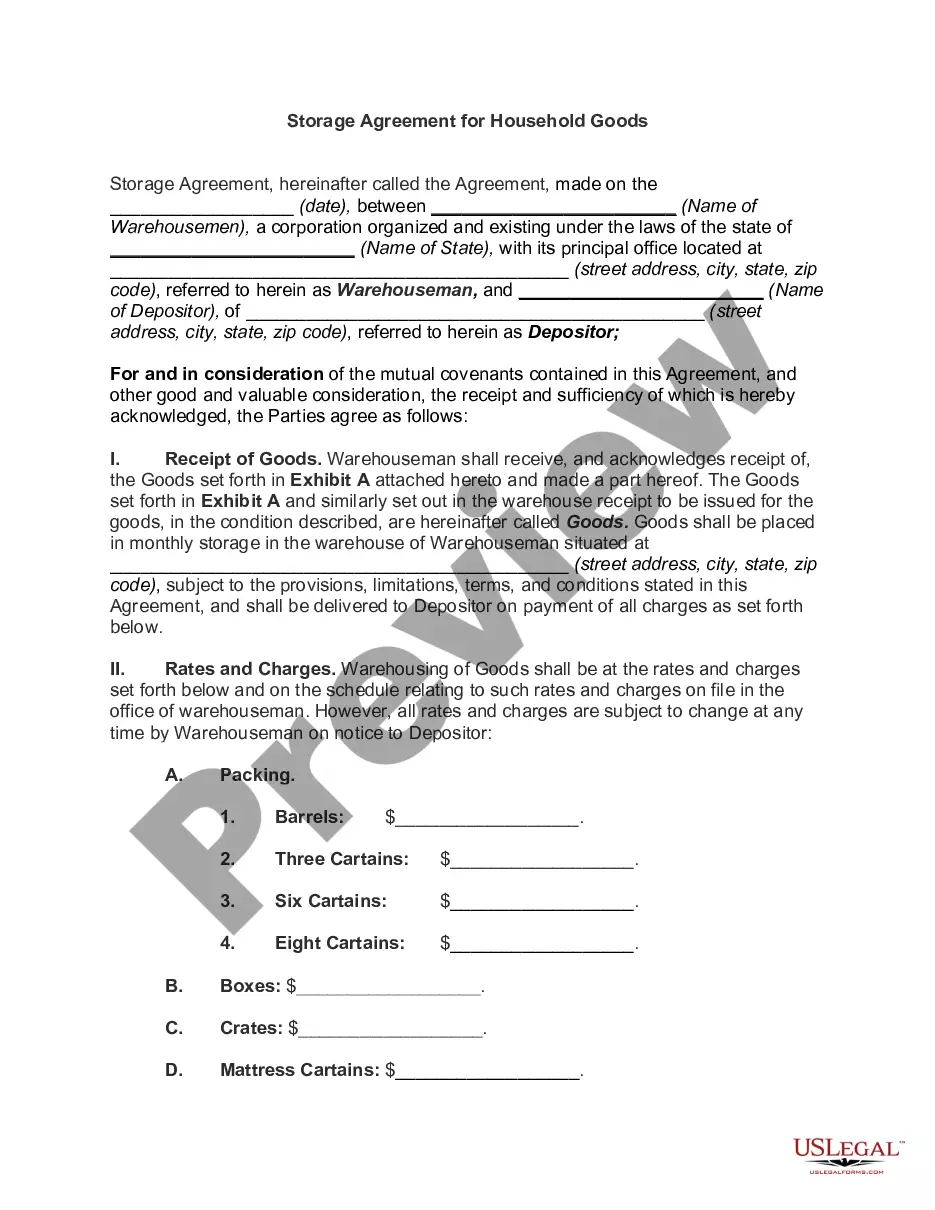

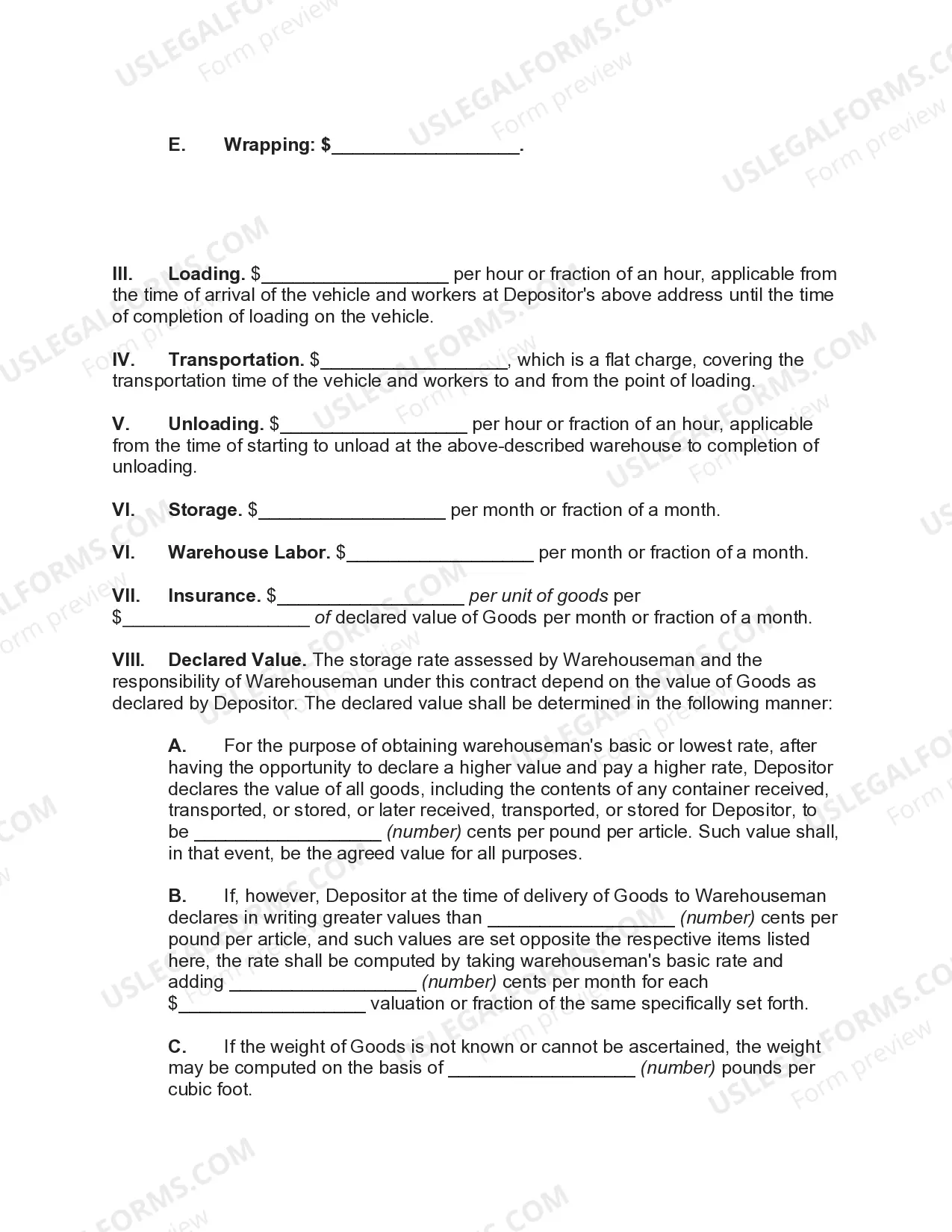

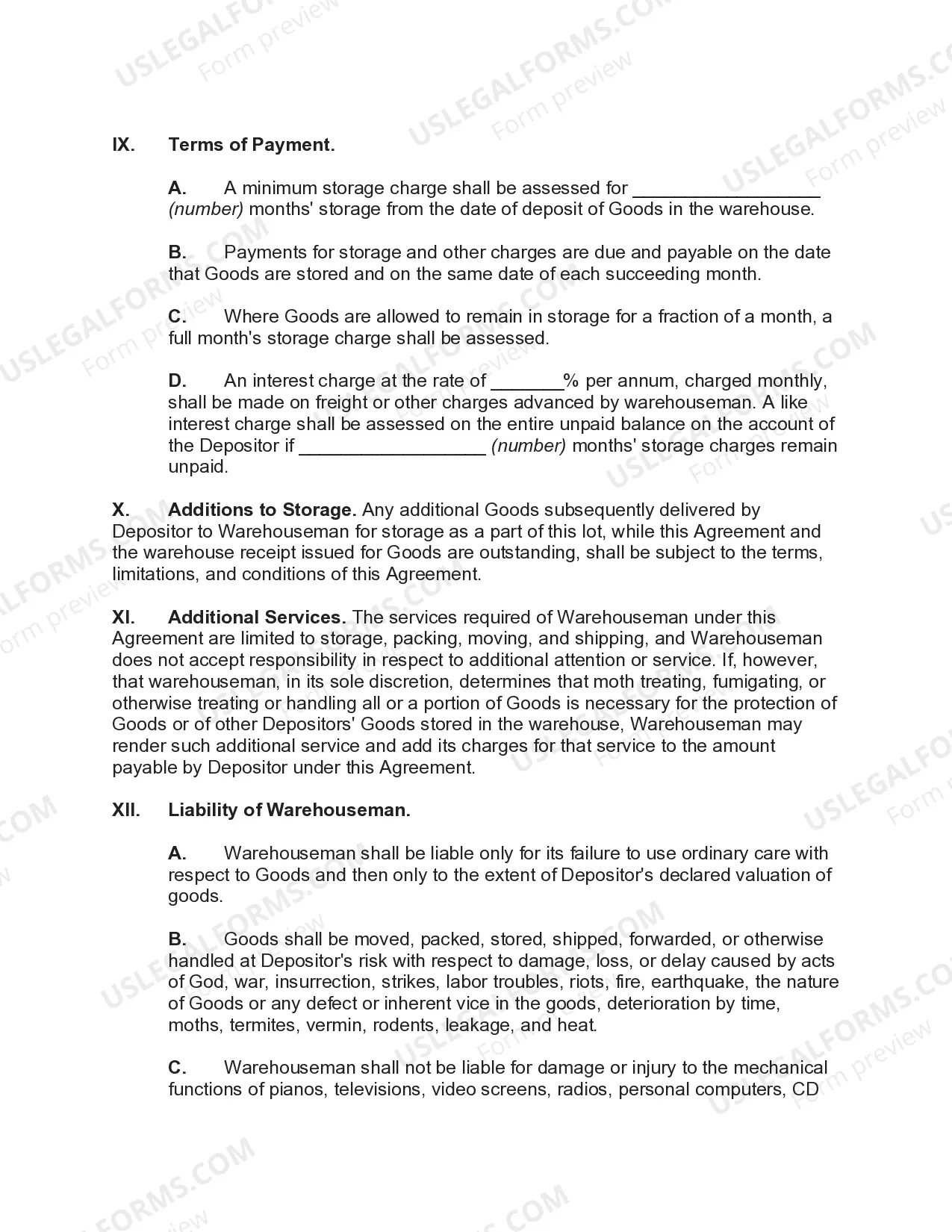

Arizona Storage Agreement for Household Goods

Description

How to fill out Storage Agreement For Household Goods?

You may invest several hours on the web attempting to find the authorized papers web template that suits the federal and state demands you require. US Legal Forms supplies thousands of authorized kinds which are reviewed by pros. You can easily down load or print the Arizona Storage Agreement for Household Goods from your service.

If you already have a US Legal Forms profile, you can log in and click the Obtain key. Afterward, you can comprehensive, change, print, or indication the Arizona Storage Agreement for Household Goods. Each and every authorized papers web template you get is yours forever. To acquire one more duplicate for any obtained develop, proceed to the My Forms tab and click the corresponding key.

Should you use the US Legal Forms website for the first time, follow the basic instructions beneath:

- Very first, make certain you have chosen the proper papers web template for your area/city of your choice. Read the develop outline to ensure you have selected the correct develop. If available, make use of the Preview key to look from the papers web template as well.

- In order to get one more edition from the develop, make use of the Research area to obtain the web template that fits your needs and demands.

