US Legal Forms - one of the largest libraries of legitimate forms in America - offers a wide range of legitimate papers web templates it is possible to down load or produce. Utilizing the internet site, you will get 1000s of forms for company and individual uses, categorized by types, claims, or key phrases.You can find the newest types of forms much like the Arizona Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement within minutes.

If you currently have a monthly subscription, log in and down load Arizona Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement through the US Legal Forms library. The Down load button will appear on each and every form you perspective. You have access to all earlier downloaded forms from the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed below are basic instructions to get you started:

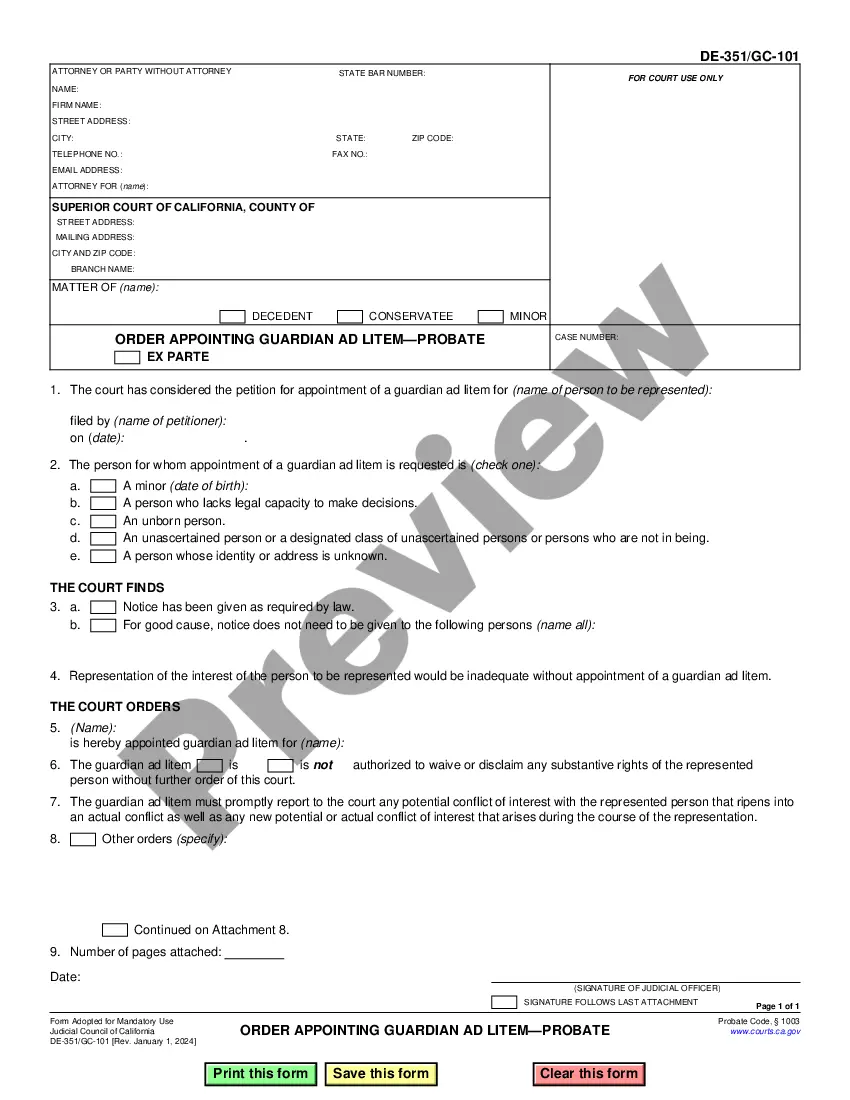

- Be sure you have picked the correct form for your personal town/county. Select the Preview button to examine the form`s information. Browse the form explanation to ensure that you have chosen the correct form.

- If the form does not satisfy your specifications, use the Search area at the top of the monitor to discover the one which does.

- Should you be pleased with the form, verify your decision by visiting the Purchase now button. Then, select the pricing prepare you like and supply your accreditations to sign up to have an bank account.

- Process the purchase. Make use of charge card or PayPal bank account to complete the purchase.

- Pick the formatting and down load the form on your device.

- Make adjustments. Load, revise and produce and sign the downloaded Arizona Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement.

Every single format you included in your money does not have an expiration time and is also the one you have forever. So, if you want to down load or produce one more copy, just go to the My Forms segment and click on the form you will need.

Gain access to the Arizona Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement with US Legal Forms, one of the most considerable library of legitimate papers web templates. Use 1000s of skilled and condition-distinct web templates that meet up with your small business or individual demands and specifications.