Arizona Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

If you wish to be thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Leverage the site's straightforward and efficient search to find the documents you require.

Various templates for business and personal use are categorized by groups and states, or keywords.

Step 4. After finding the form you need, click on the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Arizona Sample of a Collection Letter to Small Business in Advance with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Arizona Sample of a Collection Letter to Small Business in Advance.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/region.

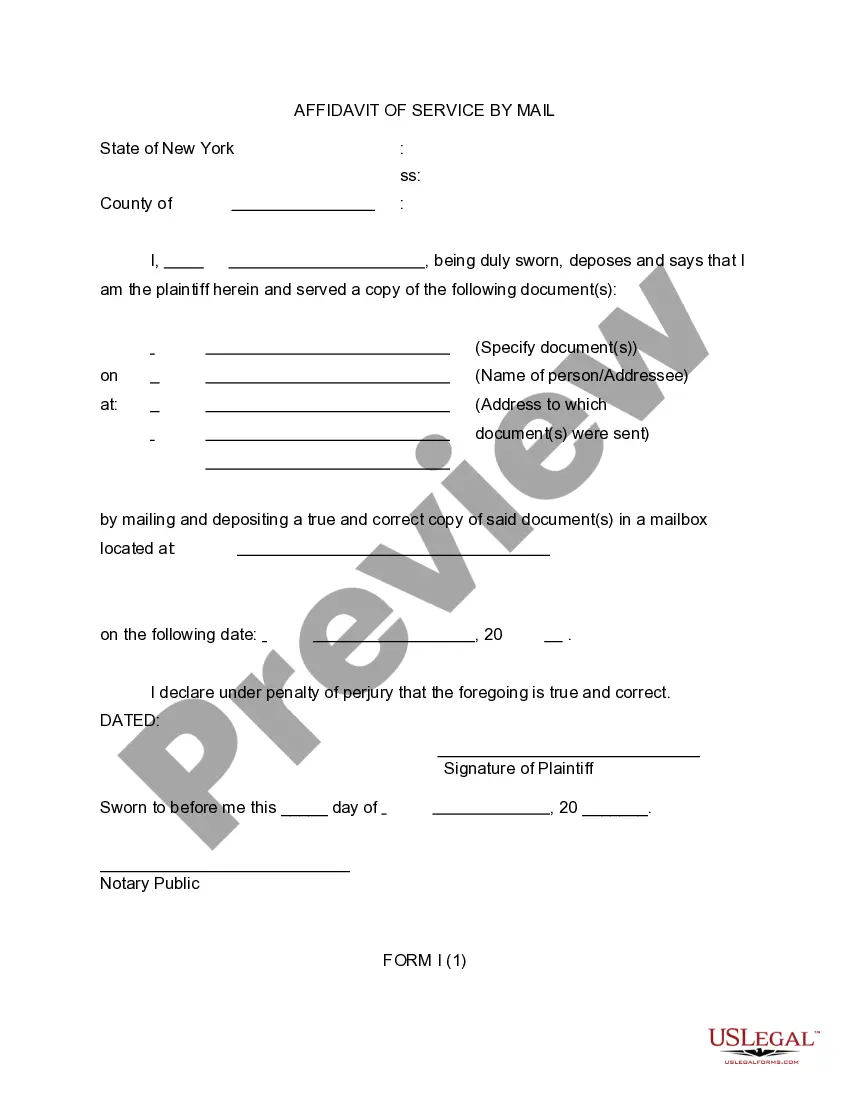

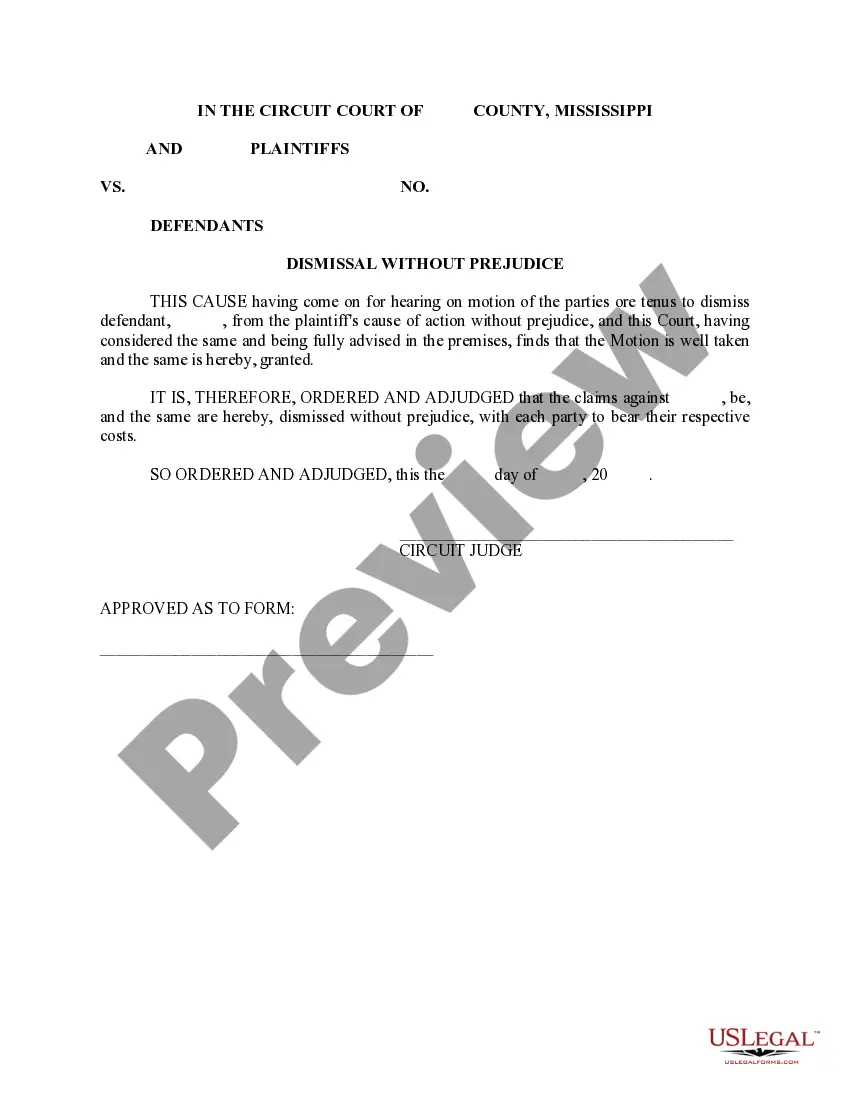

- Step 2. Use the Preview option to review the form's content. Don't forget to read through the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The best sample for a debt validation letter will clearly request verification of the debt and provide sufficient information about the account. This may include the balance and original creditor details. You can find an excellent reference in the Arizona Sample of a Collection Letter to Small Business in Advance, which offers a structured approach to ensure you cover all necessary elements.

When writing a letter for debt collection, begin with a formal salutation and introduce the purpose of your correspondence. State the amount owed, the original payment deadline, and provide clear instructions for payment. For inspiration, consider the Arizona Sample of a Collection Letter to Small Business in Advance to ensure your letter is effective and professional while increasing the likelihood of receiving payment.

To draft an effective collection letter, start with a polite greeting and state the purpose clearly. Include essential details such as the debt amount, payment methods, and any consequences for non-payment. By referring to the Arizona Sample of a Collection Letter to Small Business in Advance, you can ensure your letter is both informative and courteous, increasing the chances of a favorable response.

A properly written collection letter should include clear contact information and a specific request for payment. Additionally, it must maintain a professional tone while outlining the amount due, the original due date, and any relevant service details. By following these requirements, you enhance the effectiveness of your letter, especially when using the Arizona Sample of a Collection Letter to Small Business in Advance as a guide.