- When you have discovered the web template you need, simply click Buy now to proceed.

- Find the prices strategy you need, key in your credentials, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal profile to purchase the authorized develop.

- Find the structure from the papers and down load it to the product.

- Make alterations to the papers if required. You may comprehensive, change and indication and print Arizona Storage Agreement for Household Goods.

Obtain and print thousands of papers layouts using the US Legal Forms website, that provides the biggest assortment of authorized kinds. Use specialist and state-certain layouts to deal with your company or specific requirements.

Form popularity

FAQ

§ 42-5155(A) imposes Arizona use tax on the storage, use or consumption in this state of tangible personal property purchased from a retailer or utility business, as a percentage of the sales price. A.R.S.

Proposition 208, approved by voters in 2020, imposes a 3.5% income tax surcharge on top earners beginning in tax year 2021. Revenue from the surcharge provides direct funding to schools. Proposition 208 imposes the surcharge on taxable income over: $250,000 for single filers and married taxpayers filing separately; and.

Your Storage Unit Will Go Into Default To put it simply, this is the maximum amount of days that you can go without paying rent before things start to get real. It's usually about 30 days. Once you're in default, you'll be locked out of the property and out of your unit.

Your Storage Unit Will Go Into Default To put it simply, this is the maximum amount of days that you can go without paying rent before things start to get real. It's usually about 30 days. Once you're in default, you'll be locked out of the property and out of your unit.

Voters in Arizona have overwhelmingly approved a constitutional amendment prohibiting state and local governments from taxing any service not subject to tax as of December 31, 2017.

Purchases of physical property like furniture, home appliances, and motor vehicles, are subject to sales tax in Arizona. Arizona does not charge sales tax on the purchase of groceries, prescription medicine, or gasoline.

Warehouse in RetailA warehouse is a large building where goods are stored before they are sold.

A. If the occupant is in default for a period of more than thirty days, the operator may foreclose the lien by selling the property stored in the leased space at a public sale, for cash.

Arizona does impose sales and use tax on SaaS and cloud computing. Prewritten computer software or canned software, which includes software that may have originally been written for one specific customer but becomes available to others, are also taxable and considered sales of tangible personal property.