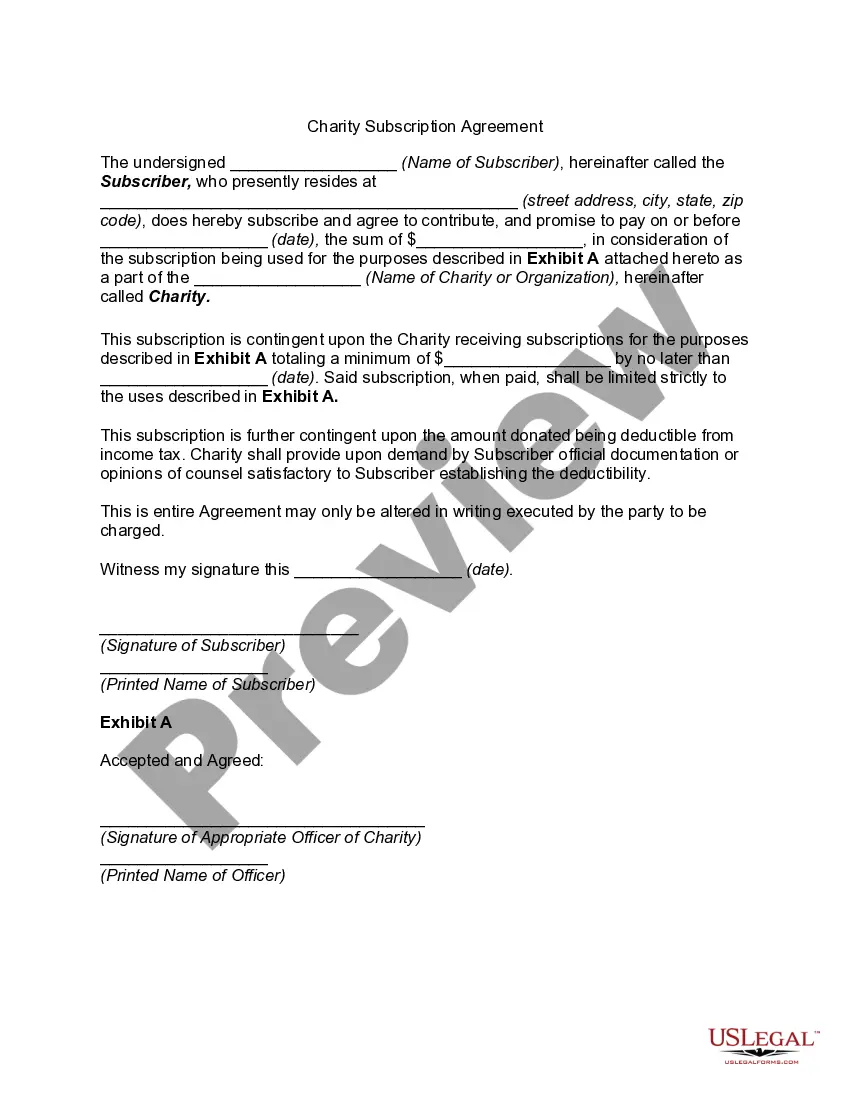

Arizona Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms that are accessible online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Arizona Charity Subscription Agreement with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to each form you saved in your account. Select the My documents section and choose a form to print or download again.

Complete, download, and print the Arizona Charity Subscription Agreement with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Arizona Charity Subscription Agreement.

