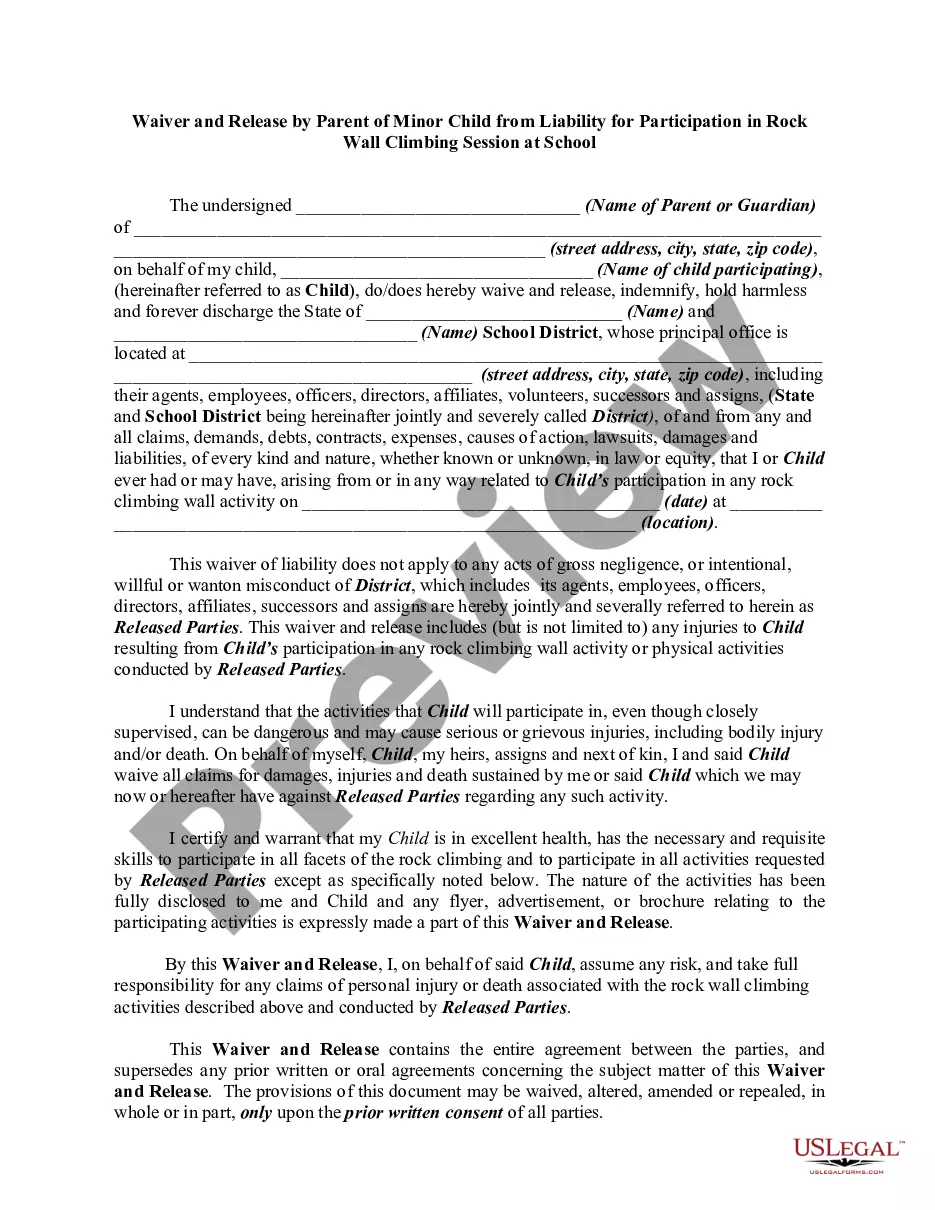

An Arizona LLC Operating Agreement for S Corp is a legal document that outlines the ownership, management, and operations of a limited liability company (LLC) that has elected to be taxed as an S Corporation under the Internal Revenue Code. This agreement serves as the foundation for how the Arizona LLC will be run, detailing the rights and responsibilities of all members involved. An operating agreement is essential for an Arizona LLC seeking S Corp taxation status as it helps establish the proper structure and guidelines required by the Arizona Corporation Commission and the Internal Revenue Service (IRS). It also ensures that the company adheres to state regulations and maintains its standing as an S Corporation. Key components of an Arizona LLC Operating Agreement for S Corp may include: 1. Name of the LLC: The legal name of the Arizona LLC shall be stated at the beginning of the agreement, along with any assumed or trade names, if applicable. 2. Purpose and Business Activities: The operating agreement should describe the primary purpose and nature of the business activities the LLC engages in. 3. Formation and Term: This section will outline how and when the LLC was formed, its duration, and any requirements for the continuation or dissolution of the company. 4. Members' Ownership and Interests: Each member's ownership percentage, capital contributions, and allocation of profits and losses should be clearly stated. This section will also outline any restrictions on transferring ownership interests. 5. Management: The agreement should explain how the LLC will be managed, either by all members or by designated managers. It should also outline the decision-making process, including voting rights, and the roles and responsibilities of each member. 6. Meetings and Voting: The operating agreement may include provisions regarding meetings of members, frequency of meetings, and voting procedures for major company decisions. 7. Financial and Tax Matters: This section outlines financial matters such as the LLC's fiscal year, accounting methods, banking arrangements, and tax reporting requirements. 8. Dissolution and Winding Up: In the event of the LLC's dissolution, this section explains how the LLC's assets and liabilities will be distributed among members and the steps required for the winding-up process. Types of Arizona LLC Operating Agreement for S Corp may vary based on individual companies, as certain provisions can be customized to meet the specific needs and preferences of the members. However, it is essential to maintain compliance with Arizona state laws and regulations, in addition to the guidelines set forth by the IRS for S Corporations. In conclusion, an Arizona LLC Operating Agreement for S Corp is a crucial legal document that provides a clear framework for the organization, operation, and taxation of an LLC that has elected to be treated as an S Corporation.

Arizona LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out Arizona LLC Operating Agreement - Taxed As A Partnership?

