North Carolina Filing System for a Business

Description

How to fill out Filing System For A Business?

If you need to complete, obtain, or print authentic document templates, utilize US Legal Forms, the largest repository of legitimate forms available online.

Utilize the site's straightforward and user-friendly search to find the paperwork you need.

Various templates for commercial and personal use are organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for the account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the North Carolina Filing System for a Business with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Acquire button to obtain the North Carolina Filing System for a Business.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state.

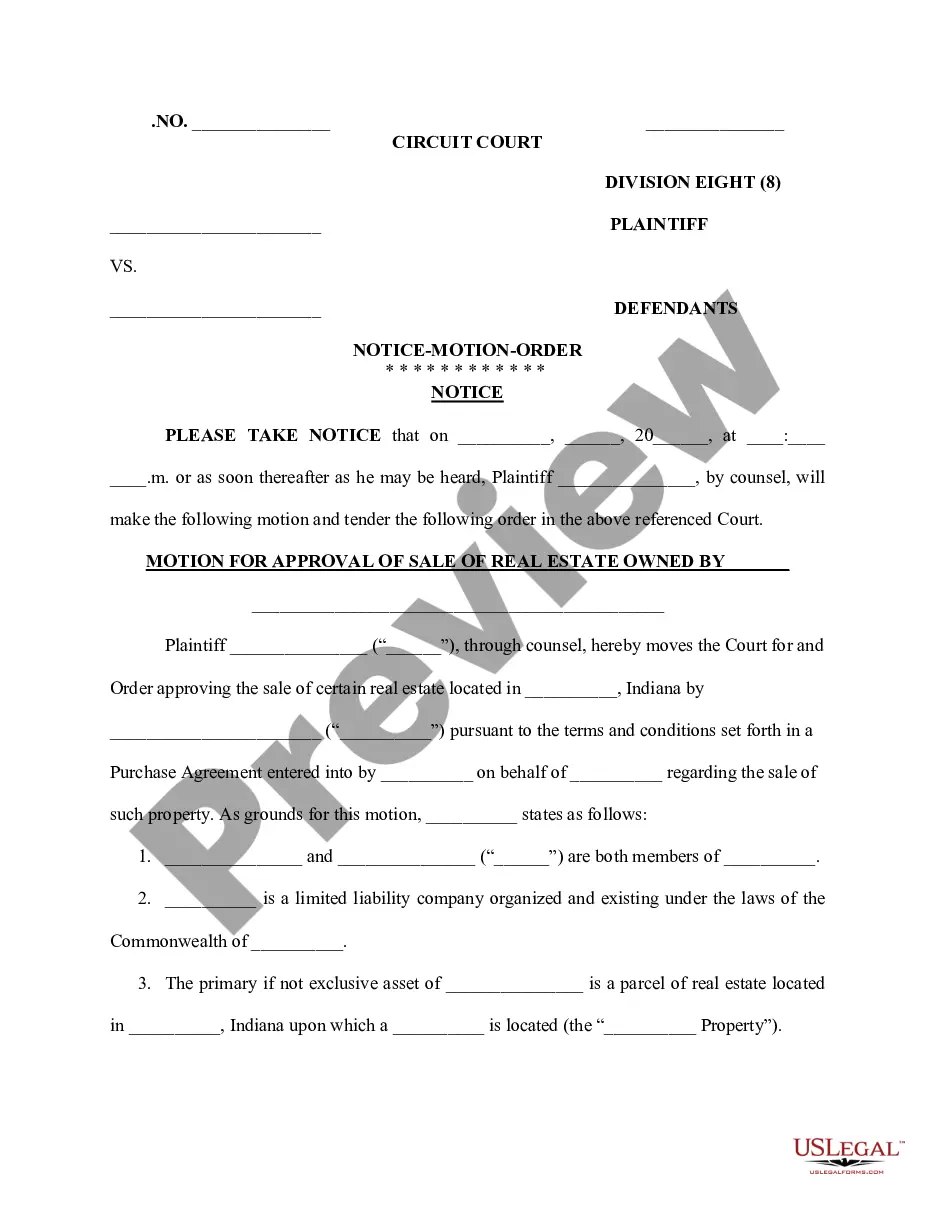

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find alternative types of the legitimate form model.

Form popularity

FAQ

California law requires business entities that prepare an original or amended return using tax preparation software to electronically file (e-file) their return to us.

Electronic Filing (E-File) Definition. Personal Finance Taxes.

Paying your taxesPay by bank draft.Pay when you eFile your return, or.Schedule your payment when you eFile your return. tax due (payment) can be scheduled up until the due date of the return. extension payments can be scheduled up to 6 months in advance. estimated payments can be scheduled up to 12 months in advance.

Yes. eFile is a safe and reliable website for preparing individual income tax returns that's authorized by the IRS. It keeps your information secure with data encryption. It also requires multi-factor authentication every time you log in to verify your identity.

The corporate income tax rates are as follows: 2.50% effective for taxable years beginning on or after 1-1-2019. 3.00% effective for taxable years beginning on or after 1-1-2017. 4.00% effective for taxable years beginning on or after 1-1-2016. 5.00% effective for taxable years beginning on or after 1-1-2015.

file Application Learn more about IRS efile that's required for most tax return preparers. It is only through an approved efile application that tax professionals, who are lectronic Return Originators (ROs), Circular 230 Practitioners, or Reporting Agents (RAs), can gain access to the Transcript Delivery System.

You can also pay your estimated tax online. For details, visit and search for "online file and pay." For calendar year filers, estimated payments are due April 15, June 15, and September 15 of the taxable year and January 15 of the following year.

California law requires business entities that prepare an original or amended return using tax preparation software to electronically file (e-file) their return to us.

Taxpayers may pay their tax by using a credit/debit card (Visa/MasterCard) or bank draft via our online payment system , or by contacting an agent at 1-877-252-3252. Taxpayers may also pay their tax with a personal check, money order or cashier's check.

Begin by registering your business with the DOR either online or on paper (Form NC-BR). Once you've registered, you'll need to file withholding taxes on a periodic basis (typically monthly or quarterly) using Form NC-5. You'll also need to use some version of Form NC-3 each year to reconcile your LLC's tax withholding.