If you find yourself spending lots of time every month reconciling your bank statement and still are not able to nail it down to the penny, this monthly bank reconciliation form might be able to help you.

Arizona Monthly Bank Reconciliation Worksheet

Description

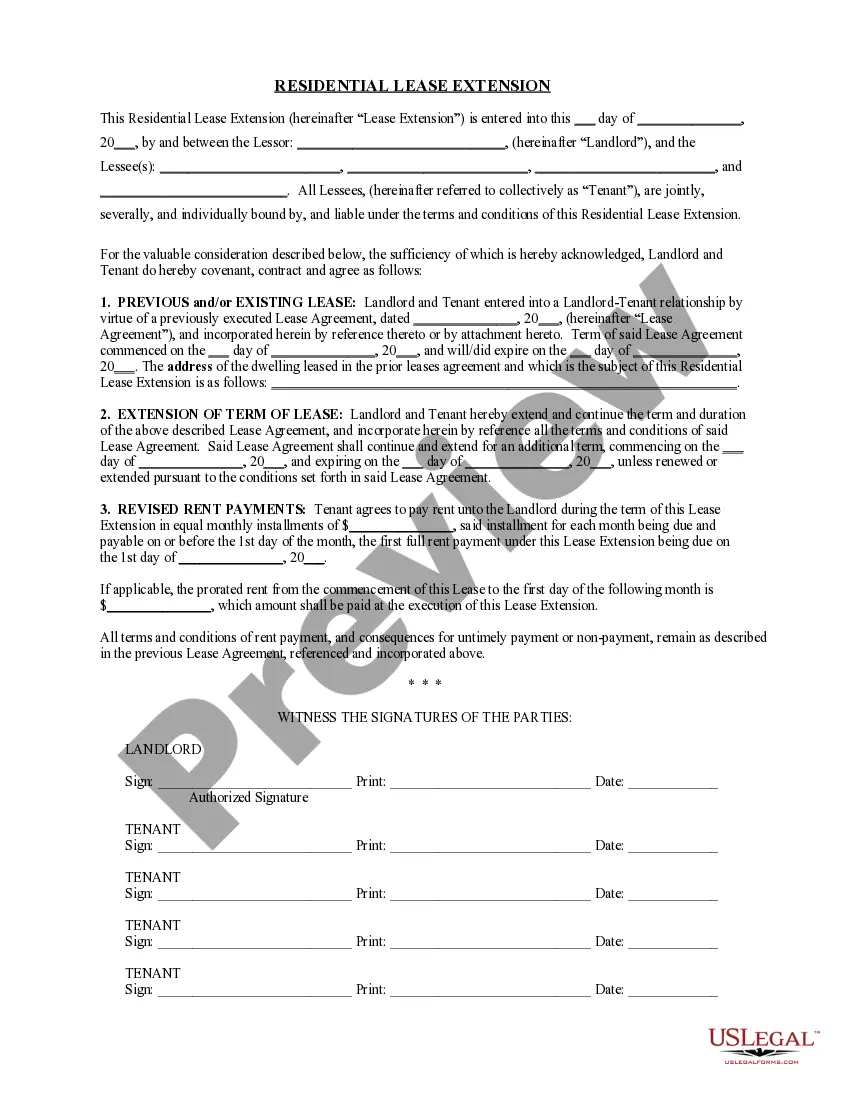

How to fill out Monthly Bank Reconciliation Worksheet?

Finding the correct legal document template can be challenging.

There are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Arizona Monthly Bank Reconciliation Worksheet, which can be utilized for both business and personal purposes.

You can review the document using the Preview button and check the form description to confirm it is the right one for you.

US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Use this service to acquire professionally crafted paperwork that complies with state requirements.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Arizona Monthly Bank Reconciliation Worksheet.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new customer of US Legal Forms, here are some simple steps to follow.

- First, ensure that you have selected the appropriate form for your city/area.

- If the document does not fulfill your needs, use the Search field to find the correct form.

- Once you are confident that the document is suitable, click on the Get now button to obtain the form.

- Select your desired pricing plan and enter the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Fill out, modify, print, and sign the acquired Arizona Monthly Bank Reconciliation Worksheet.

Form popularity

FAQ

The best formula for bank reconciliation remains the one that ensures you adjust both your bank and book balances accurately. Use the formula: Adjusted Bank Balance = Bank Statement Balance + Deposits in Transit - Outstanding Checks. This method, paired with the Arizona Monthly Bank Reconciliation Worksheet, helps streamline your reconciliation efforts, making the task efficient and reliable.

To conduct month-end bank reconciliation, begin by collecting all relevant bank statements and internal financial records. Compare the records to your bank statements, noting any missing transactions, such as outstanding checks or deposits. Using the Arizona Monthly Bank Reconciliation Worksheet simplifies this process, providing a clear structure to ensure accurate accounting each month.

The formula for bank reconciliation is simple: Adjusted Bank Balance = Bank Statement Balance + Deposits in Transit - Outstanding Checks. By performing these calculations consistently, you can verify that your financial records are accurate. The Arizona Monthly Bank Reconciliation Worksheet provides a structured way to apply this formula and maintain clarity in your accounts.

The formula used to reconcile involves taking the adjusted bank balance and comparing it with the adjusted book balance. Start with the bank statement balance, adjust for outstanding checks and deposits, then do the same with your accounting records. By ensuring both sides match, you achieve a precise reconciliation using the Arizona Monthly Bank Reconciliation Worksheet.

The three common methods for preparing bank reconciliation are the adjusted balance method, the bank balance method, and the book balance method. These methods help account for outstanding checks and deposits in transit. Utilizing the Arizona Monthly Bank Reconciliation Worksheet makes this process straightforward, allowing you to categorize and resolve transactions effectively.

To perform bank reconciliation easily using the Arizona Monthly Bank Reconciliation Worksheet, start by gathering your bank statements and your accounting records. Ensure both documents reflect the same time period. Next, align deposits and withdrawals to identify any discrepancies. With just a few adjustments, you can achieve an accurate reconciliation effortlessly.

To perform monthly bank reconciliation, begin by collecting your monthly bank statements and your accounting records. Next, compare the two and identify any discrepancies or outstanding items. Make necessary adjustments to align the balances effectively. Using an organized tool like the Arizona Monthly Bank Reconciliation Worksheet eases this monthly task and enhances your financial oversight.

A bank reconciliation sheet is a specific document where you record your bank's activity alongside your own accounting records. This sheet helps you spot discrepancies and ensures that both sets of records align correctly. Overall, it serves as a central reference for tracking financial accuracy. The Arizona Monthly Bank Reconciliation Worksheet can simplify this process significantly.

In simple terms, bank reconciliation is the process of matching your bank statement with your own financial records. This helps to identify any errors and ensures that all transactions are accurately recorded. Regular bank reconciliation is crucial for maintaining financial health. Consider using the Arizona Monthly Bank Reconciliation Worksheet for clarity and organization in this task.

A bank reconciliation worksheet is a document used to compare your company's financial records to your bank's records. It lists both the initial balances and any adjustments needed to reconcile them. This tool ensures all transactions are accounted for, helping to maintain financial accuracy. The Arizona Monthly Bank Reconciliation Worksheet offers a structured format for this process.