- You can also access forms you previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

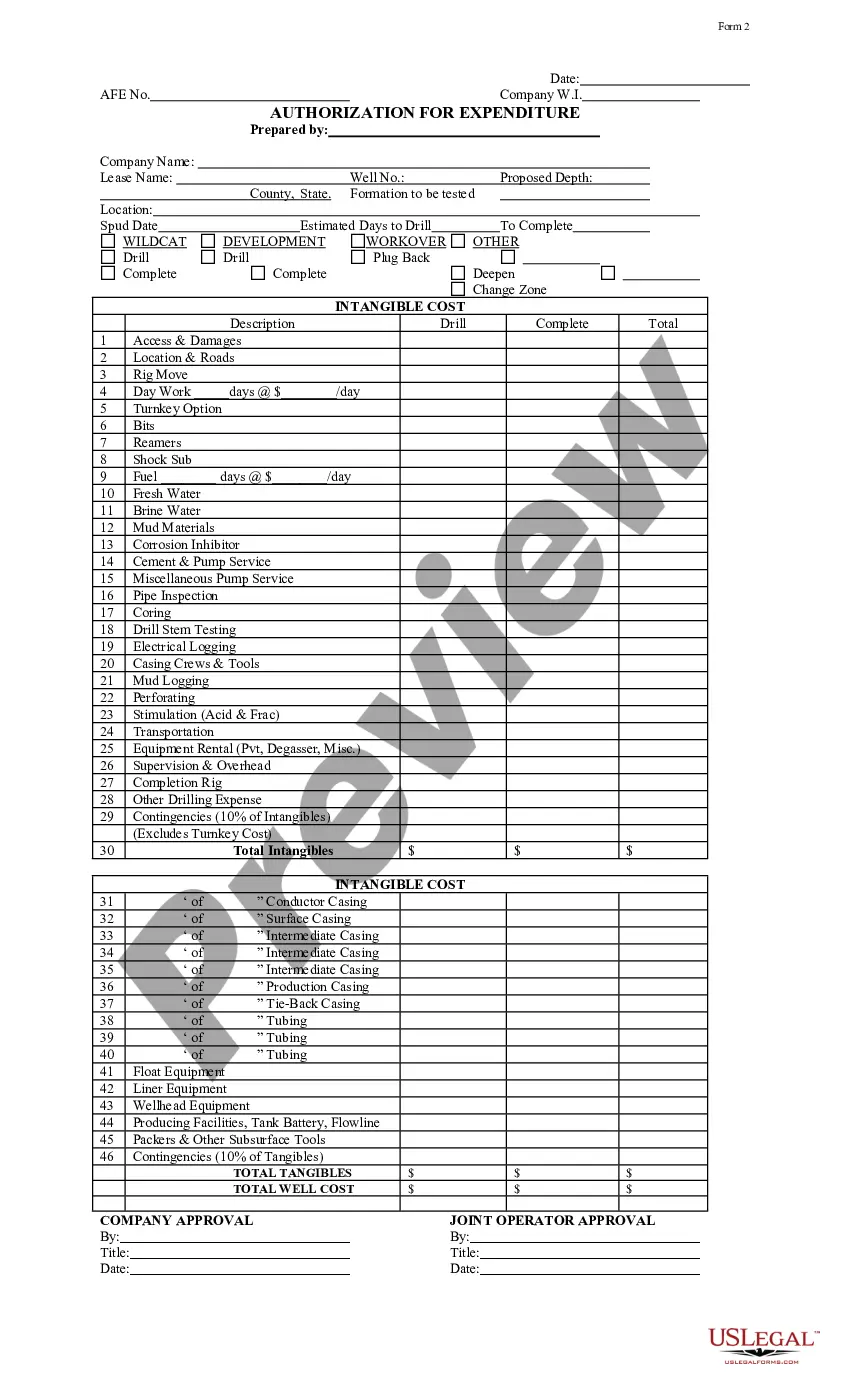

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your Visa, Mastercard, or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Arizona Charity Subscription Agreement.

Form popularity

FAQ

The $10,000 exemption in Arizona typically applies to certain forms of income, allowing taxpayers to exclude this amount from their taxable income. When you make eligible contributions through the Arizona Charity Subscription Agreement, you may also maximize your savings by taking advantage of available exemptions. This exemption can significantly affect your overall tax liability, making it essential to consider when planning your finances. For clarity on this topic, US Legal Forms provides excellent resources.

