Arizona Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Are you currently inside a situation that you need to have files for possibly organization or specific purposes just about every time? There are a variety of legal document themes available on the net, but finding ones you can rely isn`t effortless. US Legal Forms delivers a large number of develop themes, much like the Arizona Sworn Statement regarding Proof of Loss for Automobile Claim, that happen to be published in order to meet state and federal needs.

Should you be already informed about US Legal Forms internet site and also have an account, simply log in. Afterward, you may acquire the Arizona Sworn Statement regarding Proof of Loss for Automobile Claim design.

Unless you provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is to the appropriate city/region.

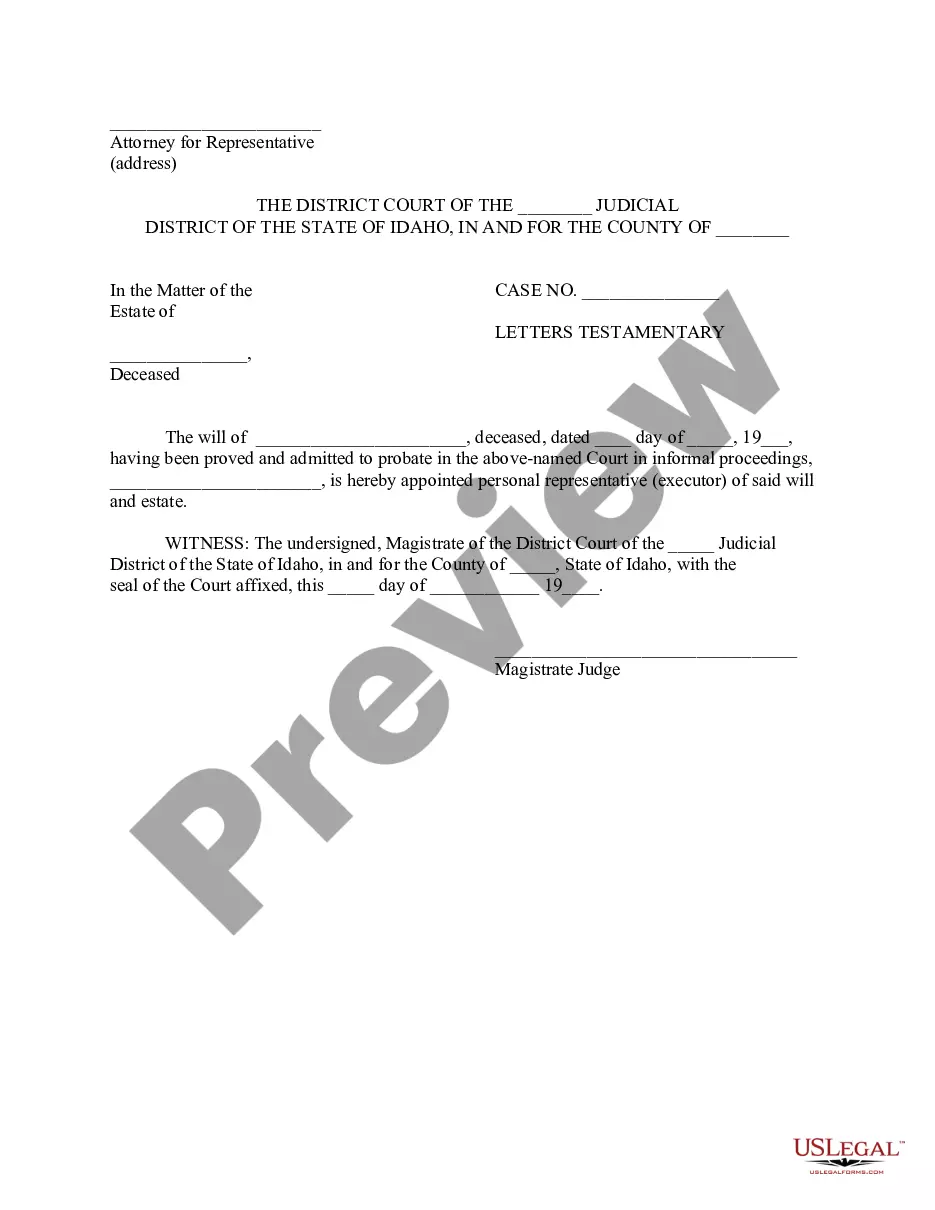

- Make use of the Review button to examine the shape.

- Look at the description to ensure that you have selected the correct develop.

- When the develop isn`t what you`re looking for, make use of the Lookup industry to find the develop that meets your needs and needs.

- When you find the appropriate develop, simply click Get now.

- Choose the prices strategy you want, fill out the desired information and facts to make your bank account, and pay money for the transaction utilizing your PayPal or charge card.

- Choose a practical data file structure and acquire your version.

Find every one of the document themes you might have purchased in the My Forms menus. You can get a further version of Arizona Sworn Statement regarding Proof of Loss for Automobile Claim at any time, if necessary. Just click the required develop to acquire or produce the document design.

Use US Legal Forms, one of the most substantial selection of legal varieties, in order to save time and stay away from errors. The assistance delivers expertly manufactured legal document themes which you can use for a variety of purposes. Generate an account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Filing a Proof of Loss is required under most insurance policies, including homeowners insurance, life insurance, and car insurance. Most insurance policies require that the policyholder provide a signed Proof of Loss within 60 days of the insurance company's request.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

The purpose of the notice of claim provision is to notify the insurance company about the losses promptly so that they can start an investigation on the same. The purpose of the proof of loss is to provide the insurer with substantial evidence for effective evaluation and claim processing.

What Does Loss Report Mean? Loss reports are insurance reports commonly prepared for auto, homeowners' and renters' policies that list information such as date of occurrence, type of claim, amount paid, and amount reserved for each claim as of the report's valuation date.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.