time Report for Payroll in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Obtain button to download the Arizona Department Time Report for Payroll.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

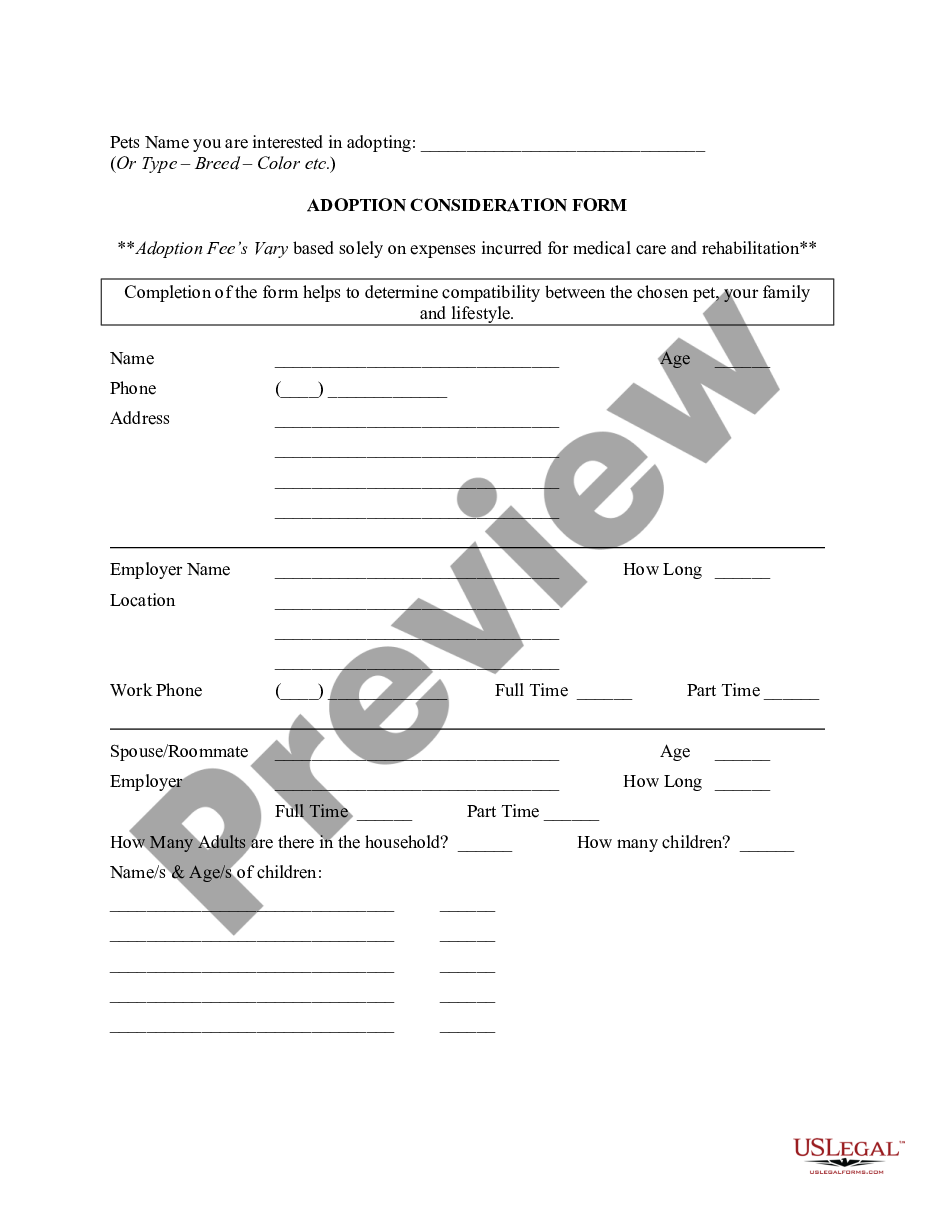

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other models in the legal form format.

- Step 4. After finding the form you need, select the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

- Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify and print or sign the Arizona Department Time Report for Payroll.

Form popularity

FAQ

The Wage Theft Prevention Act increases the requirement to retain payroll records from the three years required by DOL to six years. Employers must retain payroll records for four yearseight years if the employees are exempt.

Businesses determined liable to provide unemployment insurance coverage for their workers are required to. submit Unemployment Tax and Wage Reports (UC-018) for each quarter they are covered, even for quarters during which no wages were paid, and. to pay taxes each quarter taxable wages were paid.

Arizona law requires all employers, whether or not they have been determined liable to pay unemployment taxes, to keep the following records for the most recent four calendar years. Check stubs and canceled checks for all payments.

Employers are required to make and keep employment records for seven (7) years.

Arizona employers must obtain a Arizona Employee's Withholding Election, Form A-4, and a federal Form W-4 from each new Arizona employee. See Employee Withholding Form. Arizona's minimum wage law requires notice to new hires.

Arizona has no laws that prohibit an employer from requiring an employee to pay for a uniform, tools, or other items necessary for employment for the employer. However, an employee must consent in writing to any deduction from wages to pay for the uniform.

(Excess Wages are wages in excess of the taxable wage amount, which is the first $7,000 paid to each employee each calendar year.) If you did not file such prior quarters via TWS, the system automatically knows this and prompts you to provide the Excess Wage amounts yourself.

You can view and print your 1099-G document through your Unemployment Benefits portal. If you are a PUA claimant, you can log into your account and access your 1099-G document through the My Message center.

Unemployment Tax Wage Report (UC-018) - Use this form to report the number of full and part-time covered workers for a quarterly period and the quarterly tax due.

After selecting your tax withholding on the initial Unemployment Insurance (UI) application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form (UB-433). After completing the form, submit it to DES by mail or fax.