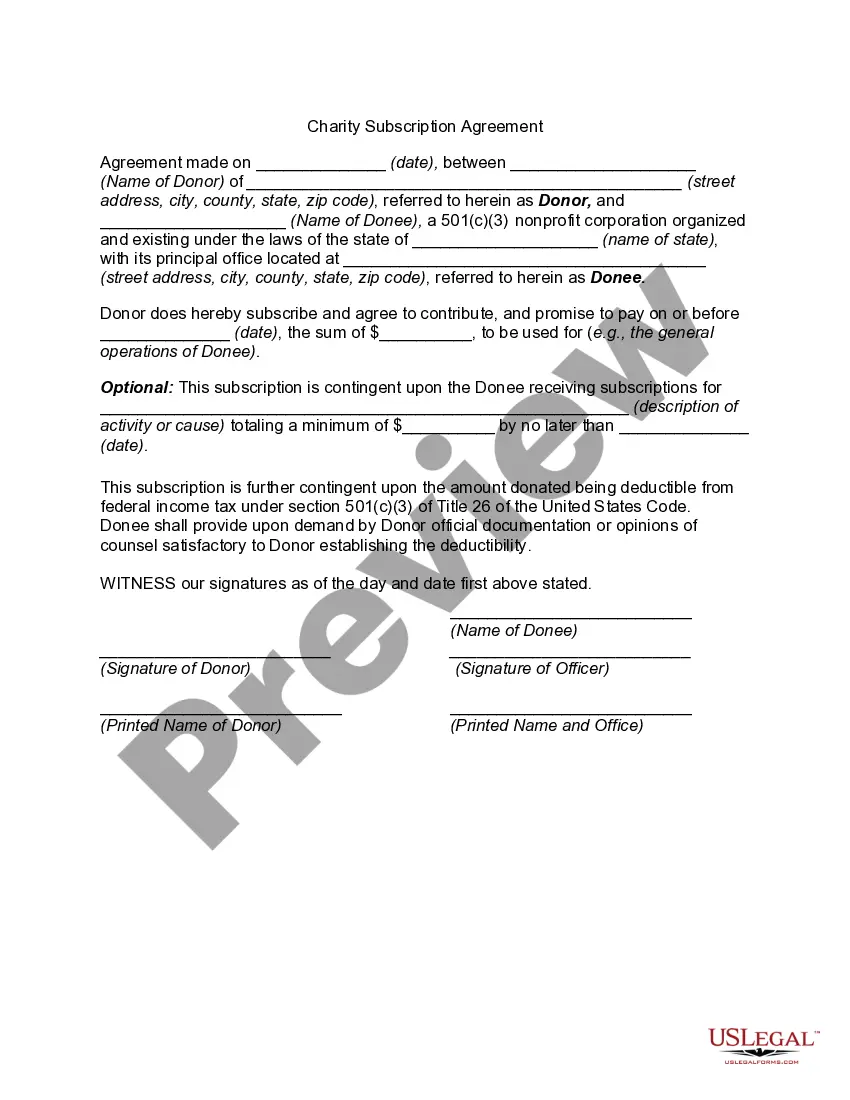

A donation agreement, also called a charitable gift agreement, is a document that established proof of a donation or gift to a charitable organization.

Under traditional contract law principles, a charitable pledge is enforceable if it meets the requirements for a legally binding contract. There must be an agreement between the donor and the charity -- in effect, the donor must promise to make a gift and the charity must promise to accept it.

How does the court view charitable pledges? The court treats/views them as contracts.

Proof can be provided in the form of an official receipt or invoice from the receiving charitable organization, but can also be provided via credit card statements or other financial records detailing the donation.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge. These are known as the three essential elements of a contract.

A donation describes the immediate exchange of money or goods from a donor. A pledge is the promised exchange of money or goods from a donor. A pledge results in a donation eventually, just not right away.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO).

Most courts view charitable pledges as legally enforceable commitments. Failure to enforce pledge collection could result in personal liability for the trustees of a non-profit. IRS rules prohibit donors from fulfilling a legally enforceable pledge from their donor advised fund.