Arizona Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Finding the appropriate official document template can be challenging. Clearly, there are numerous designs available on the web, but how can you determine the correct one you require? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the Arizona Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which can be utilized for both business and personal purposes. All documents are verified by professionals and comply with federal and state regulations.

If you are already a member, Log Into your account and click on the Obtain button to access the Arizona Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. Use your account to search for the official forms you have previously purchased. Visit the My documents tab of your account and retrieve another copy of the document you need.

Select the file format and download the official document template to your device. Complete, modify, print, and sign the obtained Arizona Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. US Legal Forms is the largest repository of official documents where you can view various file templates. Leverage the service to download professionally crafted papers that adhere to state regulations.

- First, ensure you have selected the correct document for your location/region.

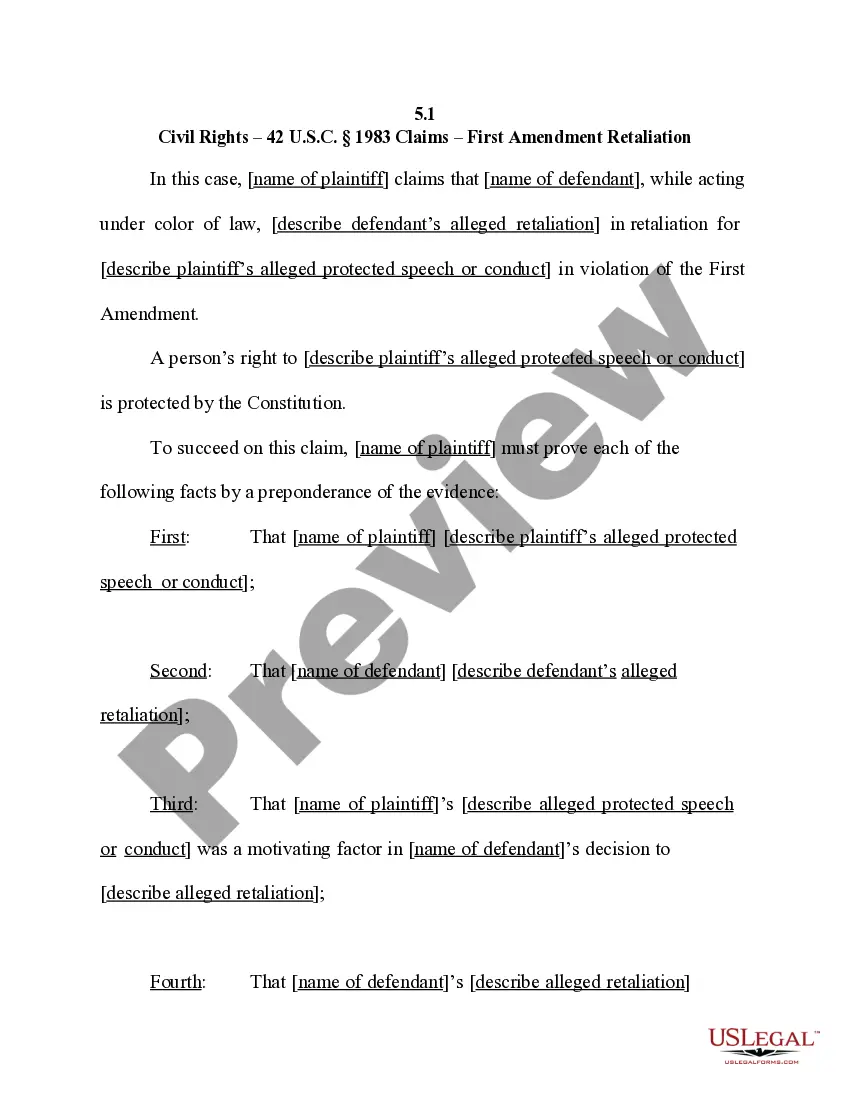

- You can browse the form using the Preview button and review the form description to confirm it meets your needs.

- If the document does not suit your requirements, utilize the Search field to find the appropriate form.

- Once you are confident the form is correct, click on the Get now button to access the document.

- Choose the pricing plan you prefer and provide the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

Each situation is different and some estates may be more complex than others, such as estates where real estate and other assets were bought or sold before distribution to the beneficiaries. However, the average trust should be fully distributed within 12 to 18 months once the trust administration has begun.

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

Most expenses that a fiduciary incurs in the administration of the estate or trust are properly payable from the decedent's assets. These include funeral expenses, appraisal fees, attorney's and accountant's fees, and insurance premiums.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

Irrevocable trusts can be used to protect assets, reduce estate taxes, get government benefits and access government benefits.