Yes, it is possible to face legal action when sending someone to collections, particularly if the collection process is not handled correctly. If a debtor believes their rights were violated, they can sue for unfair practices. To avoid such situations, always comply with regulations and consider using an Arizona Sample of a Collection Letter to Small Business in Advance as a model for proper collection communication.

A debt collector validation letter requests a detailed summary of the debt from the collector. This letter should include the original amount owed, the name of the creditor, and any relevant account numbers. You can refer to an Arizona Sample of a Collection Letter to Small Business in Advance for guidance on drafting a clear and comprehensive validation letter. This approach protects your rights and ensures transparency in the debt collection process.

Writing a debt collection letter requires clarity and professionalism. Begin by clearly identifying the debtor, the amount owed, and the reason for the collection. State your expectations for payment and provide a deadline. Referencing an Arizona Sample of a Collection Letter to Small Business in Advance can help ensure you include all necessary elements and maintain a respectful tone.

The 777 rule refers to specific guidelines that debt collectors must follow when attempting to collect debts. These guidelines protect consumers from unfair practices and ensure that collectors communicate clearly and respectfully. Understanding these rules can help you navigate debt situations more effectively. An Arizona Sample of a Collection Letter to Small Business in Advance can serve as a reference for compliant communication.

A collection notice is a communication sent to notify a debtor about an outstanding debt. It outlines the amount owed, payment options, and potential consequences of non-payment. Often, businesses use the Arizona Sample of a Collection Letter to Small Business in Advance to design these notices effectively. A well-crafted collection notice can prompt prompt action from debtors.

The required language in a debt collection letter must comply with the Fair Debt Collection Practices Act. Specifically, it should inform the debtor of their rights and the actions you may take if the debt remains unpaid. Utilizing the Arizona Sample of a Collection Letter to Small Business in Advance can help ensure you include the necessary legal language while remaining clear and respectful. This approach fosters better communication.