New Jersey Assignment of Debt

Description

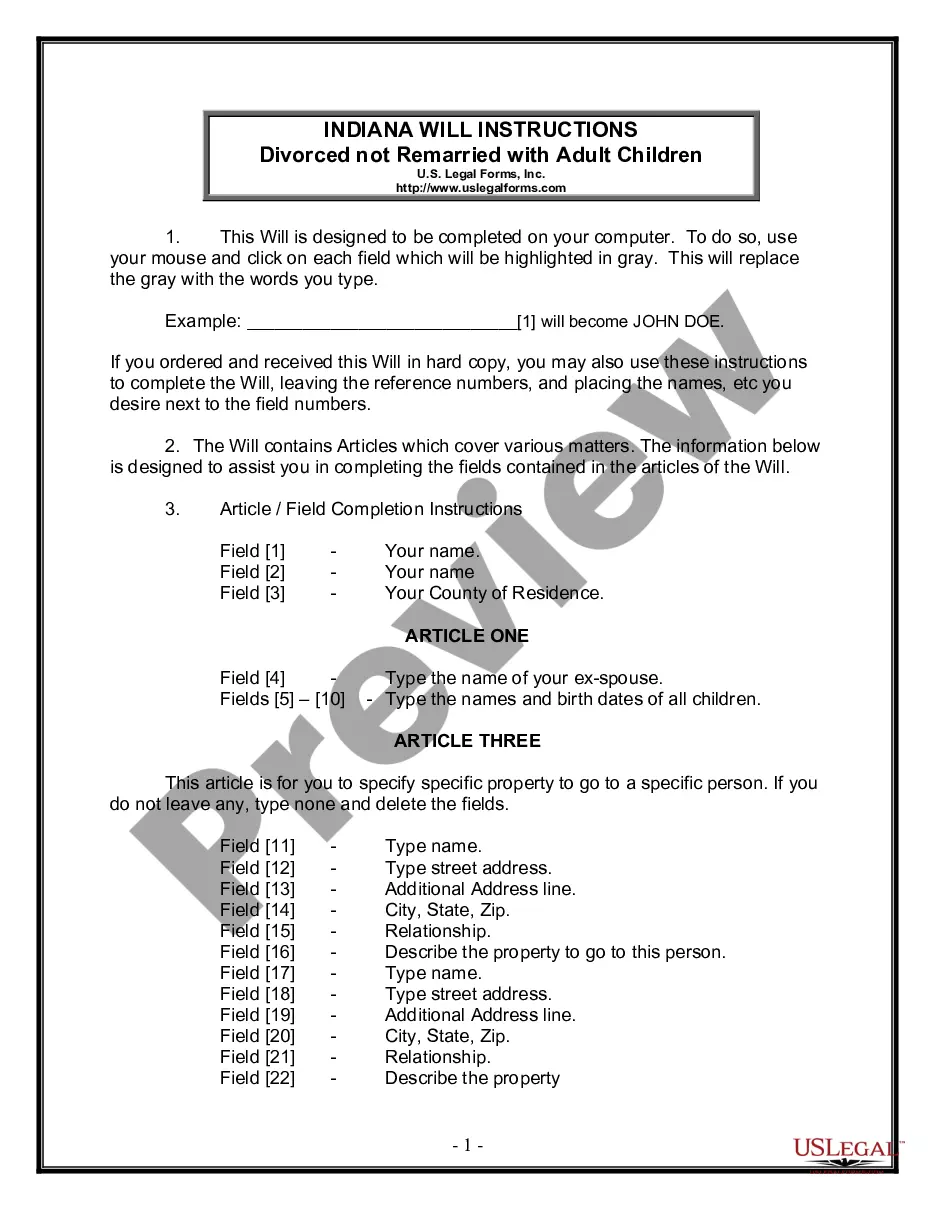

How to fill out Assignment Of Debt?

Selecting the optimal authentic document template can be a challenge.

Of course, there are numerous templates available online, but how do you locate the right one you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct document for your city/state. You can browse the form using the Preview button and view the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the correct document. Once you are certain the form is accurate, click the Buy now button to obtain the document. Choose the pricing plan you desire and input the necessary information. Create your account and make the payment using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Finally, complete, customize, print, and sign the acquired New Jersey Assignment of Debt. US Legal Forms is the largest collection of legal documents where you can find countless document templates. Use the service to obtain professionally crafted documents that adhere to state guidelines.

- The service provides thousands of templates, including the New Jersey Assignment of Debt, that you can utilize for both professional and personal purposes.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click on the Download button to obtain the New Jersey Assignment of Debt.

- Use your account to check the legal documents you have acquired previously.

- Visit the My documents section of your account to download another copy of the document you need.

Form popularity

FAQ

Generally, a 10-year-old debt can still be pursued under specific circumstances, but it may be unenforceable in New Jersey. Since the statute of limitations is six years, most collectors cannot take legal action for debts older than this period. However, creditors might still attempt to collect through other means. When dealing with such situations, exploring New Jersey Assignment of Debt services can provide valuable support and guidance.

Debt collection in New Jersey is governed by both state laws and the Fair Debt Collection Practices Act. Collectors must adhere to regulations that protect consumers from harassment and unfair practices. If you find yourself entangled in a collection process, gaining insights into New Jersey Assignment of Debt can be beneficial. Understanding your rights allows you to navigate these situations with confidence.

In most cases, a debt collector cannot take you to court for a debt that is over seven years old in New Jersey. After the six-year statute of limitations, debts typically become unenforceable through legal means. If you are facing claims regarding old debts, consider exploring New Jersey Assignment of Debt services to understand your rights. It is crucial to respond appropriately to any legal documents you receive.

A debt in New Jersey is uncollectible after a period of six years. This demarcation is established by state law, allowing debtors to have some protection from legal actions for old debts. When navigating the complexities of New Jersey Assignment of Debt, knowing this timeline can help you in negotiations with creditors. Remember, each situation is unique, so consider your options carefully.

In New Jersey, a debt generally becomes uncollectible after six years. This period is defined by the statute of limitations, which determines how long a creditor can legally pursue collections. If you are dealing with issues related to New Jersey Assignment of Debt, understanding this timeframe is essential. After six years, many debts are considered unenforceable, offering a potential relief to individuals facing financial burdens.

In New Jersey, a judgment can generally be enforced for up to 20 years. This means that creditors can pursue collection efforts for two decades following the judgment date. After this period, the court may no longer allow enforcement actions under the New Jersey Assignment of Debt laws. It's vital to understand the timeline to safeguard your financial interests.

To effectively respond to a debt collection lawsuit in New Jersey, first, review the complaint carefully. You must file an answer with the court within the specified time frame, typically 35 days. In your answer, deny or admit the allegations as appropriate and assert any defenses you may have. Engaging legal assistance can enhance your strategy as you navigate the complexities of New Jersey Assignment of Debt.

In New Jersey, the statute of limitations on most debts is typically six years. After this period, creditors may no longer take legal action to collect the debt. Familiarizing yourself with concepts like the New Jersey Assignment of Debt can empower you to navigate your financial responsibilities and potential liabilities better.

Yes, you can be sued in New Jersey for credit card debt if payments are not made as agreed. Creditors have the right to seek recovery through court if accounts become delinquent. If you’re facing such a situation, exploring options like a New Jersey Assignment of Debt can provide solutions to handle your debt more effectively.

In New Jersey, a debt judgment typically lasts for 20 years from the date of entry. This means that if a creditor wins a judgment against you, they can pursue collection for a significant period. Understanding the implications of a New Jersey Assignment of Debt can help you effectively manage your obligations and respond to any judgments.