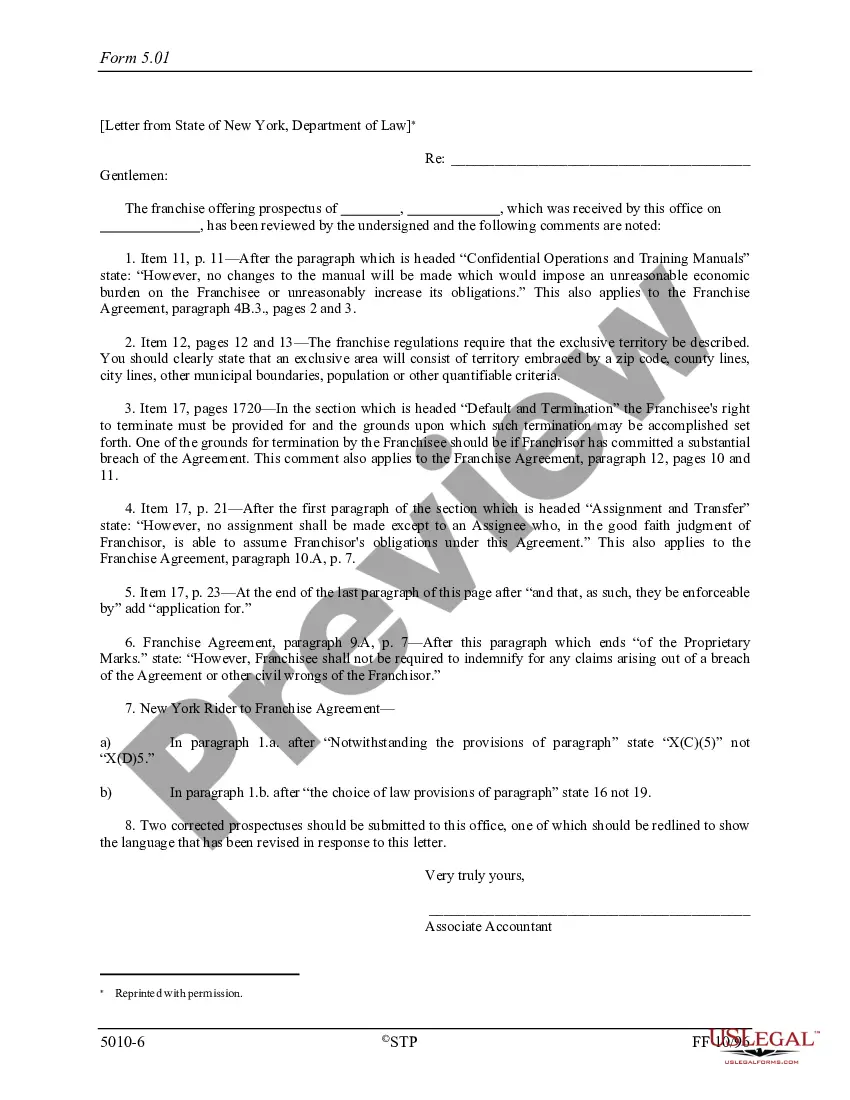

Arizona Comment Letters

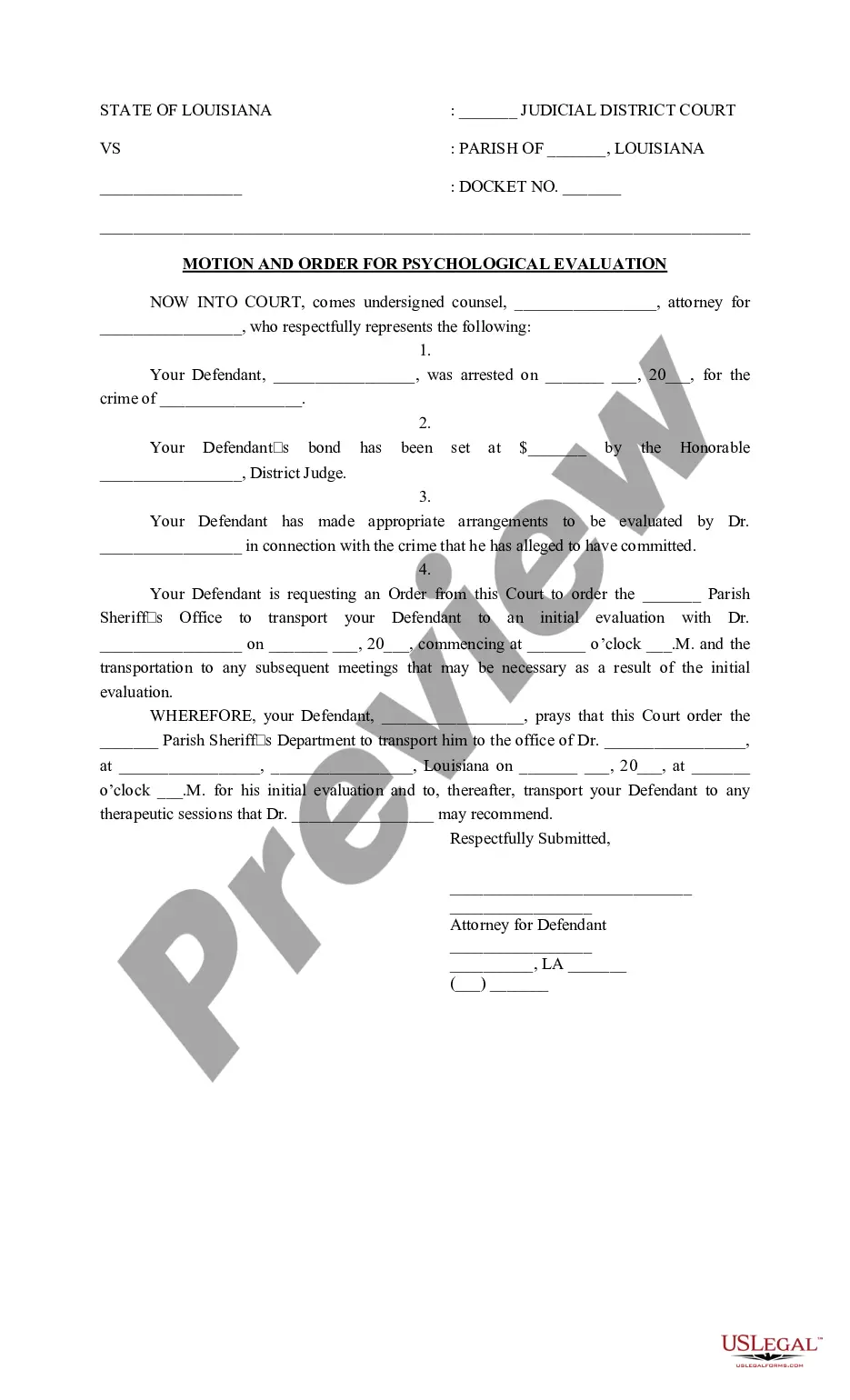

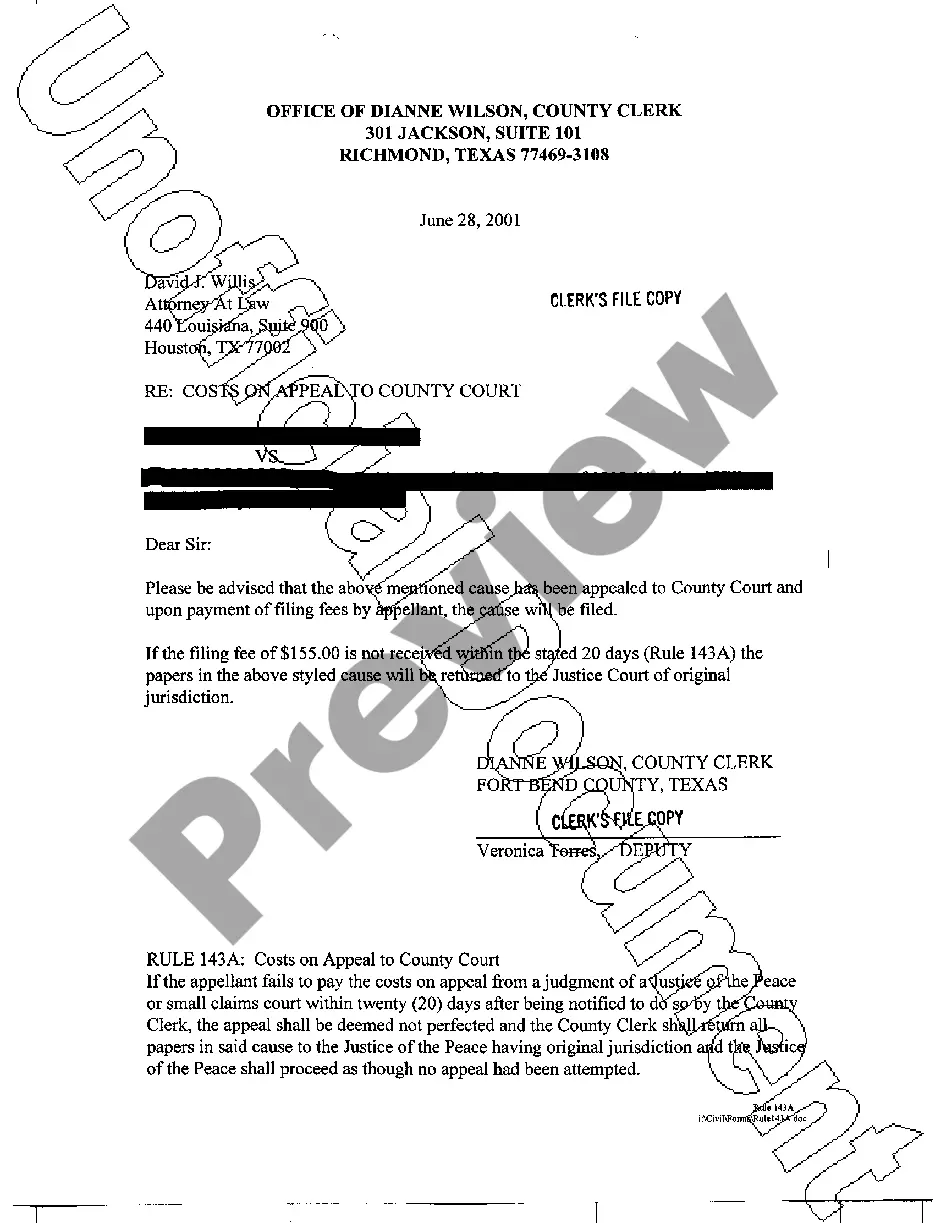

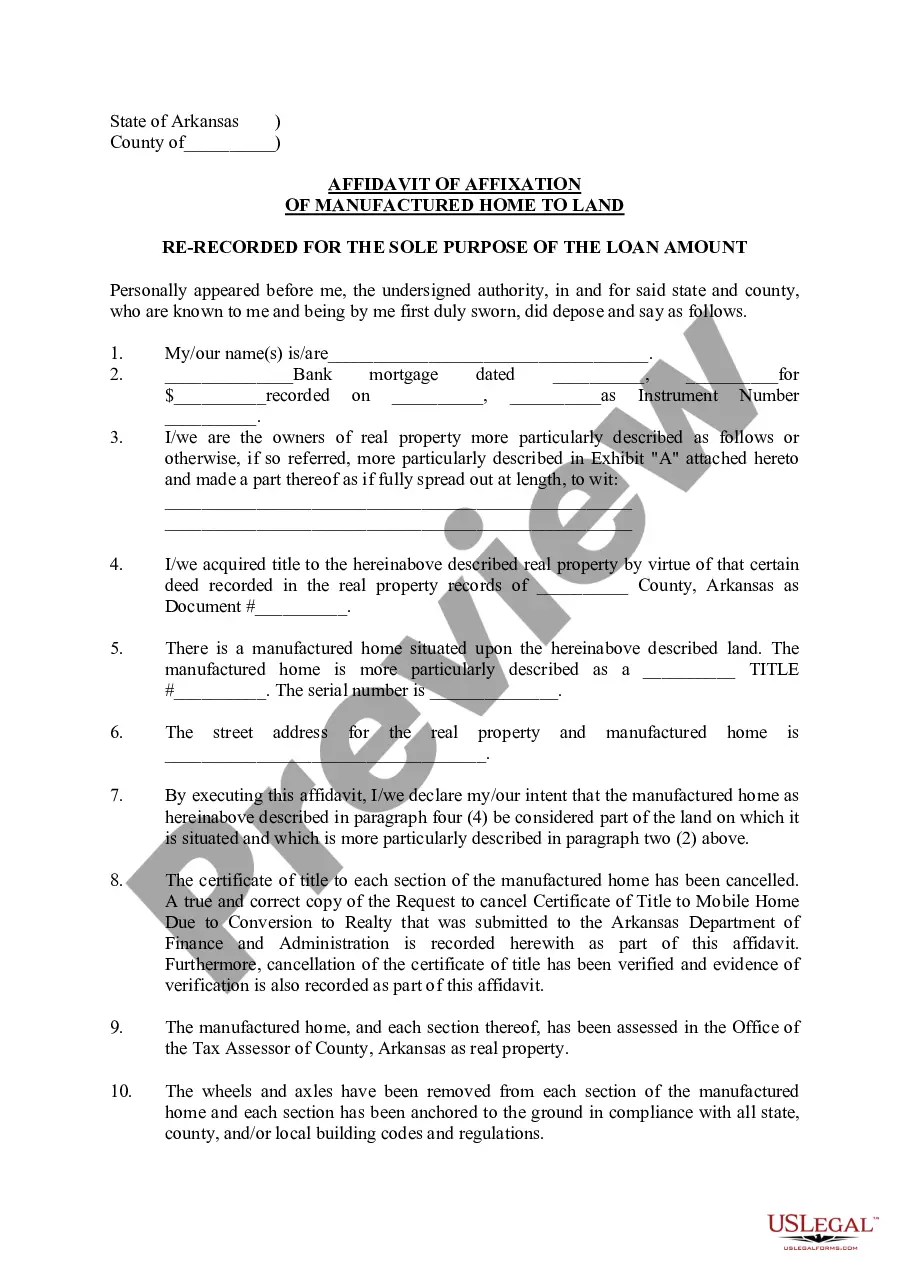

Description

How to fill out Comment Letters?

Have you been within a placement that you will need papers for either enterprise or person uses virtually every day? There are plenty of lawful papers themes available online, but finding versions you can rely isn`t easy. US Legal Forms gives a huge number of develop themes, just like the Arizona Comment Letters, which can be written in order to meet federal and state requirements.

In case you are previously acquainted with US Legal Forms web site and also have your account, simply log in. Following that, you can obtain the Arizona Comment Letters web template.

