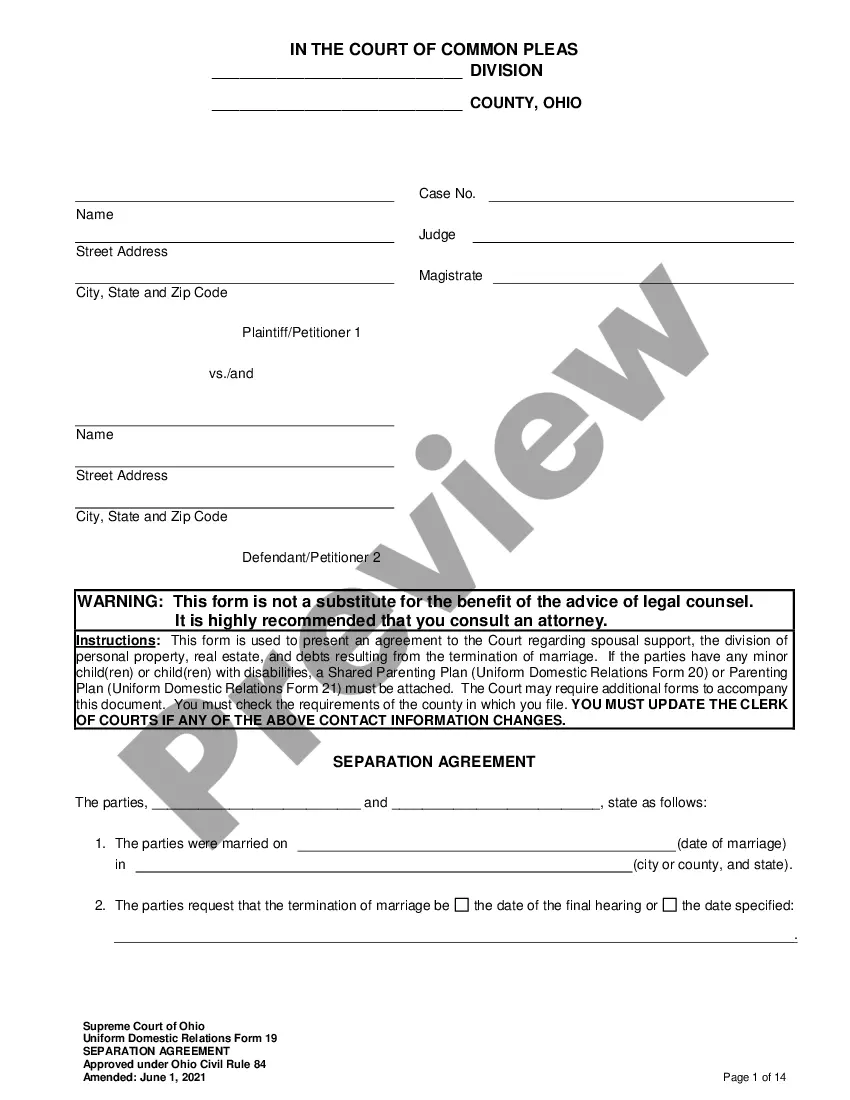

Arizona Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

Are you currently in a position where you need documents for both professional or personal reasons almost all the time.

There are numerous legal document templates available online, but locating reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Arizona Withheld Delivery Notice, that are crafted to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, enter the required information to create your account, and process your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Withheld Delivery Notice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Use the Review button to assess the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

You can use Form 140A to file if all of the following apply to you: You (and your spouse if married filing a joint return) are both full year residents of Arizona. Your Arizona taxable income is less than $50,000, regardless of your filing status. You are a calendar filer.

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

Arizona Form A1-R is an information return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended quarterly withholding tax Form(s) A1-QRT. Form A1-R is due on or before January 31, 2020.

Used by employers to reconcile the amount(s) of Arizona income tax withheld and deposited with the Department of Revenue. This form must be completed and filed 4 times a year, April 30, July 31, October 31, and January 31 of the following year. A1-QRT.

Resources:All employers will have the option of uploading all of their federal Forms W-2 and 1099 through AZTaxes.gov .Payroll companies will be able to upload their Arizona Forms A1-R or A1-APR, and their federal Forms W-2 and 1099, through the AZFSET portal .More items...

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Employee or Employer Out-of-State Withholding (Remote Worker) Withholding of Arizona state income tax from the commencement of employment is required for any resident employee physically working in the state of Arizona regardless of where the employer is based.

The Nexus Program serves out of state taxpayers by providing education on how their business activity creates Nexus with Arizona. Taxpayers may work directly with department auditors, or indirectly by way of a duly appointed representative.

Nexus can linger even after a retailer ceases the activities that caused it to be engaged in business in the state. This is known as trailing nexus. As of May 2019, Arizona does not have an explicitly defined trailing nexus policy.

Complete this form within the first five days of your employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck. If you do not give this form to your employer the department requires your employer to withhold 2.7% of your gross taxable wages.