Arizona LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Have you ever encountered a circumstance where you require documentation for various corporate or personal occasions almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t simple.

US Legal Forms offers a wide array of template options, such as the Arizona LLC Operating Agreement for S Corp, which can be tailored to fulfill federal and state regulations.

Once you locate the right document, click Acquire now.

Select the pricing plan you prefer, complete the requested information to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Arizona LLC Operating Agreement for S Corp template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/state.

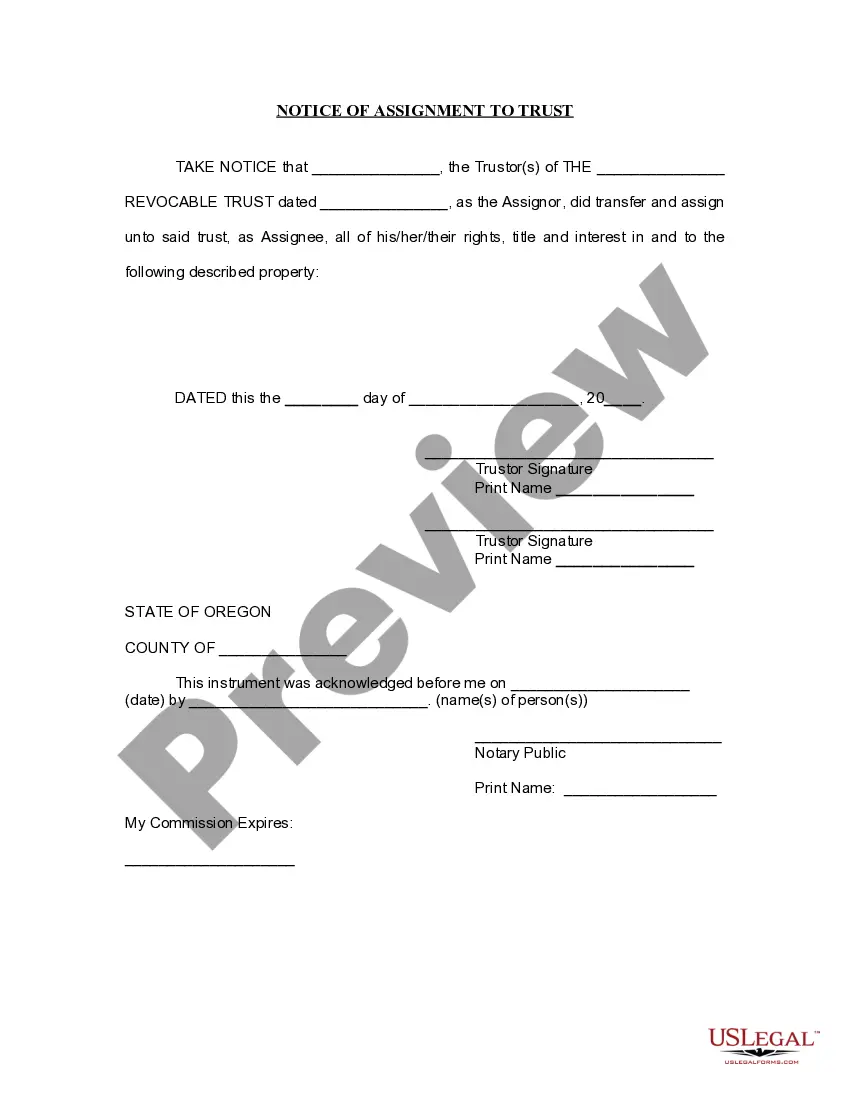

- Utilize the Review button to verify the document.

- Check the description to make sure you have selected the appropriate form.

- If the form isn’t what you need, use the Search feature to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, an Arizona LLC that operates under an Arizona LLC Operating Agreement - Taxed as a Partnership typically needs to file a tax return. Depending on how the LLC is taxed, the owners may report their share of income on their personal tax returns. Knowing the requirements for tax filing can help avoid penalties and ensure compliance with state laws.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

An Arizona LLC operating agreement is a legal document that will set forth the establishment of a company, whether it's a single-member company or a multi-member company. This document shall address all of the concerns that any member may have as they become a financial asset to the company.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Every Arizona LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Although an Arizona limited liability company is not required to have a written Operating Agreement, it is in the best interest of multiple-member companies to adopt a comprehensive Operating Agreement that sets forth their rights and obligations with respect to the company.

To convert your Arizona LLC to an Arizona corporation via a statutory merger, you need to:create a new corporation.prepare a plan of merger.obtain LLC member approval of the plan of merger.have your corporation's board of directors adopt the plan of merger.obtain shareholder approval of the plan of merger; and.More items...

Arizona allows formation of single-member LLCs Arizona LLCs are governed by the Arizona Limited Liability Company Act (Arizona Revised Statutes, Title 29, Chapter 4).