Have you been within a situation where you need paperwork for sometimes company or personal functions virtually every time? There are tons of legal papers layouts available online, but discovering ones you can rely on isn`t effortless. US Legal Forms delivers a large number of kind layouts, much like the Arizona LLC Operating Agreement for S Corp, which can be written in order to meet federal and state demands.

Should you be currently knowledgeable about US Legal Forms website and get a free account, basically log in. Following that, it is possible to download the Arizona LLC Operating Agreement for S Corp template.

Should you not come with an bank account and would like to start using US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for the correct area/state.

- Take advantage of the Review switch to review the form.

- Look at the description to actually have selected the proper kind.

- In the event the kind isn`t what you are looking for, take advantage of the Search area to get the kind that fits your needs and demands.

- Once you find the correct kind, just click Acquire now.

- Choose the prices strategy you want, complete the required information to generate your money, and purchase the transaction using your PayPal or charge card.

- Decide on a handy paper formatting and download your copy.

Get each of the papers layouts you have purchased in the My Forms menus. You can aquire a additional copy of Arizona LLC Operating Agreement for S Corp at any time, if needed. Just click on the needed kind to download or print out the papers template.

Use US Legal Forms, probably the most considerable assortment of legal varieties, in order to save efforts and prevent mistakes. The services delivers appropriately produced legal papers layouts that you can use for a range of functions. Generate a free account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

An Arizona LLC operating agreement is a legal document that will set forth the establishment of a company, whether it's a single-member company or a multi-member company. This document shall address all of the concerns that any member may have as they become a financial asset to the company.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Every Arizona LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Although an Arizona limited liability company is not required to have a written Operating Agreement, it is in the best interest of multiple-member companies to adopt a comprehensive Operating Agreement that sets forth their rights and obligations with respect to the company.

To convert your Arizona LLC to an Arizona corporation via a statutory merger, you need to:create a new corporation.prepare a plan of merger.obtain LLC member approval of the plan of merger.have your corporation's board of directors adopt the plan of merger.obtain shareholder approval of the plan of merger; and.More items...

Arizona allows formation of single-member LLCs Arizona LLCs are governed by the Arizona Limited Liability Company Act (Arizona Revised Statutes, Title 29, Chapter 4).