Unless you come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for the right town/state.

- Utilize the Review switch to analyze the shape.

- Browse the outline to ensure that you have chosen the appropriate develop.

- In the event the develop isn`t what you`re seeking, take advantage of the Look for field to obtain the develop that fits your needs and requirements.

- When you discover the right develop, simply click Get now.

- Choose the rates prepare you need, complete the specified information and facts to create your account, and buy the order utilizing your PayPal or charge card.

- Select a practical file format and obtain your duplicate.

Discover all the papers themes you possess bought in the My Forms menu. You can obtain a more duplicate of Arizona Comment Letters any time, if necessary. Just select the needed develop to obtain or printing the papers web template.

Use US Legal Forms, one of the most substantial assortment of lawful kinds, to conserve time as well as prevent mistakes. The service gives skillfully created lawful papers themes that you can use for a range of uses. Generate your account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

Although commonly referred to as sales tax, TPT is differentiated from sales tax in most states in that it is a tax imposed on the seller, rather than on the purchaser. Therefore, it is ultimately the vendor, not the customer, who is liable to ADOR for TPT associated with taxable sales made in Arizona.

If a business is selling a product or engaging in a service subject to TPT, that business will likely need a license from the Arizona Department of Revenue (ADOR) and a TPT, or business/occupational license, from the city or cities in which the business has a base or operation.

A private taxpayer ruling or a taxpayer information ruling is the department's interpretation of the law or rules only as they apply to the taxpayer making, and the particular facts contained in, the request.

A tax correction notice (TCN) is a correspondence letter sent by the Arizona Department of Revenue to inform taxpayers of important account matters or changes.

Filing an Arizona TPT return is a two-step process comprised of submitting the required sales data (filing a return) and remitting the tax dollars (if any) to the ADOR. The filing process forces you to detail your total sales in the state, the amount of TPT due, and the location of each sale.