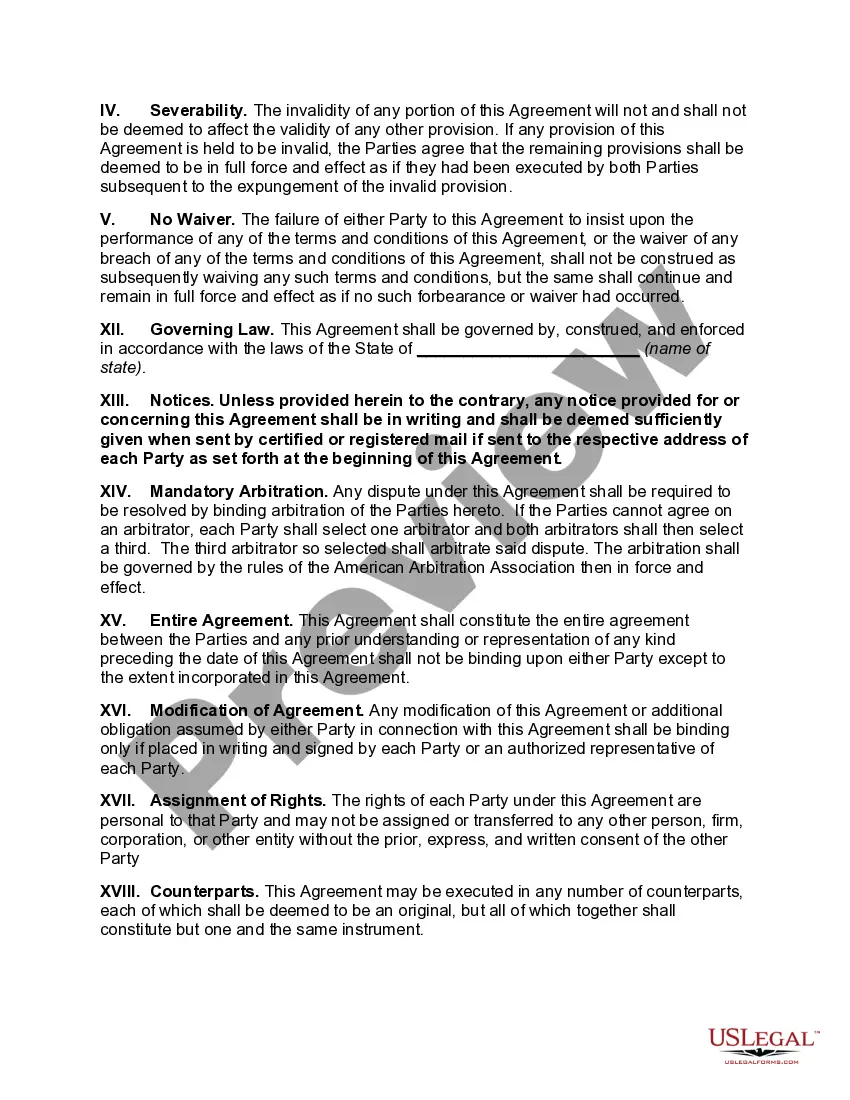

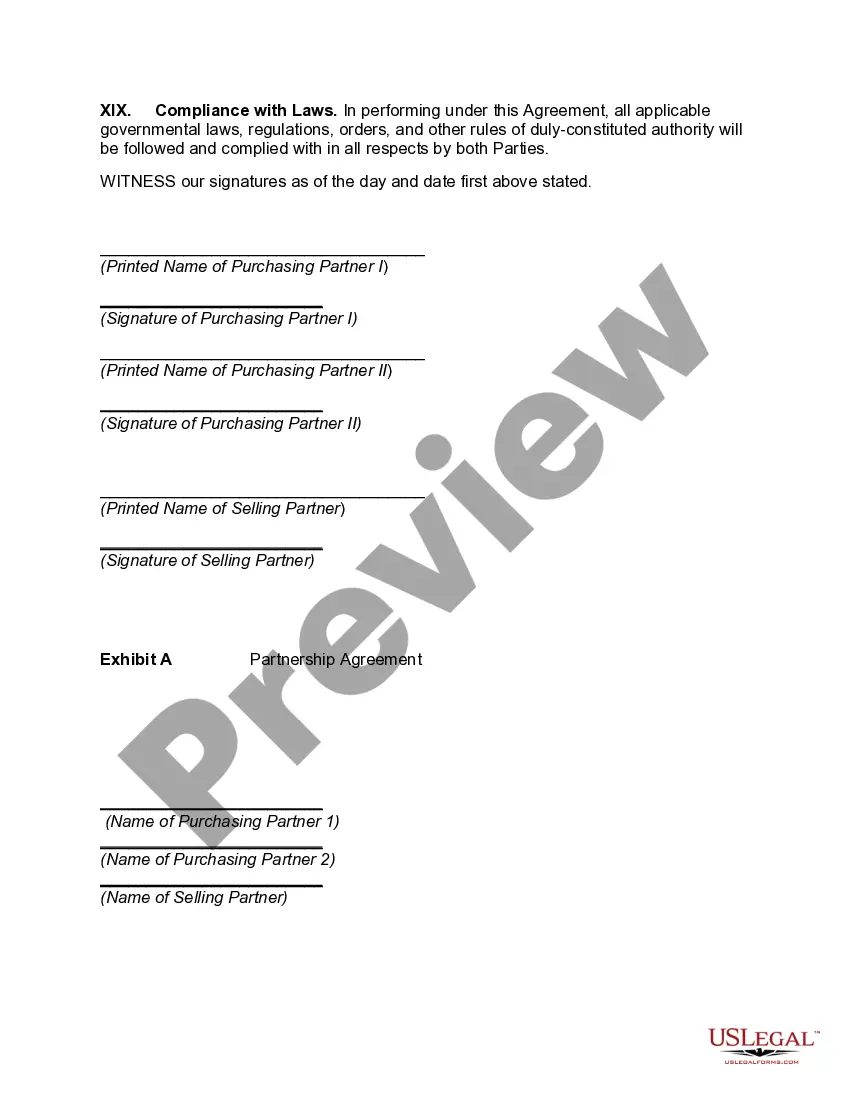

Arizona Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

Are you in a situation where you frequently require documentation for both organizations or specific functions on a daily basis.

There are numerous legal document templates accessible online, but finding reliable versions isn't easy.

US Legal Forms offers a vast selection of form templates, including the Arizona Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment, designed to comply with federal and state regulations.

Utilize US Legal Forms, which offers one of the most extensive collections of legal forms, to save time and prevent errors.

This service provides professionally designed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Arizona Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/state.

- Use the Preview button to review the document.

- Check the description to confirm you have selected the right form.

- If the form isn't what you are looking for, utilize the Search box to locate the form that meets your needs and specifications.

- Once you find the correct form, click Buy now.

- Choose the payment plan you want, provide the necessary information to create your account, and pay for the order using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can download an additional copy of the Arizona Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment anytime, if needed. Just click on the desired form to download or print the document template.

Form popularity

FAQ

First of all the external liabilities and expenses are to be paid. Then, all loans and advances forwarded by the partners should be paid. Then, the capital of each partner should be paid off.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Settlement of accounts on dissolution Losses including deficiencies of capital shall be first paid out from the profits, next from the capital, and if necessary, by the personal contribution of partners in their profit-sharing ratio.

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

The firm shall apply its assets including any contribution to make up the deficiency firstly, for paying the third party debts, secondly for paying any loan or advance by any partner and lastly for paying back their capitals. Any surplus left after all the above payments is shared by partners in profit sharing ratio.

Partnership dissolution refers to the termination of a partnership as well as the cessation of its various business activities.

Timing determines whether a partnership has dissolved or officially terminated. Both informal and LLC partnership dissolution occur when one partner leaves. The business may continue on for a time as assets are split - picture a marriage still technically existing until a divorce is finalized - but is ending.

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

Dissolution marks the end of the partnership relationship. It occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship.